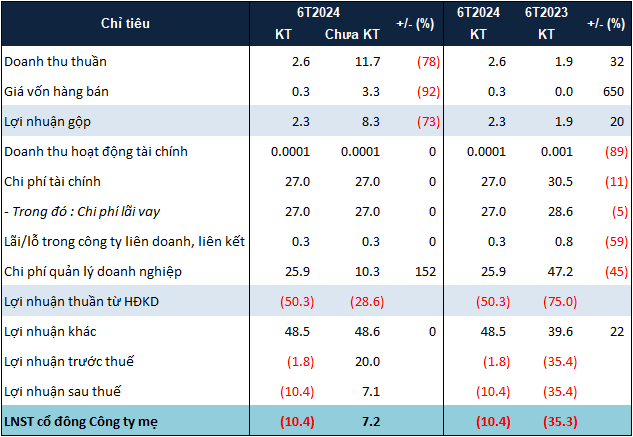

The primary reason for NRC’s profit-to-loss reversal was a 78% decline in net revenue after the review, leaving just over 3 billion VND. The company attributes this drop in revenue mainly to consulting contract earnings. Revenue from completed enterprise consulting service contracts will be additionally recognized upon issuance of value-added invoices.

On November 13, 2023, the Tax Department of District 1, Ho Chi Minh City, issued a decision to enforce administrative decisions on tax management by suspending NRC’s use of invoices for one year. This was due to NRC’s debt of nearly 100 billion VND in tax arrears overdue by more than 90 days from the due date and the extended deadline as stipulated by law.

The second reason for NRC’s loss was a 2.5-fold increase in audit management expenses compared to the self-prepared report, totaling nearly 26 billion VND. The company explained that this increase in expenses was due to adjustments in bad debt allowance and the establishment of bad debt provision as per the auditor’s recommendation.

Specifically, in the self-prepared report, NRC set aside a provision of nearly 185 million VND, while the reviewed report recognized this amount at over 15.8 billion VND.

|

NRC’s reviewed business results for the first six months of 2024

Source: VietstockFinance

|

Apart from the profit-to-loss reversal, NRC’s reviewed semi-annual financial statements for 2024 also noted a qualified conclusion. Accordingly, the auditing firm stated that during the first six months of 2024, the company recognized income from penalty for contract violation with Danh Khoi Holdings JSC (a related party) worth 66 billion VND. The company used this amount for business cooperation per the contract dated June 27, 2024. However, as of the financial statement date, the auditing firm had not obtained sufficient evidence to assess the short-term effectiveness of the business cooperation resulting from the utilization of this income.

Additionally, the auditing firm raised a key concern regarding NRC’s ability to continue as a going concern.

In response to the qualified opinion, NRC explained that the nature of the business cooperation contract dated June 27, 2024, is long-term, and the company will recognize revenue towards the end of the cooperation cycle. Therefore, the evidence provided by the company to the auditors could not convincingly demonstrate the short-term effectiveness of the cooperation.

Regarding business cooperation, at the 2024 Annual General Meeting of Shareholders held on June 25, 2024, NRC’s management shared that they had worked on and explored numerous projects in line with their strategy to focus on low-rise urban areas with existing products, infrastructure, and land titles to create liquidity and break new ground in 2024.

In the plan for utilizing capital from the issuance of 100 million shares to professional securities investors, the company intended to use 195 billion VND to partially acquire the Dai Nam Residential Area (National Highway 13, Minh Hung Commune, Chon Thanh District, Binh Phuoc Province) and 180 billion VND to partially acquire the Ham Thang – Ham Lien small industrial, commercial, and service residential area project (National Highway 1, Ham Thang Commune, Ham Thuan Bac District, Binh Thuan Province).

NRC Chairman Le Thong Nhat on the reason for acquiring the Dai Nam Residential Area

“Tightening the Reins: Bắc Giang’s Stern Approach to Curbing Tax Arrears and Safeguarding Fiscal Revenue”

The province of Bac Giang has seen impressive results in its tax revenue collection for the first seven months of the year, amassing nearly VND 9.7 trillion, a substantial 22.3% increase compared to the same period last year. This remarkable achievement can be attributed to the Bac Giang Tax Department’s proactive efforts in conducting inspections and audits to combat tax evasion and avoidance, coupled with their stringent management of tax debts, including the implementation of temporary exit bans for delinquent businesses.

“A Whopping $63.188 Billion in VAT Refunds: Ho Chi Minh City and Binh Duong Province Lead the Way”

As of the end of June 2024, the tax industry had issued 8,740 decisions on VAT refunds, totaling 63,188 billion VND in refunded taxes. This reflects the industry’s commitment to efficient and timely tax refunds, ensuring a healthy cash flow for businesses and promoting a robust economy.