The stock market opened the month with disappointing and unexpected declines, despite no negative domestic news. The failed breakthrough and sharp correction of US stock indexes are believed to have a psychological impact.

According to experts, before announcing the country’s August macroeconomic data, the market still had sessions influenced by external information, especially during the rather quiet holiday period. The failure of US stocks to break through and reverse corrections is due to recession concerns, which greatly affects the global economic outlook. However, when domestic data was released, the market recovered in the last session.

The question arises as to whether the domestic stock market can go its own way if the world stock market, especially the US, reverses course in September? Experts unanimously agree that psychological impacts from outside will only affect the short term. Vietnam’s stock market has not had a clear and strong upward trend like the US stock market, so the US stock market correction will also have limited impact. On the other hand, there will be many new supportive information in September that can create new expectations compared to the previous quiet period.

Experts also believe that adjustments may occur but will be limited. The support threshold of interest is around 1250 points. In addition, the investment perspective also focuses on specific stocks, leading stocks, and codes that are more resistant to the index over time. Most experts are maintaining a high stock ratio, even using a portion of margin.

Nguyen Hoang – VnEconomy

Although there were only three trading sessions last week, the market disappointed greatly as it could not explode but suddenly fell. There was no unexpected bad news during the holiday, the main reason is believed to be the risk from US stocks when the indexes are also at risk of creating two declining peaks. Is this reason reasonable? Why did the domestic psychology suddenly pay attention to the outside situation when it was hardly noticed before?

The recovery session at the end of the week was still weak, and I don’t think it marked the end of the adjustment.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

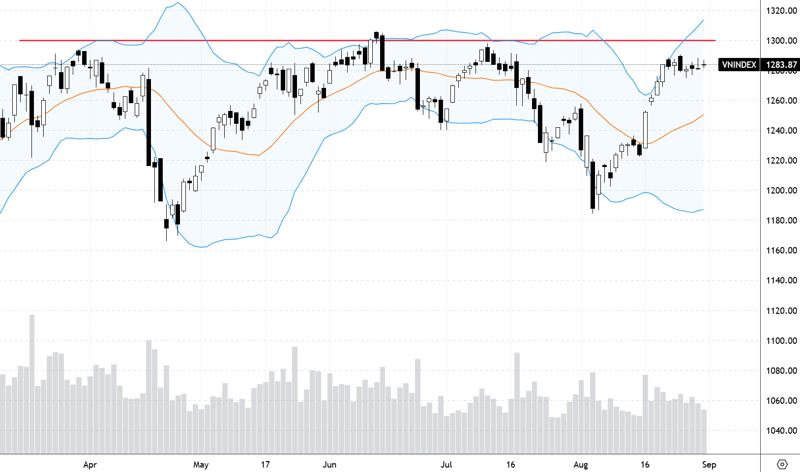

I noticed that before the holiday, the market was in a “sideway” phase with decreasing liquidity. This “sideway” region is close to the strong resistance zone of 1300 points, which has failed many times, so most investors are cautious and waiting for the “break” of the resistance zone to take appropriate action.

Unfortunately, during the National Day holiday, US stocks rose to a new high and there was a strong reversal candle before our trading session resumed. The cautious sentiment, combined with the bad news from the US stock market, increased selling pressure, causing the first holiday week to perform poorly.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

From my point of view, VN-Index is entering a period of sparse information, so developments outside of Vietnam will somehow have an impact, especially when small and individual investors account for a large proportion of the market – the group most susceptible to psychological impacts from multiple news streams. Therefore, the lackluster performance of the US stock market can also explain the sudden drop in the domestic market.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Although there is no clear correlation with the US stock market, I have seen that when this market experiences a strong sell-off, not only the Vietnamese stock market but also many stock markets in the Asian region are affected. The US market sell-off at the beginning of this week is due to concerns about a possible recession in the US economy. This is related to the global economic outlook and also affects Vietnam’s capital flow. However, it is also necessary to look back at the fact that the decline of VN-Index is also influenced by technical factors. The recovery momentum of the Vietnamese stock market has slowed down since before the holiday. With VN-Index heading towards the strong resistance zone of 1300 points, many investors will choose to take profits or stand aside and observe.

[Interactive]: Panorama of the Vietnamese economy in August 2024

Money Flow Trend: Ready for a Breakthrough Explosion?

Le Duc Khanh – Director of Analysis, VPS Securities

I believe that psychological factors always play an important role and directly affect the trading decisions of investors. Despite positive domestic information, macroeconomic information, some declining sessions of US and Asian stock indexes, or the decline of “megacap” technology stocks such as Nvidia, Micro Technology, Intel, etc. make investors worried. Anyway, at strong resistance levels, some “chaotic” trading sessions can also be explained by short-term supply and demand factors at sensitive price points. The last trading session somewhat reassured investors about the market’s prospects for the next trading week.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

The market is in a phase of eliminating investors, lacking large capital, causing investors to feel sad and discouraged, so surrounding impacts are often noticed. As for me, this is the time of opportunity, not the time of risk, of course, portfolio selection is still important, and some sectors have started to attract capital.

Nguyen Hoang – VnEconomy

Before the holiday, you highly appreciated the scenario that the market would conquer the 1300-point peak after the holiday, but that scenario did not happen. The recovery session at the end of the week is still open to this scenario, although the number of falling stocks is still higher than the rising ones and there are pulling factors. Has the adjustment ended or does the market need to retreat further?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

After the holiday, the market has not surpassed the 1280-point tug-of-war zone when the world stock indexes were adjusted quite strongly. However, if compared to this general trend, the VN-Index’s decline is temporary and mild with weak selling pressure.

The recovery session at the end of the week was still weak, and I don’t think it marked the end of the adjustment. The nearest support zone for the index is at 1250-1260 points. If the market continues to correct with weak selling pressure and still holds this zone, there may be an opportunity to create a bottom here. In case it cannot hold, investors can pay attention to the next support zone at 1220-1240 points.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

US stocks continued to witness a strong sell-off in the last session of the week, with all indexes falling by more than 1%. Therefore, the first session of the next week is very likely to be affected psychologically and there will be a declining session. However, I predict that this adjustment will stop at around 1255 +/-10 points – the confluence zone of the price gap and the 3 MA 20, 50, and 100. Friday’s session has “tested” this zone and reacted quite well. My expectation is that the market will adjust to a maximum of around 1255 +/- 10 points and then bounce back up, with a target of around 1320 points.

September will have more supportive information, not to mention that if the Fed cuts interest rates by 0.5% at the September meeting, the Vietnamese stock market will be included in the FTSE’s upgrade list, which will boost the market to break through the 1300-point peak no matter how the US stock market performs.

Le Duc Khanh

Le Duc Khanh – Director of Analysis, VPS Securities

The monthly trend of the market is still showing signs of rising and breaking the peak, but the weekly fluctuations show that the market needs to increase and accumulate at the old peak, and eventually, it will break through. In my opinion, this is not important because what we need is not only a strong increase in points but also in liquidity and the breadth of the market, the number of stocks rising on technical signals. Then, a large number of investors will be confident to invest more. So, maybe next week or the week after is the latest that VN-Index can “yield” to the expectations of “trapped” investors.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

I still tend to think that the market will successfully conquer the 130x-point peak because the short-term uptrend is still being maintained, along with the active capital rotation among leading stocks and large-cap stocks, which will play a key role in keeping the rhythm for VN-Index, helping the index avoid falling into a deep decline. state. Although the pressure of shaking has increased in recent sessions, the market has gone through a series of strong increases from around the 1185-point threshold, and a technical retracement will be necessary to eliminate trading positions, accumulate demand for the new expansion phase.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

In my opinion, the market is likely to sideway around the 1250-point zone with a narrow range, and there will be no significant sharp declines. This is truly a challenging period for investors’ patience, but it can also be a calm before the big battle.

Nguyen Hoang – VnEconomy

Macroeconomic data for August was released in the last session. What indicators do you value the most? September also has many important events such as the prospect of resolving prefunding obstacles, FTSE upgrade evaluation, FED interest rate cut… not to mention the expectation of early Q3/2024 business results. Will these supportive factors help the Vietnamese market escape external influences, even if US stocks adjust?

Le Duc Khanh – Director of Analysis, VPS Securities

Definitely – the timely release of macroeconomic information provides analysts and investors with more clues to assess the health of the economy. Forecasted GDP growth data, FDI data, PMI index, import and export indicators, and, of course, the management of exchange rates and policies of the State Bank are what investors care about. September will have more supportive information, not to mention that if the Fed cuts interest rates by 0.5% at the September meeting, the Vietnamese stock market will be included in the FTSE’s upgrade list, which will boost the market to break through the 1300-point peak no matter how the US stock market performs.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

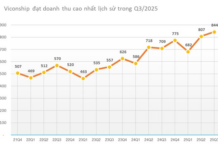

The August macroeconomic data brought clear bright spots in the production and trade activities of Vietnam in the middle of Q3. PMI reached 52.4 points, continuing to show a strong improvement in domestic business conditions and recording a continuous expansion for the past 5 months, from output to new orders. Positive economic activities from production, import and export, FDI, … in 2/3 of Q3 promise to bring a favorable Q3/2024 business results season.

In addition, the Fed will officially change its policy at the September meeting, along with the cooling down of the USD/VND exchange rate, will open up opportunities for the Government and the State Bank to implement more supportive policies for the economy in the coming time.

I think that VN-Index may be subject to short-term impacts from strong corrections in the world stock markets, mainly due to psychological factors. However, the positive factors of the domestic economy as mentioned above will still be the main and core factors in the fluctuation of stock prices in the country, helping the market reach new heights.

I predict that this adjustment will stop at around 1255 +/-10 points – the confluence zone of the price gap and the 3 MA 20, 50, and 100. Friday’s session has “tested” this zone and reacted quite well.

Nguyen Viet Quang

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

August macroeconomic data still shows highlights from FDI, which remains the highest in the last 5 years; industrial production activities; positive trade surplus growth compared to the same period, although domestic consumption has not recovered strongly. In addition, inflation is still under control within the target of the National Assembly, and the foreign exchange balance has become more stable, evident from the significant cooling of the exchange rate.

In addition to the country’s economic information, events in the late Q3 and early Q4/2024 are also expected to create favorable momentum for the Vietnamese stock market, such as the Fed’s likely interest rate cut at the upcoming meeting, decisive moves to resolve prefunding issues according to FTSE’s upgrade criteria, and especially the Q3/2024 business results of listed companies.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

In the group of August macroeconomic data, I appreciate the following indicators: industrial production, total registered foreign investment increased well, and domestic consumption and production demand recovered. Looking at the main indexes of US stocks, they have continuously hit new highs and are heading towards new peaks, while Vietnamese stock indexes this year are still in a sideway phase within a large range and lower than the highest peak by up to 15%. In addition, Vietnam’s interest rate policy is opposite to that of the US, so I think it is quite likely that our market will have its own path and differ greatly from the US market.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

PMI and DXY are the two indicators I care about the most. With the published data, Vietnamese manufacturers have increased output and new orders. Exchange rate pressure has cooled down significantly, and the government will have more options to stimulate capital flow into the economy in the last months of the year.

Nguyen Hoang – VnEconomy

Although the VN-Index adjusted slightly last week, many stocks fell quite strongly. Did you catch the bottom? What is the current stock ratio?

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my opinion, this adjustment is not strong, and VN-Index is likely to soon recover around the 1250 (+-10) threshold as the short-term uptrend is still being maintained. Therefore, I still maintain a high stock ratio, about 80% of the portfolio.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

If we look at the leading stocks, the leading stocks of