According to VietstockFinance statistics, 27 plastic enterprises announced their second-quarter 2024 financial figures (on the 3 exchanges HOSE, HNX, UPCoM). Of these, 15 improved their profits, while 12 saw a decrease. Most companies are engaged in the production and trading of finished plastic products (plastic packaging, plastic pipes, plastic boards, etc.), with plastic packaging accounting for more than half.

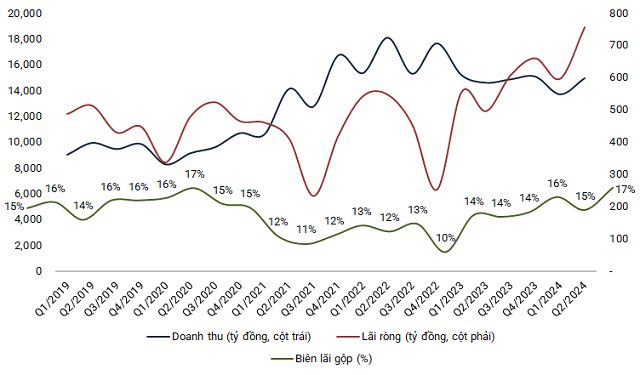

The total revenue of the plastic enterprises in the second quarter reached approximately VND 15,000 billion, a slight increase of 2.5%, but net profit increased by 26.3%, reaching VND 757 billion, with significant contributions from AAA and NTP.

AAA, DNP, HII, NTP, BMP, and TDP continued to achieve quarterly revenue of over VND 1,000 billion, accounting for 71% of the total revenue, an increase from 68% in the same period last year. The profit margin of this group did not change much, still contributing about 90%. The average gross profit margin of plastic enterprises reached 17.2%, the highest in the past 4 years.

|

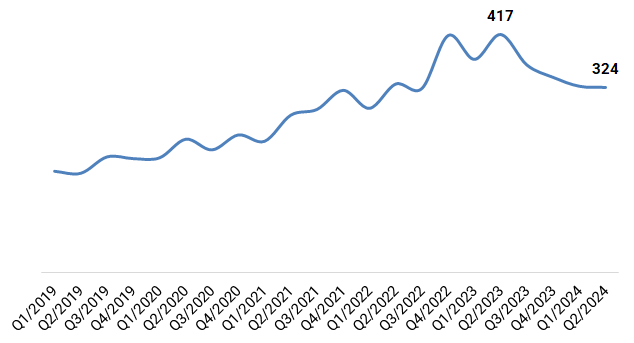

Financial performance of plastic enterprises from 2019 to present (in VND billion)

Source: Author’s compilation

|

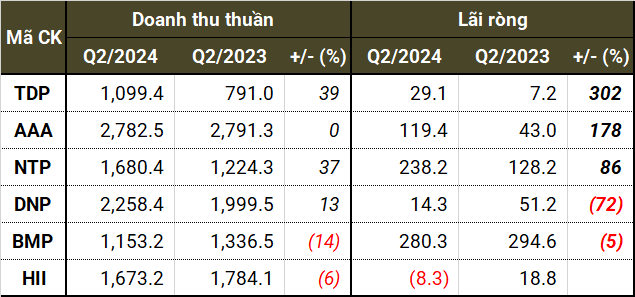

Profit increased manifold

In the group with revenue of over VND 1,000 billion, TDP and AAA, both plastic packaging businesses, reported a manifold increase in profits. Thuận Đức (HOSE: TDP) reported a net profit of more than VND 29 billion, quadrupling that of the same period and reaching the highest level in 2 years, mainly due to the contribution from the export supermarket bag product line. According to TDP, the export market in the second quarter recovered strongly, increasing by 65%. Lower interest rates also had a positive impact on profits.

However, TDP remains cautious, stating that “the sudden growth in the second quarter may not be sustainable in the long term, as borrowing costs are not certain to remain at current levels, so we do not expect a sudden increase in the following quarters.”

Stable plastic resin prices, increased gross profit from both trading and manufacturing activities, reduced interest expenses, and reversal of impairment losses on investments in other entities, as well as favorable exchange rate movements, were a series of reasons that helped Nhựa An Phát Xanh (HOSE: AAA) achieve a gross profit of VND 358 billion, the highest since the first quarter of 2022, despite flat revenue; thereby achieving a net profit of VND 119 billion, up 178%.

In the plastic construction segment, Nhựa Thiếu niên Tiền Phong (HNX: NTP) had a favorable quarter, with revenue and net profit increasing by 37% and 86%, respectively, reaching VND 1,700 billion and VND 238 billion. A gross profit margin of 33%, compared to an average of below 30% in the past 3 years, helped NTP achieve record profits since its operation. The decrease in the price of raw materials was one of the reasons for the Company’s favorable results.

Meanwhile, Nhựa Bình Minh (HOSE: BMP) saw a 14% decline in revenue to VND 1,100 billion, losing to NTP since the third quarter of last year. However, a profit of VND 280 billion, down 5%, still helped the Company outperform NTP.

DNP Holding (HNX: DNP) reported a 13% increase in revenue to nearly VND 2,300 billion and a 37% increase in gross profit to VND 411 billion, the highest ever. However, DNP‘s net profit fell by 72%, to just over VND 14 billion, as there was no longer a sudden gain from the transfer of investment portfolios as in 2023.

The only loss-making company in this group was An Tiến Industries (HOSE: HII) – a supplier of plastic resins to other companies in the “An Phát” group – which reported a loss of VND 8.3 billion, mainly due to a financial investment loss of nearly VND 30 billion, while there was no such loss in the same period last year. However, HII‘s plastic resin business was very positive, with gross profit reaching the highest level since the fourth quarter of 2021.

|

Financial performance of plastic enterprises with revenue above VND 1,000 billion (in VND billion)

Source: VietstockFinance

|

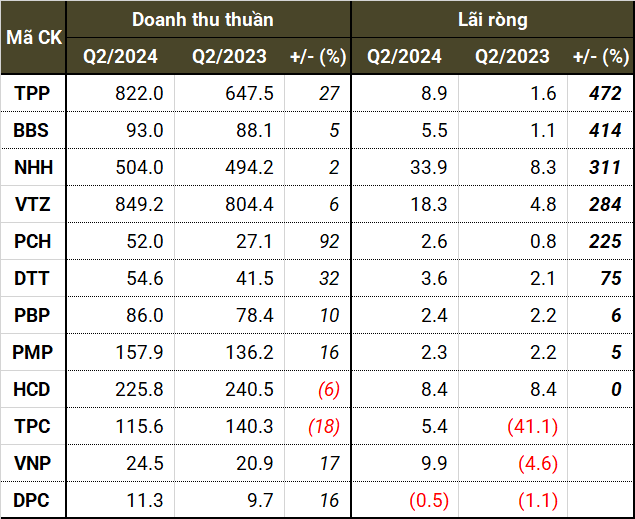

Benefiting from reduced interest expenses

In the group with a smaller revenue scale, 12 companies performed better than in the same period last year. Notable companies with a manifold increase in net profit include TPP, BBS, NHH, VTZ, and PCH, with growth rates ranging from 225% to 472%.

Tân Phú Việt Nam (HNX: TPP) achieved record revenue of VND 822 billion, up 27%, and a net profit of nearly VND 9 billion, 5.6 times higher than the previous year, thanks to the “application of many cost control measures to save expenses.”

VICEM Bao bì Bút Sơn (HNX: BBS) reported its highest quarterly profit ever, reaching VND 5.5 billion, while revenue remained low, which the Enterprise attributed to reduced asset depreciation.

For Nhựa Hà Nội (HOSE: NHH), profit increased by 311%, to VND 34 billion, thanks to reduced interest expenses and a significant increase in profit from its subsidiary engaged in floor production.

Sản xuất và Thương mại Nhựa Việt Thành (HNX: VTZ) increased its profit by 284% thanks to the expansion and diversification of sales channels and reduced financial expenses.

In the second quarter of 2024, Nhựa Tân Đại Hưng (HOSE: TPC) returned to profitability, with a net profit of VND 5.4 billion, compared to a significant loss a year earlier. Explaining the results for the first six months, the plastic packaging company stated that the sale of products with better profit margins had yielded favorable results. In addition, stable production activities and an unchanged product mix, free from the impact of inventory processing as in 2023, also contributed to the improved performance.

|

Second-quarter financial performance of enterprises with increased profits (in VND billion)

Source: VietstockFinance

|

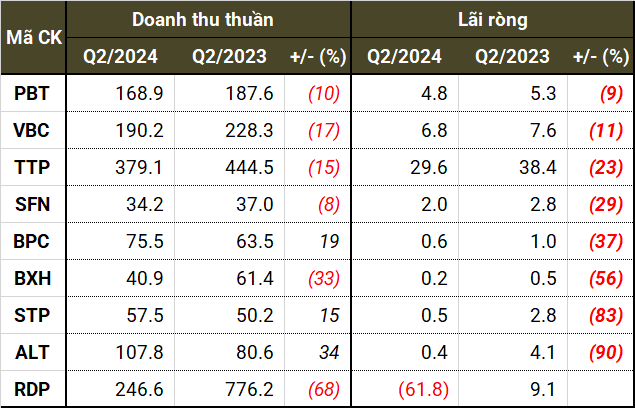

Cement bag businesses still facing challenges

Net profit remained unfavorable for 9 enterprises, despite improved revenue, mainly due to the increase in the price of raw materials.

The 23% decrease in Bao bì Tân Tiến (UPCoM: TTP)‘s profit was due to competition among companies in the packaging industry and reduced consumer demand, coupled with rising raw material prices.

The strengthening of the USD exchange rate, the increase in the price of raw materials, the low volume of captured aquatic products, and low consumption were the reasons for the 29% drop in profit for Dệt lưới Sài Gòn (HNX: SFN).

Some companies providing cement bag shells continued to show slow recovery as the real estate and construction markets remained subdued, coupled with intense industry competition.

For instance, VICEM Bao bì Hải Phòng (HNX: BXH) saw a 33% and 56% decrease in revenue and net profit, respectively, to VND 41 billion and VND 220 million. According to BXH, the domestic cement market declined sharply, with supply continuing to exceed demand. The export cement market’s transition to using new types of bag shells also led to a decrease in revenue.

Although VICEM Bao bì Bỉm Sơn (HNX: BPC) achieved higher revenue, its profit decreased by 37%, to VND 609 million, due to the increase in the price of some main raw materials, which led to higher production costs, while selling prices decreased.

On the other hand, Công nghiệp Thương mại Sông Đà (HNX: STP) saw increased revenue from clinker sales but suffered an 83% drop in net profit to VND 480 million due to increased provisions for doubtful accounts receivable.

|

Second-quarter financial performance of enterprises with decreased profits (in VND billion)

Source: VietstockFinance

|

Interest expenses decreased significantly

In the second quarter of 2024, plastic enterprises spent VND 324 billion on interest expenses, a decrease of 22% compared to the peak of VND 417 billion in the same period last year. 20 out of 27 companies reported a reduction in interest expenses, ranging from 9.3% to 100% (as in the case of PCH), partly due to lower interest rates over the past year.

The companies with the highest interest expenses included DNP, AAA, TDP, and RDP, which reported decreases of 15%, 12%, 18%, and 26%, respectively. Meanwhile, NTP halved its interest expenses compared to the previous year.

|

Interest expenses of plastic enterprises from 2019 to present (in VND billion)

Source: Author’s compilation

|

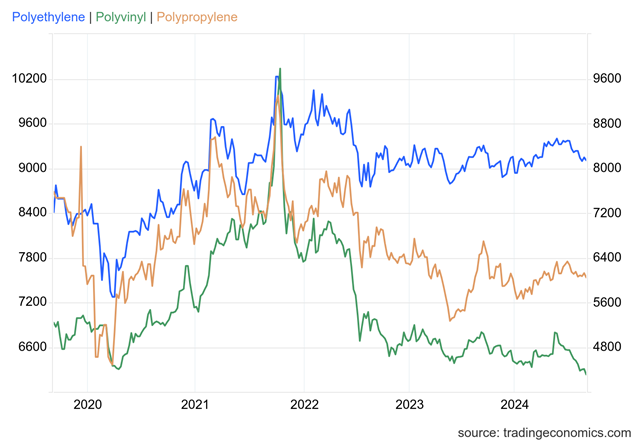

FPTS Securities expects the gross profit margin for the full year 2024 of plastic construction enterprises to be close to 31% – higher than the average of 25.3% in the period 2018-2022, as plastic resin prices are currently very low, along with improving demand. However, companies with high selling prices, such as BMP, will face pressure to reduce selling prices to maintain their competitiveness.

Regarding plastic resins, FPTS expects PVC prices to gradually recover to USD 900/ton this year, higher than the average price in the period 2018-2020 by about 6.2%, but significantly lower than in 2021-2022, due to the improved consumption of plastic resins globally and an expected Brent oil price of around USD 85/barrel in 2024.

|

Price movement of PP, PE, and PVC plastic resins in the period 2020-2024

Source: Tradingeconomics.com

|

“Tasco Auto Invests in Strategic Subsidiary Takeovers and Increased Holdings in High-Performing Subsidiaries”

Tasco Auto, a leading automotive distributor in Vietnam, has unveiled its strategic investment plan. The company aims to transform select associated businesses into subsidiaries and increase its stake in high-performing ones. This move underscores Tasco Auto’s commitment to fortify its core business and investment prowess, solidifying its position as a powerhouse in the Vietnamese automotive landscape.