Kirin Capital’s Banking Outlook 2024 report reveals that as of July 2024, the banking system’s liquidity has returned to stable levels after more than 3 months of exchange rate stabilization by the State Bank.

This is reflected in the cooling of interbank interest rates and the continued inflow of resident deposits into the banking system.

STRONG PERFORMANCE ACROSS SEVERAL AREAS

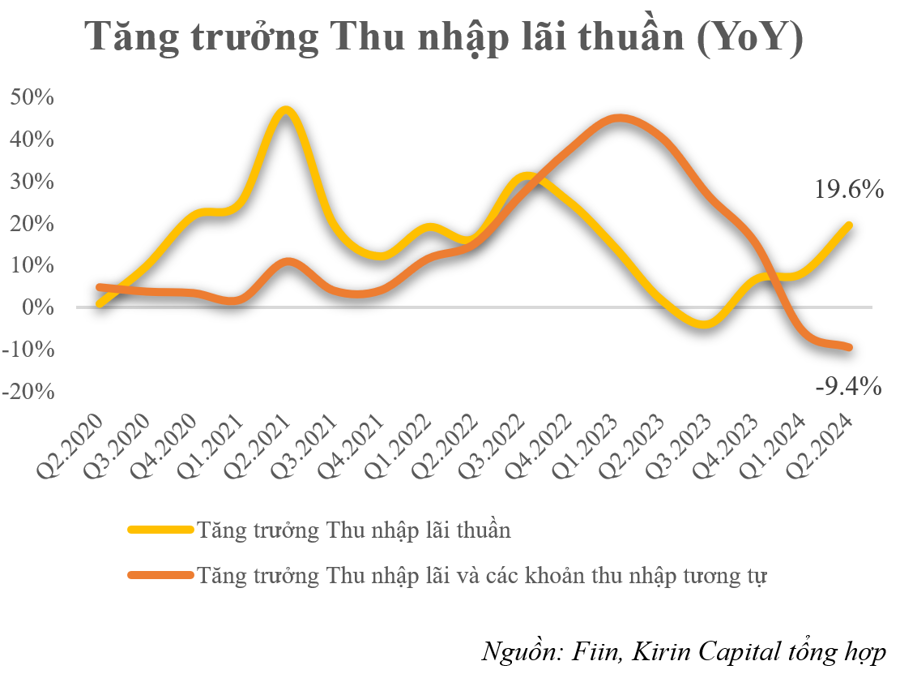

According to Kirin Capital, aggregating data from 27 listed banks in the market shows that the industry’s interest income and similar income saw a significant decline in Q2 2024, reaching only VND 247,680.1 billion, a 9.4% decrease compared to the same period.

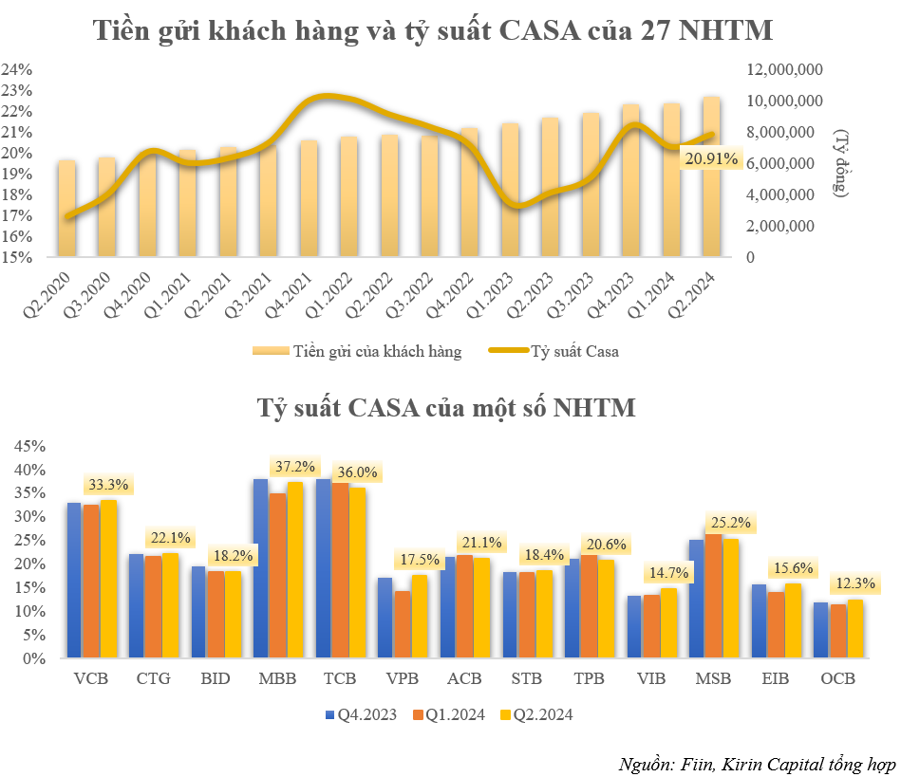

However, due to the strong growth in the industry’s CASA ratio (non-term deposits), which increased by 20.91% in Q2 2024, coupled with declining deposit interest rates during this period, interest expense decreased sharply by 0.5%, from 4.9% to 4.4% in Q2 2024, pushing NIM (net interest margin) up slightly from 3.4% to 3.5%. As a result, the industry’s net interest income in the last quarter unexpectedly grew strongly, higher than the previous six quarters, with a year-on-year increase of 19.6% and reaching VND 128,595.8 billion.

The industry’s non-interest income in Q2 2024 maintained a stable upward trend, reaching VND 34,690.7 billion (up 4.43% year-on-year). This increase was mainly driven by the banks’ service activities, particularly the Bancassurance segment, which grew by 15.5% compared to the same period last year.

“We believe that the recovery in the Bancassurance segment will need to be monitored in the coming quarters as the insurance industry has just emerged from a crisis, causing public trust to remain fragile. In addition, the State Bank has also recently issued stricter regulations on commercial bank staff providing Banca advice, so this segment will not be able to recover in the short term,” the report emphasized.

Moreover, up to now, banks have effectively controlled operating expenses, with the industry’s CIR (cost-to-income ratio) reaching 31.7%, only slightly increasing by 0.1% compared to the previous quarter and significantly decreasing compared to 34.4% in the same period. This positive outcome is attributed to the comprehensive digital transformation of the banking industry in the past period. Large commercial banks continue to maintain a CIR ratio below the industry average, while some small-scale commercial banks are still operating inefficiently.

NON-PERFORMING LOANS START TO DECLINE

According to Kirin Capital, since Q1 2022, the system’s pure LDR ratio (ratio of credit balance to mobilized capital) has remained above 100%, even recording an increase to 103.69% in Q1 2024 and 105.68% in Q2 2024.

“The reason for this situation is that the growth rate of customer deposits fails to keep up with the growth rate of customer lending. This is a notable point for the banking industry as it directly affects the system’s liquidity. It also hinders the industry’s credit growth due to a lack of liquidity for lending,” the report said.

Regarding non-performing loans, statistics from listed banks show that the industry’s NPL (non-performing loan) ratio in Q2 2024 remained at 2.2% and showed no signs of decreasing. While NPLs in Group 2 have started to cool down compared to Q1 2024, decreasing from 2.1% to 1.8%, it is still lower than the same period in 2023 (2.6%). However, it is clear that the NPL of the banking industry is still on an upward trend.

As of the end of Q2 2024, the industry’s NPLs had reached VND 240,320 billion, up 8.01% compared to Q1 2024 and up 26.12% year-on-year. The core reason, according to Kirin Capital, remains the stagnant real estate market, with bad debts yet to be resolved.

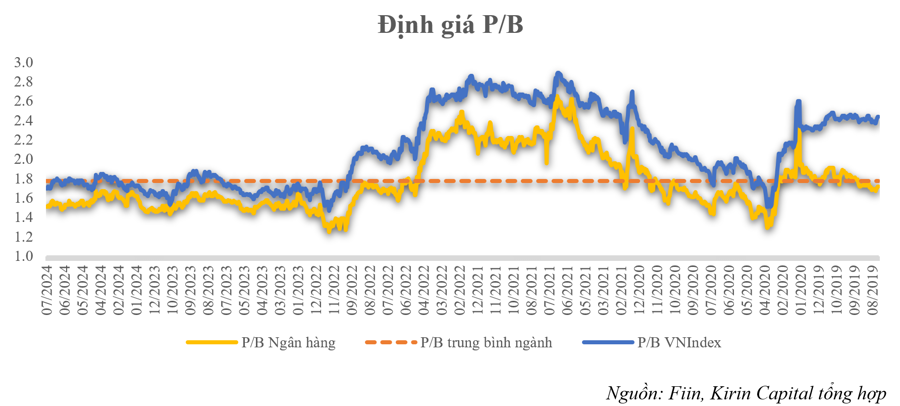

Nevertheless, according to Kirin Capital, the industry’s P/B valuation at the end of July 2024 (at 1.51) was still lower than the industry’s 5-year average P/B (1.77). Therefore, the current stock price has reflected these risks. In addition, banks are likely to continue to perform well in handling bad debts in the coming period, as they have experience dealing with bad debts from 2010–2012. As a result, Kirin Capital considers the banking sector attractive for long-term investors at the present valuation.