Net selling cools down

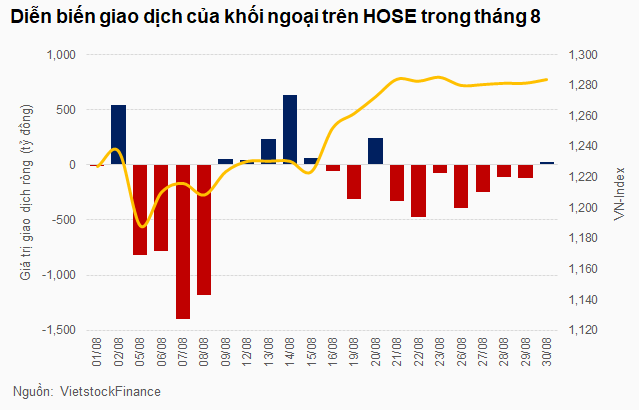

Foreign transactions in August were clearly divided according to time frames. It started with a series of uncomfortable moves, putting pressure on the VN-Index and even dropping below the 1,200-point mark at one point.

Specifically, foreigners net sold in 5 out of the first 6 trading sessions of the month, peaking at nearly VND 1,400 billion on August 7, with VHM being the most heavily sold, at nearly VND 720 billion. At that time, the information that VHM planned to spend nearly VND 14 trillion to buy treasury stocks was not attractive enough to keep foreigners holding this stock.

But since then, foreign investors have reversed their actions by continuously net buying, and even though they returned to net selling at the end of the month, it was not too strong. This somewhat reduced the pressure on the VN-Index and, in fact, the index has advanced to the 1,280-point range.

Thus, after peaking in June 2024, foreigners significantly reduced their net selling in the following two months of July and August, partly creating conditions for the return of the VN-Index.

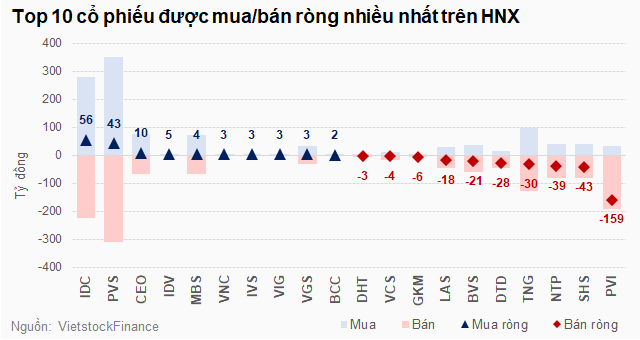

In summary, foreigners net sold more than VND 4,455 billion on HOSE in August, bringing the net selling value in the first 8 months of 2024 to more than VND 65,795 billion, widening the gap compared to the “huge” value of more than VND 56,208 billion in 2021. In contrast to the cooling down on HOSE, net selling on HNX increased significantly, with a value of more than VND 228 billion, doubling that of July and also marking the second consecutive month of net selling.

In total, foreigners net sold more than VND 4,683 billion in August and more than VND 65,490 billion in the first 8 months of 2024.

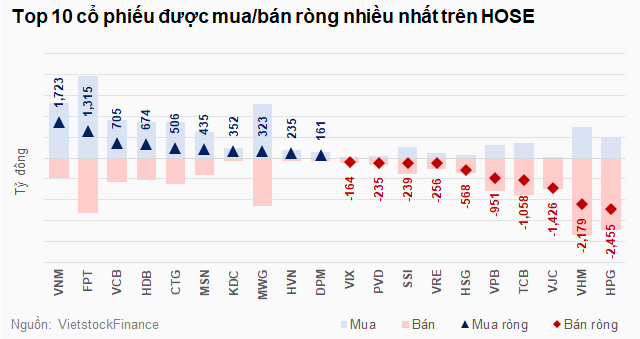

Many large caps were net sold for thousands of billions, FPT reversed the situation

Returning to HOSE, the stocks of many big players on the exchange were heavily net sold, of which HPG was the most net sold at nearly VND 2,455 billion, followed by VHM with more than VND 2,179 billion. In addition, there were two other stocks that were net sold for more than a thousand billion VND, including VJC with nearly VND 1,426 billion and TCB with nearly VND 1,058 billion.

On the opposite side, the two stocks that were net bought for more than a thousand billion VND were VNM with nearly VND 1,723 billion and FPT with more than VND 1,315 billion. Notably, FPT attracted attention when it completely reversed the situation compared to being the most net sold stock in the market in the previous two consecutive months of June and July, the period when the wave of technology stocks gradually passed.

On the HNX exchange, PVI was the most net sold stock, at nearly VND 159 billion. Conversely, IDC led in net buying with a value of nearly VND 56 billion, and this stock is also often among the top net bought stocks every month.

What actions for the future?

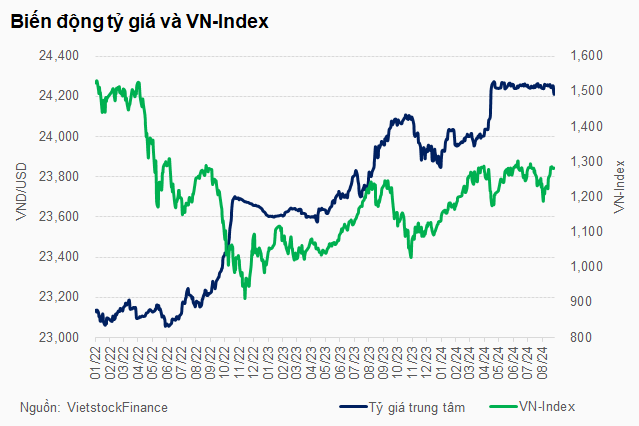

Foreigners’ net selling has shown signs of cooling down since the end of July and has become more apparent in the second half of August, along with the sharp drop in USD exchange rates in the country, against the backdrop of the weakening strength of the greenback in the international market, as the Fed’s monetary policy easing prospects become clearer.

In the interbank market, August 19 recorded the exchange rate falling below 25,000 VND/USD for the first time since April 2024. The State Bank of Vietnam (SBV) adjusted the mid-rate on August 31 to 24,224 VND/USD, down 21 VND from the beginning of the month and down 51 VND from the peak of the first 8 months.

It can be seen that exchange rate pressure has eased after a tense first half of 2024. The US economy remains strong, and the Fed’s slow rate cut has supported the strength of DXY. The positive interest rate differential between USD and many other currencies in the world has attracted capital flows from emerging and frontier markets (including Vietnam) back to the US. In Vietnam, exchange rate pressure was also fierce in the first quarter and early second quarter when FDI enterprises had higher demand for buying USD.

To stabilize the exchange rate, the SBV has applied liquidity coordination measures on the interbank market such as issuing bills, supplying money through OMO, increasing bill and OMO interest rates, and even selling foreign currencies to reduce supply-demand tension.

Sharing with us on this topic, Vo Kim Phung – Head of Analysis Division of Beta Securities Joint Stock Company, said that the risk of exchange rates has decreased when the Fed signals a rate cut, which is expected to help reduce exchange rate pressure. In addition, the rapid cooling of the exchange rate in the past time has also created more room for the SBV in monetary policy management towards loosening, supporting the economy and businesses. These are two of many factors that have helped the VN-Index recover impressively and regain previous points.

In addition, the market is expecting the policy direction to continue to focus on promoting the goal of prioritizing economic growth, thereby helping Vietnam maintain its good growth momentum in the coming years.

Mr. Phung believes that the above factors, along with many other bright spots such as improved credit growth, positive macro data, and expectations for businesses to continue to recover profits quarterly, making the market more attractive… have helped foreign investors regain confidence in the Vietnamese market and thus narrowed the net selling in August 2024. This also helps to relieve psychological pressure on individual and institutional domestic investors when foreigners have continuously net sold in the first 8 months of 2024.

Mr. Dao Hong Duong – Director of Industry and Stock Analysis – VPBank Securities Joint Stock Company (VPBankS) also shared the same view. The net transaction volume of foreign investors is positively correlated with exchange rate fluctuations. Now that the exchange rate has cooled down and the positive outlook for the Fed to start cutting interest rates in September could be one of the factors reducing the net selling volume of foreign investors.

For the Vietnamese stock market, the Fed’s loose policy can have a positive long-term impact. The Fed’s easing will affect the ECB’s monetary policy direction, while limiting the strength of the US dollar and reducing exchange rate pressure in Vietnam. When the exchange rate pressure is under control, Vietnam will have more room for monetary policy to continue to promote the goal of credit growth and economic growth in the fourth quarter of 2024. It is clear that at the end of August, when the exchange rate cooled down, the OMO interest rate and the interbank interest rate for short-term loans also started to decrease.

Mr. Duong also believes that information about the possibility of market upgrade can also positively affect the psychology of both domestic and foreign investors.