For the first time since May 2023, the two listed exchanges witnessed a trading value below 10,000 billion VND, reaching 9,938 billion VND. The lowest trading value was recorded on April 27, 2023, at 8,547 billion VND. The sudden drop in liquidity does not necessarily indicate a lack of funds in the market but rather a significant gap in supply and demand regarding price.

The VN-Index still managed a slight increase of 3.08 points or 0.25%. The breadth remained positive, with 218 gainers and 163 losers. It is evident that the trading activities were less vibrant but not weak. Both buy and sell orders were relatively high, reflecting the passiveness of both sides.

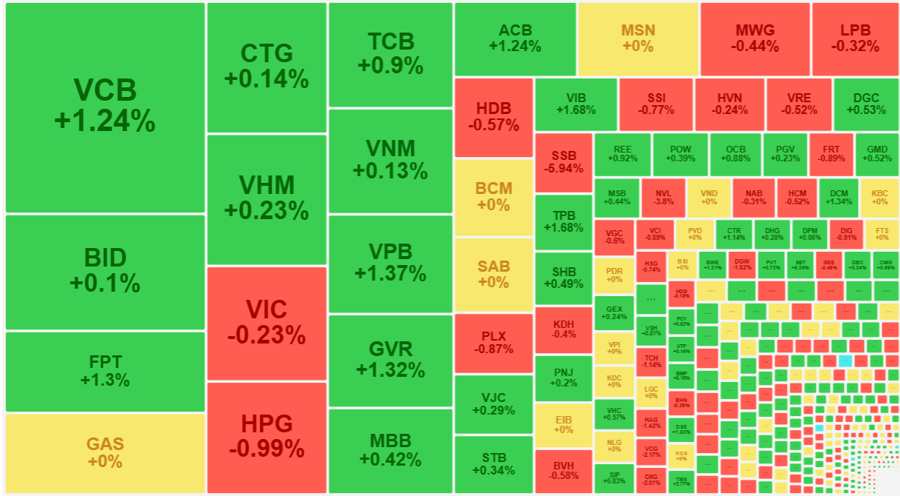

From the sellers’ perspective, only a few stocks faced actual pressure, resulting in significant price drops. While there were 163 losing stocks, only 52 stocks witnessed a decline of more than 1%. Simultaneously, only 11 of these stocks had a liquidity of over 10 billion VND. Some notable declining stocks include NVL, which fell by 3.8% with a matching value of 202.5 billion VND; DGW decreased by 1.62% with a matching value of 115.8 billion VND; SSB dropped by 5.94% with a matching value of 82.9 billion VND; DXG decreased by 2.01% with a matching value of 72.1 billion VND, and VCG fell by 2.17% with a matching value of 50.1 billion VND.

The HoSE also witnessed a few dozen stocks declining by 2-4% or even more, but their trading volume was merely a few hundred to a few thousand units, which is insignificant. When liquidity represents a cash flow of a few million or a few tens of million VND, the prices are not reliable.

On the brighter side, the stocks that witnessed price increases attracted slightly better liquidity, although nothing remarkable. Out of the 218 gaining stocks, 76 stocks increased by more than 1%, and only 17 of them had a liquidity of over 10 billion VND. The total trading value of these 76 stocks accounted for approximately 30% of the HoSE’s matching value, but the majority (78%) was concentrated in the six stocks with the best attraction of cash flow: FPT with 543.3 billion VND, a 1.3% increase; TPB with 524 billion VND, a 1.68% increase; VPB with 418.6 billion VND, a 1.37% increase; DCM with 358.4 billion VND, a 1.34% increase; CSV with 174.8 billion VND, a 2.21% increase, and VCB with 143.9 billion VND, a 1.24% increase.

Consequently, a large proportion of stocks experienced price fluctuations within a narrow range, accompanied by very limited cash flow. On the positive side, this can be interpreted as a sign of dwindling supply, as the market has been in a distinct downward trend since the end of August. The market has also witnessed several sessions with substantial trading volumes, and the 10-session average before this period was approximately 14,000 billion VND per day. The gradual decrease in liquidity over the past few days indicates that selling pressure has weakened following a series of news about storms and floods and the continuous decline of global stock markets.

Nevertheless, the market demonstrates a relatively strong ability to support blue-chip stocks. Yesterday, the VN30 group triggered a recovery rhythm in the afternoon, and today, this group also witnessed the most stable increase, although the amplitude was not strong. The VN30-Index closed this session with a 0.29% increase, while the Midcap and Smallcap decreased by 0.07% and increased by 0.1%, respectively. Notable performances among the blue-chips include VCB, up by 1.24%; FPT, up by 1.3%; VPB, up by 1.37%; GVR, up by 1.32%, and ACB, up by 1.24%. If the VN-Index is to form a bottom, the role of leading stocks will be decisive.