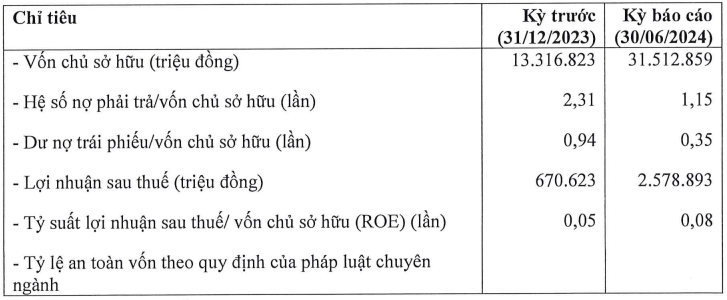

As of June 30, 2024, Vinpearl’s total assets stood at nearly VND 67.8 thousand billion, a significant increase of almost 54% compared to the previous year. While payables also rose by nearly 18% to over VND 36.2 thousand billion, bond debt decreased by almost 12%, leaving a balance of more than VND 11 thousand billion.

|

Vinpearl’s Business Results for the First Half of 2024

Source: HNX

|

Currently, Vinpearl has two international bond issues and no domestic issues outstanding. One of Vinpearl’s international bonds, with the code VPLD2429001, was recently issued on August 20, 2024. It has a face value of USD 200,000 per bond, with a total issuance size of 750 bonds, raising a total of USD 150 million. The bond will mature on August 20, 2029, and offers an interest rate of 9.5% per annum.

The other outstanding international bond, VPLD2126001, was issued on September 21, 2021, and will mature on September 21, 2026. It has a face value of USD 200,000 per bond, with an issuance size of 2,125 bonds, raising a total of USD 425 million. This bond has a lower interest rate of 3.25% per annum.

In April, Vinpearl successfully redeemed two bond issues, VPLB1921001 and VPLB2024002, totaling VND 2,000 billion (VND 1,000 billion each). In addition to the principal amount, Vinpearl also paid a total of nearly VND 108 billion in interest expenses for these two bond issues in the first half of 2024.

“Sacombank Offers Long-Term Deposit Certificates with 7.1% Annual Interest”

“Starting September 5, 2024, Sacombank is offering its customers an attractive long-term investment opportunity with the launch of its registered, high-interest long-term deposit certificates. With VND 5,000 billion on offer, both individual and institutional investors can now access a safe and profitable avenue to optimize their idle funds, earning higher returns than traditional savings accounts.”