The stock market witnessed a lackluster performance during the September 10 session. Strong selling pressure, particularly in the afternoon session, pushed the main index deeper into negative territory towards the end of the day. The VN-Index closed at 1,255 points on September 10, marking a 13-point decline from the reference point. Foreign investors continued their net selling streak, offloading nearly VND400 billion, mainly in large-cap stocks, which exerted significant pressure on the market.

With this substantial correction and the lack of aggressive buying interest, securities companies maintained their outlook for the VN-Index to undergo further adjustments in the next session. Investors are advised to remain cautious in their trading activities.

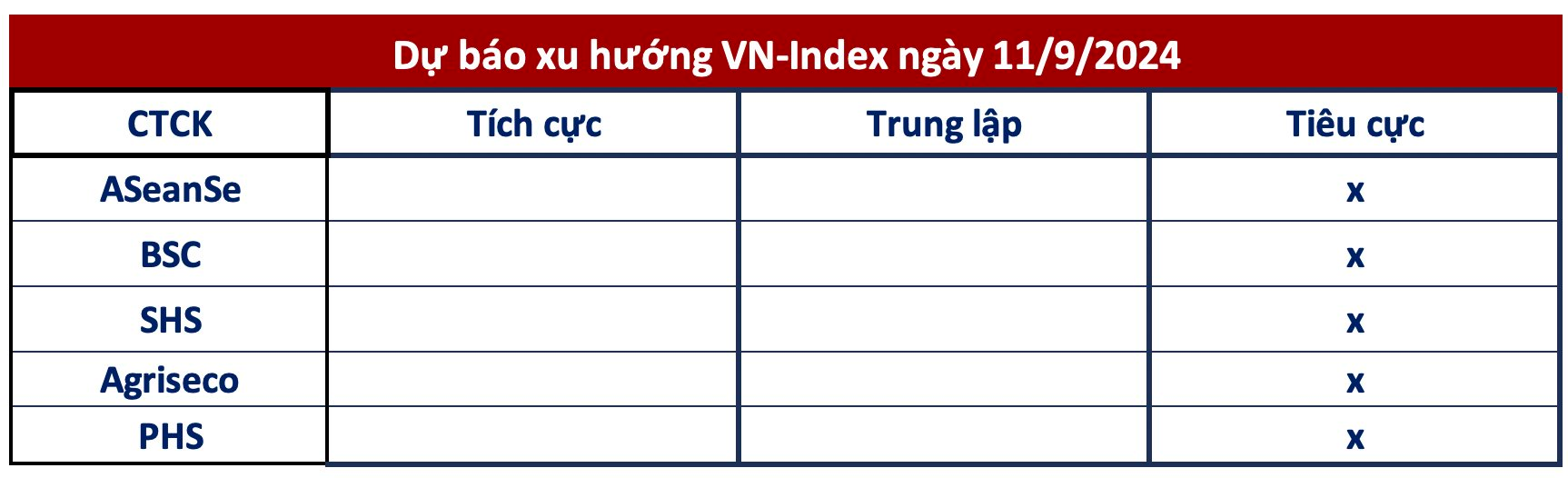

ASEAN Securities

assessed that selling pressure remains dominant, and the market faces the risk of a deeper correction if there isn’t a significant improvement in capital inflows. Investors are advised to maintain a moderate portfolio allocation, focusing on stocks with strong long-term competitive advantages, and await confirmatory signals before taking action.

Sharing a similar cautious sentiment,

BSC Securities

anticipated that the VN-Index could decline further towards the 1,230-point level if it fails to hold the 1,250-1,255 support zone in the upcoming sessions.

According to

SHS Securities

, the VN-Index is exhibiting less positive momentum as it failed to sustain the support zone defined by the 20-session moving average. The current situation does not indicate an increase in buying power or short-term capital inflows. In the following sessions, the main index may continue to face corrective pressure towards the 1,250-point level and attempt a recovery towards the nearest resistance zone around 1,265 points.

Agriseco Securities

projected that the VN-Index might retest the 1,250-1,260 range and form a balance in the next session, although the extent of declines in subsequent sessions is not expected to be significant. Investors are advised to maintain their positions and await new investment opportunities as the market establishes a new equilibrium.

Likewise,

Phu Hung Securities (PHS)

anticipated that the correction could extend further, with the VN-Index potentially retreating to the 1,220-1,240 zone. The recommended strategy for investors is to maintain their positions and closely monitor the support zone for any signs of a rebound.

Tomorrow’s Stock Market Outlook: Which Three Sectors Should Investors Consider for Profit-Taking?

The stock market witnessed another volatile session on September 9th. Despite the fluctuations, the emergence of buying interest indicates that investor sentiment is not overly pessimistic. The presence of buyers suggests a hopeful outlook for a potential rebound.