One Capital Hospitality (OCH) to Focus on M&A in the Near Future Due to Lack of Growth in the Food Sector

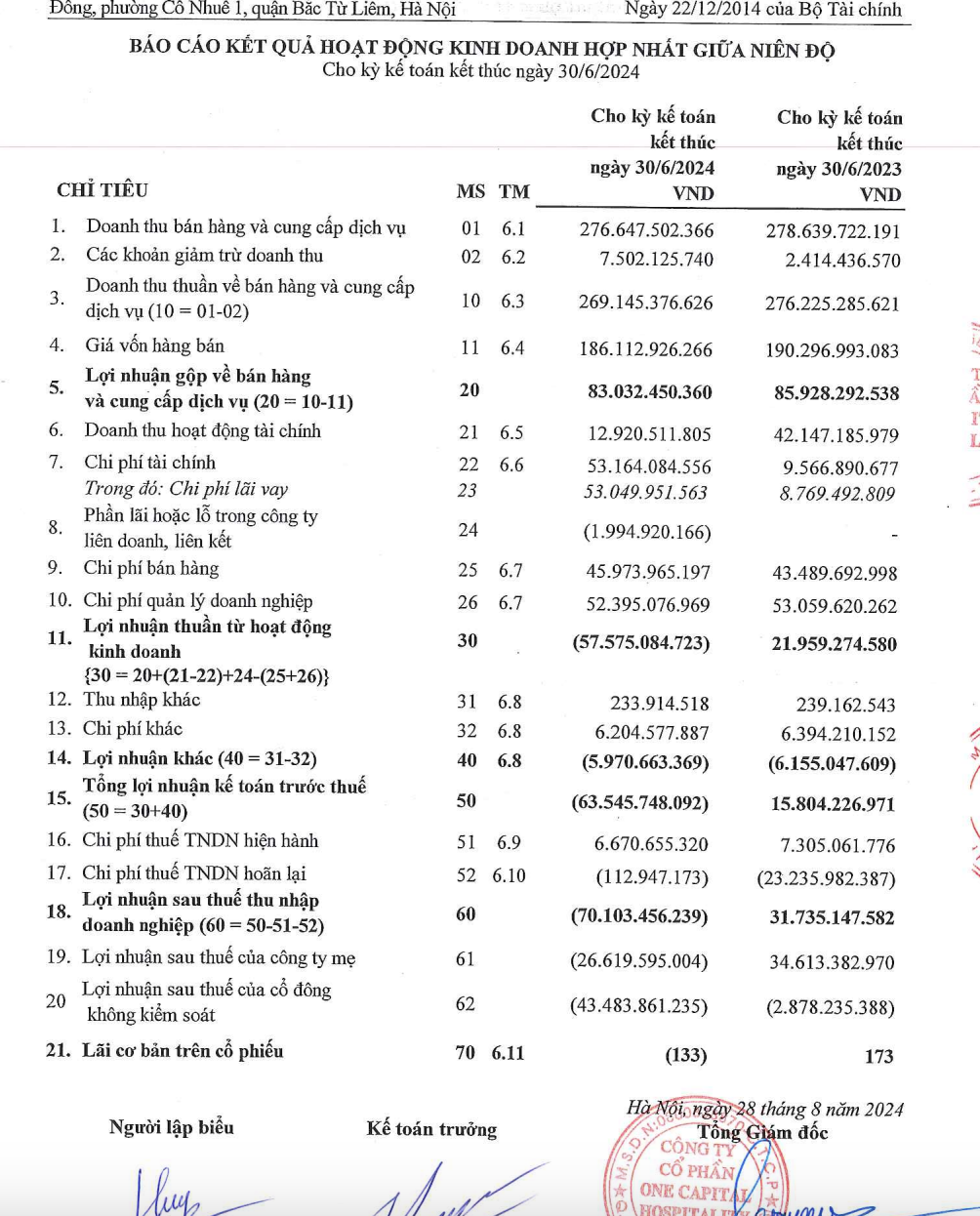

One Capital Hospitality Joint Stock Company (OCH: MCK) has recently released its reviewed semi-annual financial statements for 2024. For the first six months of the year, OCH generated VND 269.1 billion in net revenue, a slight decrease of 2.6% from the same period last year. After deducting the cost of goods sold, OCH reported a gross profit of VND 83 billion.

Financial income decreased by 69.4% to VND 12.9 billion, while financial expenses increased significantly by 5.5 times to VND 53.1 billion due to higher interest expenses. Selling and management expenses remained relatively stable, recorded at VND 46 billion and VND 52.4 billion, respectively.

As a result, for the first half of 2024, OCH reported a post-tax loss of VND 70.1 billion, an increase of VND 2.2 billion compared to the previously self-established report.

OCH’s business results for the first six months of 2024. Screenshot.

It is known that in 2014, after Mr. Ha Van Tham, the former Chairman of OCH and the former Chairman of Ocean Bank and Ocean Group, became embroiled in legal issues towards the end of that year, OCH recorded a record loss of VND 867 billion. This was the highest loss in OCH’s history since its listing.

Including the losses from 2016, 2017, 2021, and the first half of 2024, OCH has accumulated a loss of nearly VND 655 billion.

OCH is a subsidiary of Ocean Group Joint Stock Company (Ocean Group, OGC: MCK). This company owns two famous brands, Kem Trang Tien and Givral cakes, and is also the owner of the Sunrise Nha Trang, Sunrise Hoi An, and Starcity Nha Trang resort chains, among others.

At the 2024 Annual General Meeting of Shareholders, OCH’s management stated that the food business remains the company’s main pillar, as almost all profits come from this sector, while the hotels are not yet operating efficiently due to the impact of Covid and the incomplete recovery of the tourism market.

OCH’s management added that with their current brands and products, the company can achieve stable revenue of over VND 1,000 billion and consolidated profits of VND 180-200 billion. However, there is no growth momentum, and it is very difficult to achieve a breakthrough increase. Therefore, the management has determined that the best growth driver in the near future will be through mergers and acquisitions (M&A).

As of June 30, OCH’s total assets amounted to VND 4,047.7 billion, of which only VND 506.2 billion were short-term assets. The company holds VND 4.1 billion in cash and VND 109.2 billion in bank deposits. Short-term receivables increased by 35% to VND 127.6 billion, with a provision for doubtful debts of VND 173.7 billion. Notably, OCH has a receivable amount of VND 46.24 billion from individuals at Viptour – Togi JSC, with a full provision of VND 46.24 billion, and a receivable amount of VND 53.2 billion from Mrs. Nguyen Thi Dung, with a full provision of VND 53.2 billion.

OCH’s inventory value stands at VND 337.4 billion, mainly comprising production and business costs in progress for the Starcity Airport project (VND 218.3 billion), with a provision of VND 102.3 billion, and the Tan Phu Trung Factory project (VND 74.8 billion). However, OCH has decided to halt investment and construction in the Tan Phu Trung Factory project and is in the process of formulating a plan to transfer this project.

As of the end of the second quarter of 2024, OCH’s financial borrowings amounted to VND 1,687.5 billion. The company’s largest creditor is Vietinbank, with outstanding debt of VND 1,500 billion. This loan was taken by Givral Cake Joint Stock Company to purchase the capital of Binh Hung Production and Trading Limited Liability Company. The loan term extends until December 16, 2030, with an interest rate of 7% per annum in 2023. The loan is secured by all the shares and related rights of Binh Hung Production and Trading Limited Liability Company in IDS Equity Holdings Joint Stock Company, OCH’s term deposits, and all assets attached to the land lot located at 72-74 Tran Phu Street, Loc Tho Ward, Nha Trang City, Khanh Hoa Province, owned by Nha Trang Evening Star One-Member Limited Liability Company.

Intention to Divest from Multiple Projects, Including One Highlighted by the Auditor

According to the report of OCH’s Board of Directors at the 2024 Annual General Meeting of Shareholders, the company’s shareholders approved the continuation of the unimplemented contents of the resolutions of the 2022 and 2023 Annual General Meetings of Shareholders. These include the proposal to divest entirely from 5.14 million shares of Tan Viet Joint Stock Company, divest from over 16 million shares of Viptour Togi Joint Stock Company (the investor of the Starcity Westlake project), divest from the entire capital of Nha Trang Evening Star One-Member Limited Liability Company (the investor of the Starcity Nha Trang Hotel project), and divest from the Starcity Airport project. The expected transferee of these divestment deals is Ocean Group, OCH’s parent company.

Notably, regarding the Starcity Airport project, the audited reviewed semi-annual financial statements of OCH for 2024 highlighted the production and business costs in progress worth VND 218.3 billion for this project. Specifically, the Saigon Airport Plaza project in Tan Binh District, Ho Chi Minh City, is a collaboration with Green Ocean Investment and Services Co., Ltd. (now known as Pegasus Thang Long Co., Ltd. “Pegasus Thang Long”). As of June 30, 2024, the received investment capital contribution for this project amounted to VND 116 billion. All expenses incurred are the value of the land use right and the construction costs in progress for the project, which have been mortgaged at a bank to secure Pegasus Thang Long’s loan. This collateral has been subject to an enforcement decision to recover Pegasus Thang Long’s debt. The company determined the loss to be the entire project cost incurred, amounting to VND 218.3 billion. Consequently, the company set up a provision of VND 102.3 billion (equal to the loss after being offset by the amount received from the business cooperation with Pegasus Thang Long, VND 116 billion). The company’s management assessed that there are no further obligations to be fulfilled related to Pegasus Thang Long and the Starcity Airport project.

Explaining this issue, OCH stated that the company and Pegasus Thang Long had a business cooperation agreement to jointly implement the Saigon Airport Plaza project in Tan Binh District, Ho Chi Minh City. In 2014, OCH’s Board of Directors passed a resolution agreeing to use the land use right, ownership of houses and assets attached to the land, and future assets formed from the Saigon Airport project as collateral for the loan of Green Ocean Investment and Services Joint Stock Company (now Pegasus Thang Long Co., Ltd.) at OceanBank’s Saigon Branch.

In 2021, the Ho Chi Minh City Center for Auction and Valuation of Assets organized an auction for Pegasus Thang Long’s debt at OceanBank’s Saigon Branch. As a result, the new creditor won the auction and became the assignee of all rights and obligations related to Pegasus Thang Long’s debt to OceanBank.

In May 2022, the Hanoi People’s Court issued a decision on the appellate judgment regarding the credit contract dispute between OceanBank, the new creditor, and Pegasus Thang Long, with OCH as a related party. According to the decision, Pegasus Thang Long is responsible for repaying the principal and interest calculated up to March 17, 2021, to the new creditor (the successor of the old creditor’s rights and obligations).

In April 2023, the Civil Judgment Enforcement Division of Tan Binh District, Ho Chi Minh City, issued a decision to forcibly collect the land use right and assets attached to the land at Lot 58, Map 10, Ward 2, Tan Binh District, Ho Chi Minh City, according to the Certificate of Land Use Right, Ownership of Houses, and Other Land-attached Assets granted to the project.

In the future, OCH will continue to take necessary actions to protect the company’s legitimate rights and interests.

In the stock market, during the trading session on September 11, OCH shares were priced at VND 5,700 per share. Currently, this stock is under warning and will be removed from the margin list from September 12 due to the company’s consolidated net profit for the first six months of 2024 being negative, as per the reviewed semi-annual consolidated financial statements for 2024.

Major Banks Donate Tens of Billions to Support Fellow Citizens in Storm and Flood-Affected Areas

With the above donations, banks, both private and national, aim to contribute additional resources to provide further support to the flood-affected communities.