In mid-July, Quang Minh School JSC launched the sale of the QMS Tower project at the intersection of To Huu and Vu Trong Khanh streets in Ha Dong district, Hanoi. The sales event immediately caused a stir in the home-buying community, “rocking” the Hanoi housing market. The most impressive aspect of the project was its exorbitant prices, outdated design, reflective glass cladding on the exterior, and a fireworks display to celebrate the project’s “revival” that shrouded the area in smoke.

Image from the QMS Tower project launch in early July.

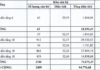

Before the sale, broker Luong provided some customers with expected project prices. Specifically, two- and three-bedroom apartments with areas ranging from 70 to 120 square meters were expected to be priced from VND 50 to 65 million per square meter.

“A 67-square-meter apartment at an expected price of VND 54 million per square meter would cost around VND 4.1 billion, fully furnished,” the broker advised.

However, by the time of the official launch, the price of the 67-square-meter apartment had increased to VND 4.5 billion. Specifically, smaller apartments ranging from 67 square meters and below were priced at VND 62-68 million per square meter. Larger apartments, ranging from 90 to 100 square meters, were priced at VND 75-85 million per square meter. Notably, apartments with areas of 110 square meters and above were priced from VND 89-98 million per square meter, with a value of approximately VND 1.0-1.1 billion per apartment.

At these prices, many homebuyers were dismayed by the exorbitant cost. Moreover, the sample designs further disappointed prospective buyers, as they were considered outdated and not in line with the prices, especially given the information from the developer that the project offered “the lowest prices compared to quality and delivery status.”

QMS Tower project with golden glass cladding on the exterior.

Just over a month after the official launch, the project’s appeal has been largely dampened, falling short of expectations for a revived condominium project that would relieve the supply pressure in Hanoi’s condominium market.

Broker Luong shared, “The project has stopped sales, and the investor has withdrawn the price list.” The broker also acknowledged that the current asking prices are too high and suggested that buyers consider alternative projects with more reasonable pricing.

It is known that the QMS Tower project has a total investment of nearly VND 2,000 billion. The project was granted a construction permit in 2018 and was expected to be completed in 2020. However, construction halted after the roof-sealing ceremony in April 2020.

After more than four years of suspension, the project was restarted, and the investor announced that the project had been roofed and completed 85% of the total volume, with expected delivery in December 2024. The project is scheduled for commissioning in Q1 2025.

The project comprises 490 apartments. Specifically, floors 1 to 5 are designated for commercial and service purposes, floor 6 for community activities, floors 7 to 37 for residential apartments, floors 38 to 44 for hotel apartments, and floor 45 for services.

The New Real Estate ‘Gold Rush’: Strategies to Curb the Frenzy

In recent times, land prices in Hanoi have been surging to unprecedented highs, sparking fears of an asset bubble. This unusual surge in prices has led to concerns about a potential “virtual fever”, with many worried about a possible real estate “bubble”.

“Is Hanoi’s Real Estate Market on Fire? Are Investors Being Taken for a Ride?”

In recent years, Hanoi’s real estate market has witnessed an unprecedented surge in prices, with auction prices for land in outlying districts and apartments in suburban areas reaching a staggering 100 million VND per square meter. As the spiral of price increases continues, many investors are now seeking an exit strategy.

“Apartment Prices to Rise 5-10% by Year-End”

The demand for apartments in major cities is outpacing supply, leading to a trend of rising prices. With a potential influx of remittances into Vietnam as a result of changing laws, the gap between supply and demand is expected to widen, further driving up costs.