Following two promising rebounds, shares of HPG, owned by Hoa Phat Group, took a sharp downturn during the September 10th session, falling to 25,150 VND per share—the lowest price so far this year. Over the past three months, HPG has lost 15% of its market value. This downward trend began in mid-June when the outlook for the global steel industry was overshadowed by oversupply.

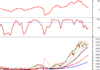

This situation is expected to persist in the short term, continuing to put pressure on steel prices and raw materials such as iron ore and coking coal. According to KBSV, a sharp decline in raw material input prices will create pressure on Hoa Phat’s provisioning in the third quarter, causing gross profit margins to shrink during the period.

However, in the medium term, this securities company believes that Hoa Phat’s gross profit margin will remain high due to (1) input costs falling faster than selling prices (domestic steel prices have fallen by 3% since the beginning of the year, supported by recovering domestic consumption) and (2) the company’s tight control over inventory turnover days, maintaining the lowest level since the beginning of 2022.

According to KBSV, domestic steel consumption will be the main driver of Hoa Phat’s sales volume in the coming time due to (1) the gradual recovery of the real estate market and (2) the increase in steel consumption during the year-end construction season. This securities company also noted that domestic orders will have higher gross profit margins than export orders due to lower transportation costs.

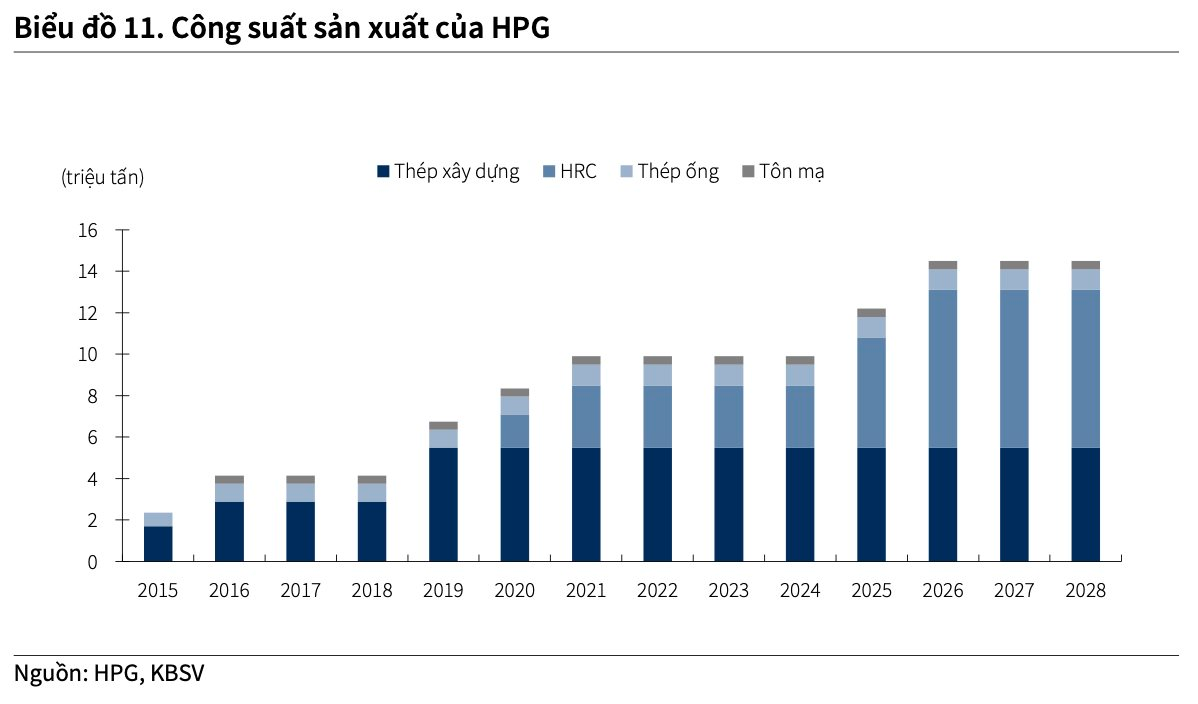

In the long term, the operation of the Dung Quat 2 Integrated Steel Mill will contribute to improving Hoa Phat’s production capacity and product quality. Dung Quat 2 has two blast furnaces, with its main products being hot-rolled coils and high-quality steel with a total capacity of 4.6 million tons per year. According to the orientation of the leaders, 70% of the hot-rolled coil production will be supplied to meet domestic consumption needs, and the remaining 30% will be exported.

Currently, the construction progress of Phase 1 and 2 of Dung Quat 2 Integrated Steel Mill has reached 80%/50%, ensuring the progress of Phase 1 to be operational and starting commercial operation from Q1/2025 with the first blast furnace (capacity of 2.3 million tons/year). As of the end of Q2, the value of the basic construction in progress of Dung Quat 2 Integrated Steel Mill was recorded at VND 42,400 billion, up 58% compared to the previous quarter.

Risks from the global market

Despite its relatively solid medium and long-term prospects, Hoa Phat still faces significant risks from the global market. The outlook for China’s steel exports is declining as major markets such as the US and EU increase trade protection measures.

With high inventory levels and declining EBITDA margins, KBSV believes that manufacturers will prioritize reducing inventory and optimizing capacity in the coming period. This could put further downward pressure on steel prices in the short term, with prices stabilizing once the domestic steel market in China rebalances.

In a negative scenario, Hoa Phat’s gross profit margin may be affected when Dung Quat 2 Integrated Steel Mill goes into operation and HRC prices continue to decline, as the blast furnace is not yet operating at maximum capacity and the company starts to recognize depreciation expenses. Therefore, HRC price movements need to be monitored to make a comprehensive assessment.

In addition, regarding the proposal to apply anti-dumping measures on HRC imports from China and India (AD20), KBSV believes that the need for trade protection for hot-rolled coil products exists, as these two countries currently account for more than 80% of Vietnam’s HRC imports.

However, the production and supply capacity of HRC in the domestic market is still limited (estimated total capacity of HRC of Formosa and Hoa Phat by 2026 will be more than 14 million tons/year, lower than the current demand of 15-16 million tons/year, according to VSA). The application of anti-dumping duties may hinder the ability of domestic enterprises to access supply and production. KBSV assesses the probability of AD20 being applied at a medium level (50-60%).

The Steel Giant No Longer Stands Tall: Hoa Phat Exits Vietnam’s Top 10 Largest Listed Companies as Vingroup Makes a Comeback with a Near 15,000 Billion VND Surge in Market Capitalization.

For 22 consecutive trading sessions, foreign investors have been net sellers of Hoa Phat Group’s stocks, offloading shares worth a total of nearly VND2.6 trillion.