|

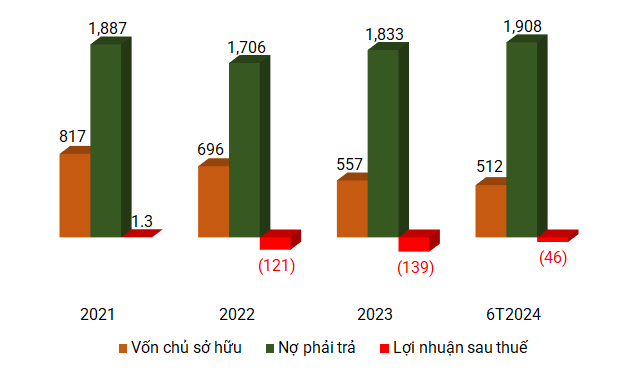

Financial Performance and Status of Nam Land from 2021 onwards (in trillion VND)

Source: Consolidated by the author

|

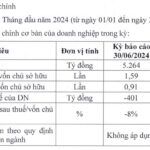

The loss has decreased the company’s equity to 511 trillion VND from 557 trillion VND at the beginning of the year. As of the end of June, the debt remained relatively unchanged at 1,900 trillion VND. The bond debt stood at 900 trillion VND. The return on equity (ROE) was negative 8.9%.

Nam Land has been unprofitable since 2021. In that year, the real estate company made a meager profit of 1.3 trillion VND. In 2022, the company incurred a significant loss of 120 trillion VND, followed by another loss of 139 trillion VND in 2023. As a result, its equity decreased from 817 trillion VND to 511 trillion VND.

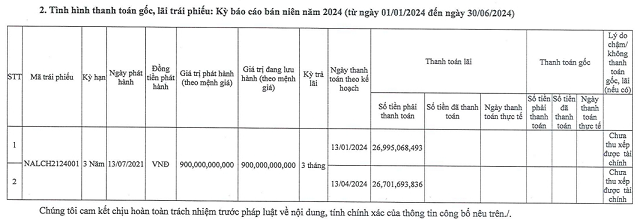

Due to financial difficulties, the company has been unable to pay a total of 54 trillion VND in interest payments for the two periods in January and April 2024 to the bondholders of the 900 trillion VND bond lot (code: NALCH2124001) as it has not yet arranged finances.

Source: Nam Land

|

Nam Land’s only bond issue has a three-year term and was issued on July 13, 2021, which means it has now passed the maturity date and HNX has canceled the registration of this bond lot. The bonds are non-convertible, non-warrant-attached, and asset-backed. The interest rate for the first four terms is fixed at 10.3% per annum, with subsequent terms floating but not less than 10.3% per annum.

Proceeds from the bond issue were intended to be used to settle credit obligations with VPBank (VPB) up to a maximum of 400 trillion VND, and the remaining for investment cooperation with Gotec Vietnam JSC to develop the Shizen Home commercial center and luxury apartment project in Ben Nghe Ward, Tan Thuan Dong Ward, District 7, Ho Chi Minh City.

In late 2022, Nam Land committed in a minutes of meeting to repurchase the entire bond lot before the due date, which was no later than June 30, 2023. However, the 2023 principal and interest payment report shows that the Company has not been able to fulfill its promise and also owes interest for the July and October 2023 terms, only paying 50% of the April 2023 term due to the same reason of not yet arranging finances.

Shizen Home Project Perspective. Source: Gotec Land

|

Nam Land reports a loss of more than 120 billion VND as the early bond repurchase date approaches