External natural disaster risks continued to weigh on the market during today’s trading session. A cautious sentiment prevailed, with selling pressure intensifying towards the end of the day, causing the index to plunge more than 15 points at its lowest, eventually closing down over 12.50 points at the 1,255-point level.

The breadth was extremely negative, with 320 declining stocks against only 94 gainers. No sector managed to stay in positive territory. Large-cap groups, including banks, fell 1.17%; real estate dropped 2.49%, and securities declined by 1.54%. Mid and small-cap groups such as Materials, which had risen enthusiastically the previous day, fell 1%. Software services decreased by 1.32%, telecommunications by 1.25%, and food, beverages, and tobacco, which had been positive in the morning, turned negative in the afternoon, falling by 0.14%.

The market was painted in red. The stocks that inflicted the most damage on the market today were VCB, which shaved off 1.65 points from the index; BID, which contributed a decline of 0.77 points; and SSB, which took away 0.76 points. Other stocks that had a notable negative impact on the market included HPG, TCB, CTG, VIC, and VRE.

Despite the heightened selling pressure, there was some bottom-fishing activity, causing liquidity across the three exchanges to surge to VND 18,000 billion. However, foreign investors net sold VND 384.4 billion, with a net sell figure of VND 380.0 billion in matched orders.

The main net buying sectors for foreign investors in matched orders were retail and oil & gas. The top stocks purchased by foreign investors in matched orders included VHM, VNM, CTG, VCI, GMD, DGW, BMP, MWG, FRT, and DGC.

On the selling side, foreign investors net sold banking stocks in matched orders. The top stocks sold by foreign investors in matched orders were MSN, FPT, VPB, HPG, HDB, HSG, BID, VCB, and VRE.

Individual investors net bought VND 361 billion, with a net buy figure of VND 387.2 billion in matched orders.

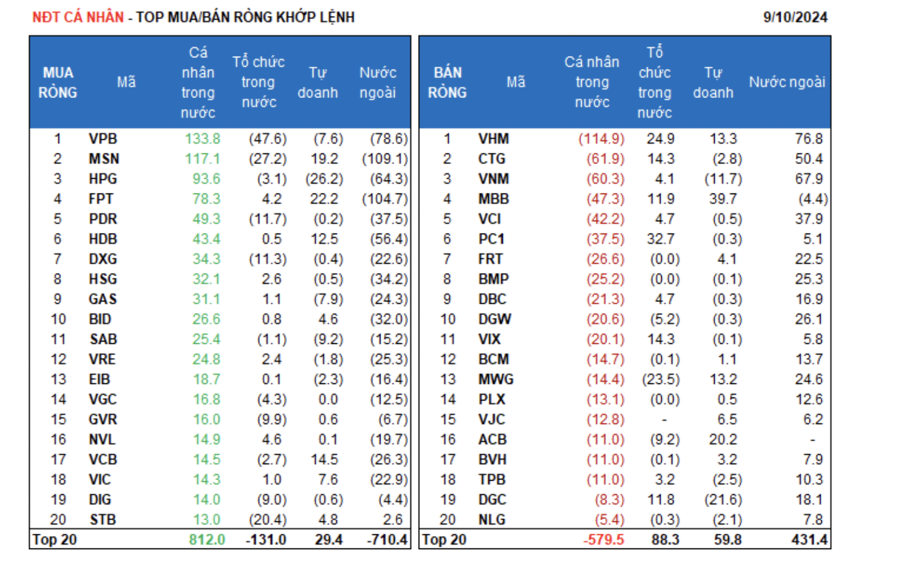

In terms of matched orders, individual investors net bought 12 out of 18 sectors, mainly focusing on basic resources. The top stocks purchased by individual investors included VPB, MSN, HPG, FPT, PDR, HDB, DXG, HSG, GAS, and BID.

On the selling side, in matched orders, individual investors net sold 6 out of 18 sectors, mainly focusing on retail and financial services. The top stocks sold by individual investors included VHM, CTG, VNM, MBB, VCI, PC1, BMP, DBC, and DGW.

Proprietary trading accounted for a net buy of VND 151.7 billion, with a net buy figure of VND 132.4 billion in matched orders.

In terms of matched orders, proprietary trading net bought 9 out of 18 sectors, with the strongest purchases in banking, construction, and materials. The top stocks bought by proprietary trading today included MBB, TCD, TCB, FPT, ACB, MSN, VCB, VHM, MWG, and HDB. On the selling side, basic resources stocks were net sold. The top stocks sold by proprietary trading included HPG, DGC, VNM, SAB, PNJ, GAS, VPB, GMD, HDG, and TLG.

Local institutional investors net sold VND 125.2 billion, with a net sell figure of VND 139.6 billion in matched orders.

In terms of matched orders, local institutions net sold 12 out of 18 sectors, with the largest value in banking. The top stocks sold by local institutions included VPB, TCD, MSN, MWG, GMD, TCB, STB, BAF, TRC, and PDR. On the buying side, financial services stocks were net bought. The top stocks purchased by local institutions included PC1, VHM, CTG, VIX, MBB, DGC, FUEVFVND, VHC, HDG, and GEX.

Today’s matched transactions totaled VND 1,788.9 billion, up 9.1% from the previous session, contributing 10.4% of the total trading value.

Notably, there was a transaction in PC1, with 3.7 million units (equivalent to VND 103 billion) sold by an individual investor to a local institution.

Additionally, there was a transfer of 675 million units of PNJ shares (valued at VND 70.1 billion) between foreign institutions. Individual investors continued to participate in matched transactions in the banking sector (SHB, SSB, TCB, VCB), large-cap stocks (VHM, MWG, MSN), and KOS.

In terms of fund flow allocation, there was an increase in Real Estate, Banking, Construction, Agricultural & Seafood Farming, Food, Retail, and Software, while there was a decrease in Securities, Steel, Chemicals, Oil & Gas, and Aviation.

Specifically, in terms of matched orders, the fund flow allocation increased for mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing for large-cap (VN30) stocks.