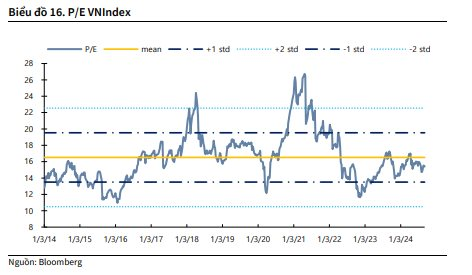

In its recently published report, KBSV Securities assesses the current market P/E to be around 15 times, according to Bloomberg data. This P/E ratio excludes abnormal profits and represents a valuation on par with the two-year average.

On the positive side, factors influencing the stock market in September include persistently low-interest rates, which continue to support domestic production, industry, investment, and consumption. In the short term, September will be a period when the third-quarter business results become clearer, allowing the market to establish new expectations.

Overall, macroeconomic growth data for August 2024 and the second quarter of 2024 indicate a stable macroeconomic environment, with encouraging signals from GDP growth, export turnover, IIP, PMI, and FDI attraction…

There is a high likelihood that the Fed will cut interest rates for the first time in September. The USD/VND exchange rate and the DXY index have also cooled down considerably in anticipation of this move. This will support the State Bank in maintaining its loose monetary policy to boost economic development and, consequently, the stock market. Additionally, the Fed’s rate cut will positively impact investor sentiment.

On the flip side, notable risks to the market include escalating conflicts in the Middle East and various regions worldwide. In the short term, this could negatively affect oil supply and freight rates, increasing the risk of a return to inflation. If the conflict spreads, it may impact the geopolitical situation in the region and adversely affect economic activities.

Additionally, the risk of a recession in the US persists as the labor market cools and economic data shows signs of slowing down. Declining consumption in the Chinese market affects commodity prices and export activities.

Assessing the impact of these risks on the Vietnamese stock market, KBSV believes that geopolitical factors are currently unpredictable. Meanwhile, the concern about a recession in the US remains just that, as current data does not indicate significant risks, given the Fed’s likely rate cut in September.

Declining demand in the Chinese market has been reflected in commodity prices and has had some impact on the import and export situation of certain goods. This has been partly evident in the business results and stock prices of affected companies. The slowdown in Chinese demand has been ongoing, and a revival in demand will be a game-changer for improving the business results of these companies.

On the monthly chart, the VN-Index has been trading within a sideways range for over six months, with a lower bound of around 1,175 (+-10) and an upper bound of 1,30x. With a gentle upward slope and a lack of leading drivers to trigger a breakthrough, the index has yet to break free from its correction phase since the historical peak of 1,53x. It is possible that it may follow a triangular pattern in the medium term.

However, on the daily chart, after forming a short-term bottom at 1,185 points, the VN-Index has entered a positive recovery phase, marked by the occurrence of a FTD on August 16. Despite exhibiting technical correction signals after a steep rise, the emergence of the FTD, coupled with the MA20 crossing above the MA50 and MA100, paints a generally supportive technical picture for the short-term upward trend.

Thus, the dominant short-term trend for the index is still upward in September. KBSV leans towards a 70% probability scenario, where the VN-Index will recover at the support zone of around 1,260 (+-5) and have the opportunity to surpass the short-term peak of 1,30x before encountering more evident corrective pressure at the medium-term resistance zone of around 1,330 (+-15). In the remaining 30% probability scenario, the index may undergo a deeper correction to the next support zone at 1,23x before staging a recovery.

KBSV maintains a positive outlook on the growth potential of specific stock groups for the remainder of the year. Additionally, the banking sector, with the theme of “Recovery in Demand,” and the securities sector, with expectations of improvement in the context of the market upgrade process, are highlighted as investment themes for this month.

According to the analysis team, the market is entering a short-term adjustment phase, which will present a good opportunity for investors who have not yet established positions or those looking to increase their holdings.