Vice Governor of the State Bank of Vietnam Dao Minh Tu (right) speaks on the possibility of achieving the credit growth target of 15% for the year – Photo: VGP/Nhat Bac

|

Specifically, according to Vice Governor of the State Bank of Vietnam (SBV) Dao Minh Tu, the credit growth target for the year is set at around 15%, with adjustments made according to practical requirements up to the end of the year. As of now, a growth rate of 7.75% has been achieved.

In the first months of the year, credit growth was negative, even reaching -2% in the first quarter. However, it has picked up significantly since April, especially in July and August. At this point last year, the growth rate was only 5.33%, but we still managed to achieve the target of 13.71% by the end of the year.

“This year, the speed and overall trend of the economy have improved greatly, and the growth rate across all targets is assessed to be very positive. We believe that we can achieve the 15% target,” said the Vice Governor.

She added that the 15% growth target is a guiding figure in the management and not an imposed number. However, the most important thing now is to focus on credit growth, which means expanding investment to contribute to economic growth.

The SBV has set very determined tasks for credit growth from the beginning of the year and introduced a series of positive solutions and measures, drawing on experience from previous years as well as new approaches for this year. This includes allocating and facilitating all credit institutions, with a 15% target allocation for all commercial banks to proactively operate in credit granting by the end of 2023.

In addition, the SBV has taken steps to gradually lower interest rates. The average lending rate for new loans is currently 6.23%, a decrease of 0.86% compared to the end of 2023, while the deposit rate is 3.84%, an increase of 0.23%, with only a small number of small commercial banks making this adjustment. The Vice Governor emphasized that the increase in deposit rates and the decrease in lending rates mean that commercial banks have shared a significant burden with businesses.

Secondly, the exchange rate has been very stable, with the currency depreciation standing at only 1.5% so far, which is much lower than in other countries. The SBV will continue to maintain a stable, reasonable exchange rate that attracts foreign investment.

Liquidity for the economy and credit institutions has decreased simultaneously, meaning that the lending capacity of commercial banks, including credit room, resources, and liquidity, is sufficient to meet credit demand. The critical factor now is the ability to absorb loan demand. There is a need to boost both the demand for loans from businesses and their capacity to absorb capital. Many other macroeconomic policies and solutions are also being implemented to facilitate businesses in absorbing credit capital.

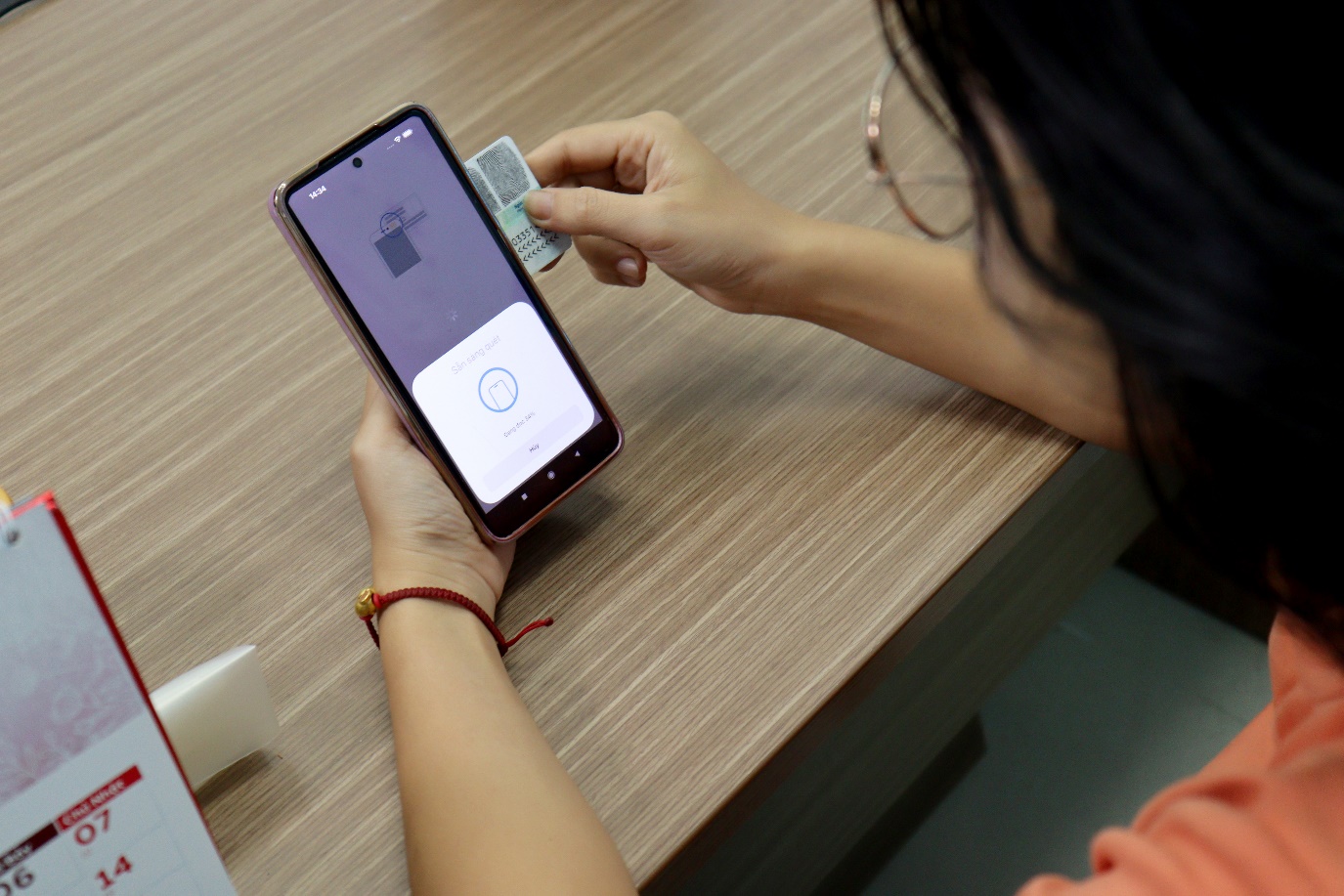

Connectivity conferences in all 63 provinces and cities, preferential credit policies, and credit policies within the target program are being vigorously implemented. In terms of mechanisms and policies, after the implementation of the new Law on Credit Institutions, the SBV has removed or simplified many procedures and conditions for commercial banks to have a legal basis for promoting lending. Another contributing factor is the application of technology in credit activities, which facilitates both borrowers and lenders.

These are some of the measures that the SBV has been and will continue to implement, attaching great importance to creating conditions for businesses to access capital and facilitating commercial banks. The SBV also requires commercial banks to focus more on key and priority areas as directed by the Government and the Prime Minister.

Regarding preferential credit packages, the package for seafood exports has disbursed VND 36,000 billion, exceeding the expected figure of VND 30,000 billion. On the morning of September 7, the Prime Minister directed the SBV to continue to increase the balance of this package to about VND 50-60,000 billion. In addition, the credit package for social housing of VND 140,000 billion will also be further incentivized, with the interest rate reduced by an additional 1%, bringing the total reduction to 3%, and the term extended from 5 years to 10 years to help homebuyers access and actively disburse this package.

“These are the contents that the SBV will continue to carry out in the coming time. With the credit outstanding balance up to now and with the policies of the industry, as well as the strong direction of the Government, the Prime Minister, and the synchronous monetary and fiscal policies, the SBV hopes that the credit growth rate in 2024 will contribute to achieving the economic growth target of 6.5 – 7%,” said the Vice Governor.