Mr. Le Chi Phuc

|

In its recently published report on September 9, Ballad Fund shared: “We are witnessing a transition from optimism about economic growth and expectations of Fed rate cuts to concerns about a global recession.” This statement reflects the fund’s heightened caution towards the increasingly imminent risk of a global downturn.

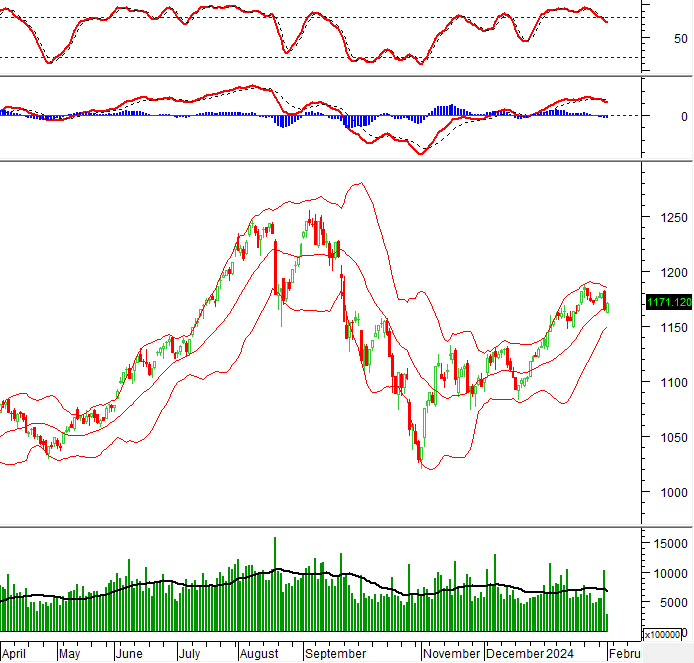

In August 2024, while the VN-Index gained 2.99%, Ballad Fund modestly increased by 0.65%. However, year-to-date, the fund outperforms the market with a 15.78% increase compared to the VN-Index’s 13.62%.

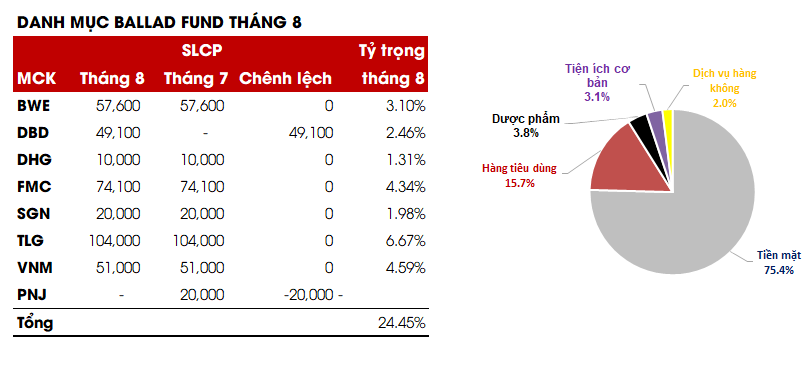

Ballad Fund’s investment portfolio clearly reflects this cautious approach. The fund holds only seven stocks from well-established companies with consistent cash flow and lower volatility compared to the market, comprising nearly 24.45% of its total assets. Over 75% of the remaining weightage is held in cash.

Global Recession Fears

Elaborating on their perspective, Ballad Fund stated that currently, the major economies of the US, China, and the EU are experiencing slowed growth, and the risk of a recession has been gradually increasing over the past few months.

According to Mr. Phuc, a recession poses a significant risk that could trigger a massive outflow of money from risky assets.

“With the high-leverage financial instruments becoming more common nowadays, a downward spiral, when it occurs, can lead to rapid and severe sell-offs beyond the usual volatility,” he said, recalling the 20% drop in the Japanese stock market during the first week of August.

Regarding the Vietnamese market, Ballad Fund noted that the economic recovery and the rapid decline in the US Dollar Index are creating favorable conditions for Vietnam’s monetary policy to maintain its accommodative stance.

However, he argued that the country’s economic outlook depends not only on domestic management but also on the international context, which is becoming less optimistic. “If the global economy falls into a recession in 2025, it will significantly impact Vietnam’s growth rate and the trend of investment flows in the coming months,” the fund stated.

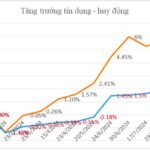

Unfeasible Credit Growth Target

Ballad Fund expressed particular concern about the Vietnamese banking sector’s 15% credit growth target.

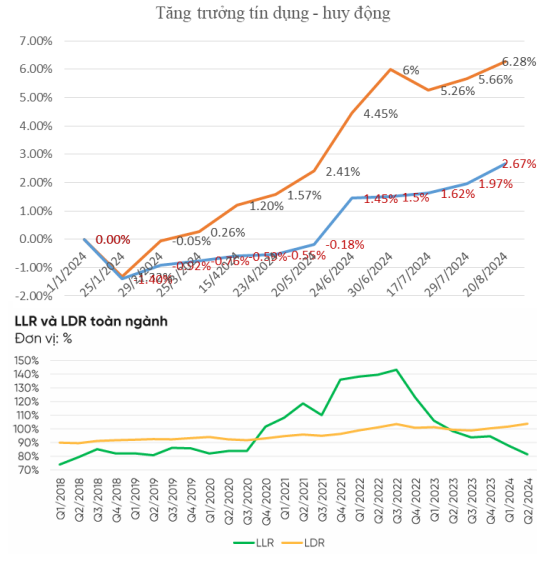

“By the end of August, the entire banking system achieved a meager record of less than 3% in deposit growth, while credit growth reached nearly 7%. To meet this target, the banking sector must mobilize three times the amount raised in the first eight months,” the fund’s expert analyzed. “This is an unfeasible goal.”

They also warned that pushing for higher credit growth could increase the risk of bad debts, especially in the real estate sector. “The previous periods of higher credit growth than deposits during the loose monetary policy years of 2008, 2010-2011, and 2021-2022 witnessed a subsequent surge in real estate credit, leaving liquidity shocks and significant bad debt consequences. With the bad debt from the 2022 real estate sector unresolved, continuing to aggressively push credit growth could elevate potential bad debt risks from the real estate sector to higher and more challenging levels,” the fund stated.

Weakening Market Liquidity and Lack of Clear Opportunities

In the Vietnamese stock market, Ballad Fund observed a noticeable weakening in market liquidity, and recent positive macroeconomic news no longer significantly impacts market liquidity.

“Domestic liquidity is not increasing, while foreign investors have slowed down but still maintain net selling whenever the VN-Index approaches the 1,300-point threshold,” Ballad Fund stated.

The fund also drew attention to the pressure on liquidity from recent large issuances of securities, real estate, and corporate bond stocks. Additionally, the recent shift in focus to the real estate market has caused some investment funds to be diverted from the stock market to this sector.

“As a result, August’s trading value dropped by 30% compared to March-April, even though the VN-Index is in the same point range. Vietnam’s stock market has never sustained an upward trend amid a sharp decline in liquidity,” the fund’s expert stated.

Lastly, Ballad Fund reminded investors about the pressure of bond maturities towards the end of the year, which remains a significant burden on the cash flow of many large enterprises, including listed companies.

Given their cautious stance, Ballad Fund advised investors to prepare resources to seize opportunities when the market experiences significant fluctuations.

“The current environment entails considerable risks and potential volatility, along with a scarcity of evident opportunities. Possessing ample purchasing power and liquidity can offer a significant advantage when risks fully materialize and are reflected in stock prices in the upcoming period,” Ballad Fund concluded.

“SGI Capital: Equity Inflows Unlikely to Improve Amid Global Market Turbulence”

According to SGI Capital, the Vietnamese stock market has never witnessed a phase where it sustains an upward trajectory amidst a sharp decline in liquidity.

The Stock Brokers’ View: VN-Index Faces Deeper Correction Risk

The VN-Index is showing signs of weakness as it fails to hold the support level of the 20-day moving average. This could indicate a potential shift in market sentiment and a possible downward trend in the coming days. With the index struggling to maintain its footing, investors are advised to proceed with caution and keep a close eye on their positions. A break below this key technical level could trigger further selling pressure and result in a more pronounced correction. Vigilance and a strategic approach are crucial in navigating this uncertain period.