MB has introduced a novel solution to facilitate the elderly in updating their biometric data and protecting them from the rising threat of online scams.

The Vulnerability of the Elderly to Online Scams

Biometric technology is rapidly becoming one of the most advanced security measures in Vietnam, especially with the growing popularity of online transactions. Even after two months of implementing the new regulations from the State Bank of Vietnam (SBV), the topic of biometrics remains a hotly discussed issue. According to Circular No. 18/2024/TT-NHNN, from January 1, 2025, customers will be unable to perform online transactions without providing their biometric data.

Additionally, to ensure timely pension payments, Vietnam Social Security (VSS) has implemented pension payments through personal accounts in 43 provinces and cities since August 1, 2024, and will continue to do so in the remaining 20 provinces and cities from September onwards. While this is a significant step towards optimizing the payment process and ensuring convenience and security for pensioners, many elderly individuals face challenges in completing the biometric authentication process due to technological limitations or device incompatibility with features like NFC.

The surge in online transactions, coupled with limited technological access, makes the elderly prime targets for cyber scams.

Scammers have been taking advantage of this situation by impersonating bank employees and contacting customers via phone calls, Zalo, or Facebook. They request personal and bank account information under the pretext of “supporting biometric data collection.” These scammers even demand video calls to capture the customer’s facial expressions, gestures, and voice to carry out sophisticated scams, ultimately stealing money from their accounts or using their personal information for malicious purposes.

MB’s Revolutionary “Sinh Trac Co Hoi” Feature

Recognizing the challenges faced by the elderly, many banks have implemented solutions to assist customers in updating their biometric data at physical branches. However, the need to visit a branch in person, coupled with long waiting times and geographical constraints, remains a significant hurdle for older customers, especially those with health issues. This creates a significant gap in ensuring the elderly can easily and safely participate in the modern financial system.

There is a growing need for a remote, quick, and effective solution. MB has addressed this by introducing the “Sinh Trac Co Hoi” feature, a technological innovation that allows family members to assist their elderly loved ones in updating their biometric data through the MBBank App.

Biometric data can now be conveniently scanned and updated for family members through the MBBank App.

Specifically, once a family member’s online profile is complete and their biometric data is updated, users can access the “Add” section in the MBBank App and select the “Sinh Trac Co Hoi” feature. This enables them to effortlessly update their parents’ or grandparents’ information without visiting a physical branch. This innovation not only enhances technological convenience but also adds a layer of security for the elderly, safeguarding them from potential risks associated with online transactions.

As online scams continue to proliferate, protecting the elderly—the most vulnerable demographic—becomes a critical responsibility for families. MB’s “Sinh Trac Co Hoi” feature offers a simple yet effective solution, empowering customers to take charge of their loved ones’ financial security. This initiative underscores MB’s commitment to building a digital bank that is not only safe but also inclusive and user-friendly for all.

The Highest-Paid Chairman in the Banking Industry — How Much Do Sacombank Employees Earn in 2023?

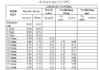

Chairman of Sacombank’s Board of Directors, Duong Cong Minh, earned an impressive 8.6 billion VND in 2023, making him the highest-paid individual in the banking industry and the second-highest across all markets in Vietnam. Meanwhile, the average Sacombank employee took home a substantial 372.6 million VND for the year.

“VRB Bank: Facilitating Vietnam-Russia Financial Ties and Economic Collaboration.”

The Vietnam-Russia Joint Venture Bank (VRB) is a unique collaboration between the Bank for Investment and Development of Vietnam (BIDV) and VTB, Russia’s leading foreign trade bank. Over its 18-year journey, VRB has expanded its reach to all key provinces and cities across the country, offering a comprehensive range of financial services.

![[On Chair 12] Better Choice Awards 2024: Why Not ‘Best’ and the Upcoming 30-Day Activities as Revealed by the Head Organizer](https://xe.today/wp-content/uploads/2024/09/v-quote-te-3-150x150.jpg)