In a recent report, Rong Viet Securities (VDSC) assessed that the VN-Index recovered to the balanced valuation zone (P/E 14x-15x) in August amid positive second-quarter business results and a robust growth outlook for the second half of the year.

Entering September, the positive macro context and the removal of bottlenecks to meet FTSE Russell’s upgrade criteria, if progressed, will be catalysts to maintain the recovery momentum and return to an upward trend.

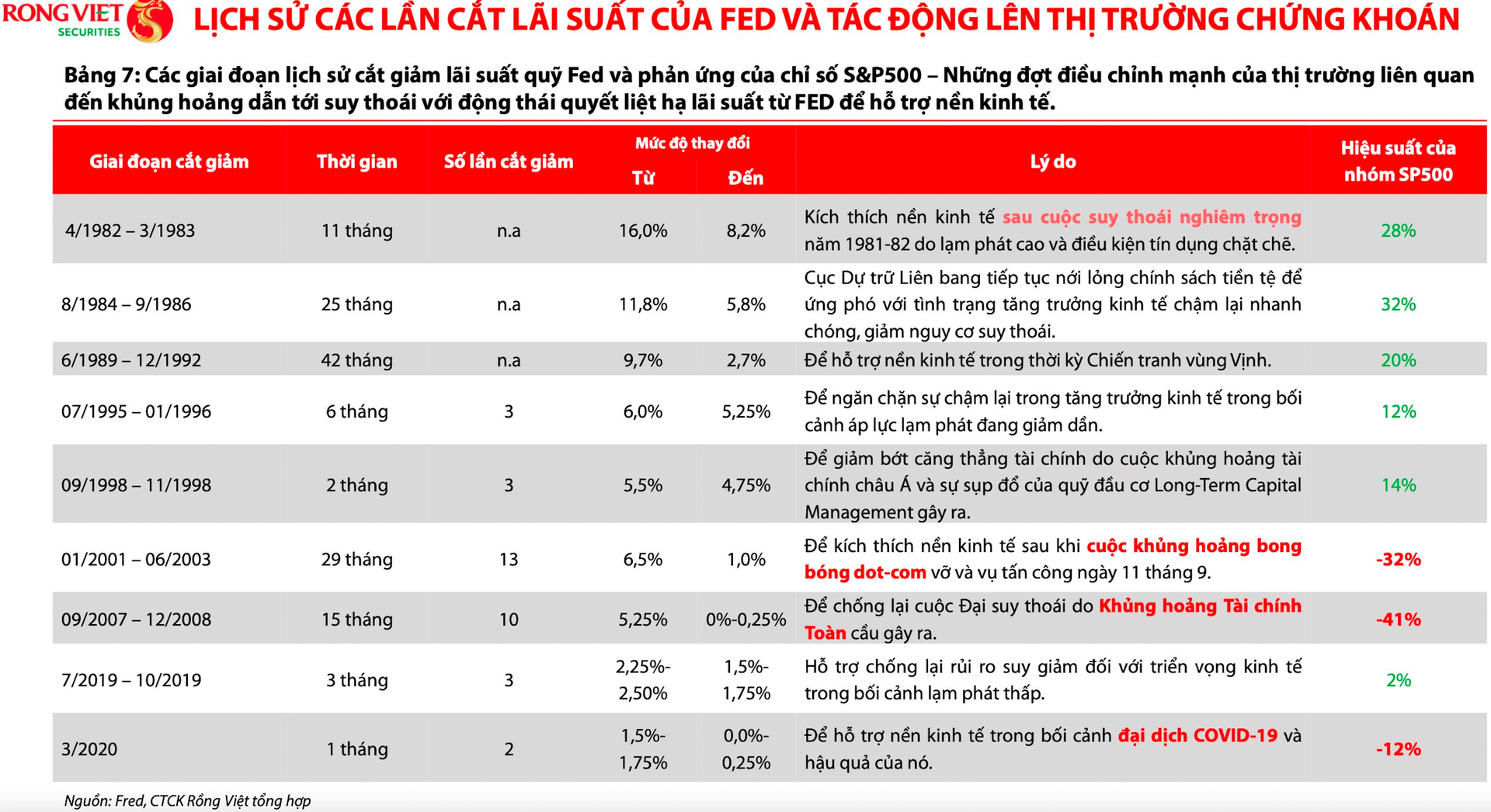

The focus of global investors will be on the FOMC meeting taking place from September 17-18, as the Fed is highly likely to end the monetary tightening period with a decision to cut interest rates for the first time in four years. A 25-basis-point cut is the base-case scenario. However, a 50-basis-point cut, according to CME FedWatch, is becoming increasingly probable following uninspiring economic data.

Additionally, the BOJ’s interest rate decision on September 20 warrants attention. A rate hike decision or a hawkish message about the potential for a rate increase for the remainder of the year could further weaken the US dollar.

The trend of a weak US dollar would create a favorable environment for policymakers to implement supportive policies to maintain low-interest rates, stimulate investment and consumption, and contribute to high economic growth (6%-7%) amid significant fiscal and monetary room for the remainder of the year.

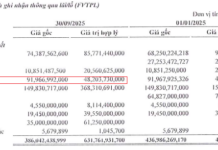

According to estimates, public investment disbursement reached 31.6% of the yearly plan, with an additional VND 530 trillion disbursed. Meanwhile, credit in the first eight months of 2024 increased by 6.25% since the beginning of the year, and an additional VND 1,000 trillion could be injected into the economy to achieve the 15% target.

Vietnam remains on the watchlist for a potential upgrade to secondary emerging market status by FTSE Russell in its September annual review. Compared to the closest evaluation, relevant authorities have made practical efforts to remove obstacles and promote the development of the stock market with the goal of upgrading the stock market.

Specifically, on July 19, the State Securities Commission published a draft circular amending and supplementing solutions to allow foreign institutional investors to purchase securities without requiring 100% pre-funding and providing foreign investors with equal access to information, thereby meeting the remaining two criteria for an upgrade in FTSE’s assessment.

Nonetheless, these solutions are not yet officially effective. Therefore, VDSC anticipates that FTSE Russell will likely express positive remarks regarding the efforts of the management in this evaluation, and the chances of an upgrade approval by FTSE Russell in 2025 will become more feasible when the aforementioned circular takes effect, and foreign institutional investors provide positive feedback during the utilization of the pre-funding solutions.

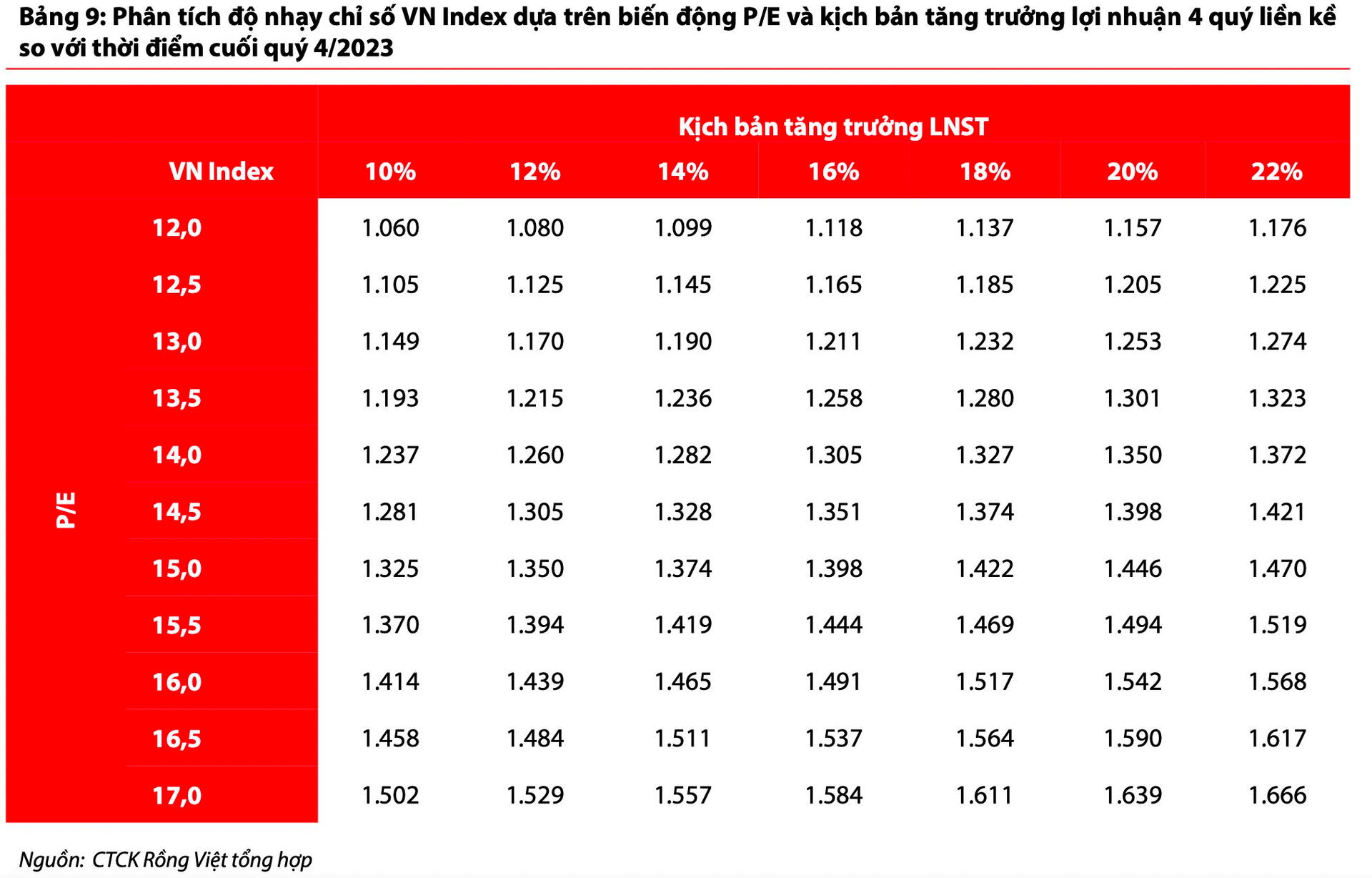

Regarding index levels, VDSC expects the VN-Index to trade within the 1,250-1,325 range in September to bring the yield gap (4%, Figure 24) between the stock market and 10-year government bonds closer to the five-year average of 3.6% (corresponding to a P/E of 15.2x). This is the level the market has touched several times since the beginning of the year when the market sentiment has maintained positive momentum.

With the macro outlook continuing to show positive developments, the sideways trending of the VN-Index is preserved, and the range of 1,237 – 1,325 is considered a reasonable valuation zone for the index after reflecting the 6-month business results of 2024. This implies that investors can increase their stock proportion if the index drops below the lower boundary and realize profits when the index rises to the upper boundary.

“With individual investors having consistently made net purchases for nearly two years, the return of foreign investors will be the driving force for the VN-Index’s re-rating,” the VDSC report emphasized.

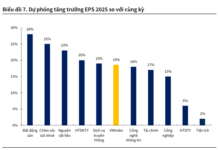

VDSC maintains a positive view on stocks in the Banking, Industrial Zone, Food and Beverage, Consumer, and Industrial Goods and Services sectors.

Residential Real Estate, Financial Services, Information Technology, Retail, Utilities and Energy, and Construction and Building Materials are also sectors that investors may consider when there is a reasonable discount in market price.

Regarding the banking group, the analytical team anticipates that this sector will lead the profit growth in Q3/2024 for the VN-Index, as Q3/2023 is considered the most challenging period for the industry, with numerous negative factors occurring simultaneously, such as weak credit growth, low NIM, high credit costs, and bad debt.