Steel Stocks Continue to Trail the Broad Market

Despite expectations of increased construction and repair demand following Typhoon Yagi, steel stocks only briefly shone on Monday (09/09) before resuming their downward trend. It’s evident that steel stocks are underperforming compared to the broader market, despite a collective price increase.

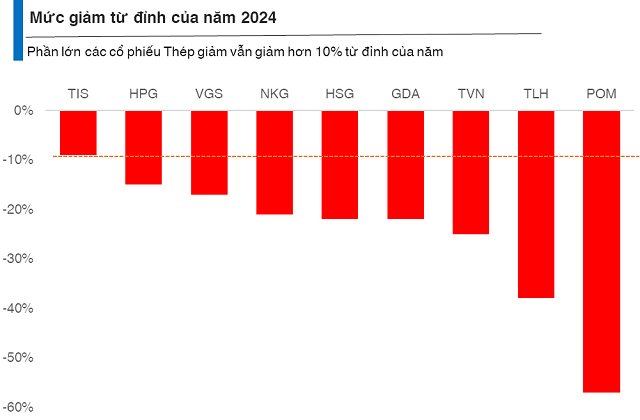

The majority of steel stocks are still down more than 10% from their 2024 highs (as of the close of trading on 09/09)

|

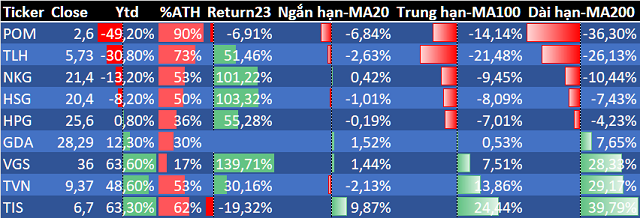

According to statistics, the drawdown (the difference between the current market price and its highest point in 2024) for steel stocks remains in correction territory (down more than 10%) or bear market territory (down more than 20%), as seen in HPG (-15%), HSG (-22%), and NKG (-21%).

Meanwhile, the VN-Index has yet to experience a significant correction in 2024, with a maximum drawdown of only 9.89%.

From a technical perspective, steel stocks have damaged investor confidence by losing their long-term upward trends. Out of the 9 stocks in the statistic, 5 are now trading below their MA200, including HPG, HSG, NKG, TLH, and POM.

The evidence clearly indicates that steel stocks are lagging and underperforming the broader market, particularly since mid-August 2024.

For investors closely monitoring the industry, the weakness in steel stocks is not entirely surprising. The primary concern now is timing the bottom for steel stocks. If the positive momentum from Monday’s session continues, a “W-shaped” recovery pattern may emerge. However, if significant selling pressure persists, investors may need to accept the risk of retesting lows before participating in any potential uptrend.

Waiting for Policy Support

Recent news has overshadowed the mid-to-long-term outlook for the steel industry. Nonetheless, in a recent report by VCBS Securities, domestic consumption is expected to continue its strong recovery, given the rebound in Vietnam’s real estate market, with a high number of projects underway in both the North and South. Moreover, increased public investment is anticipated to boost growth for the entire industry in the second half of 2024.

The construction and real estate market, which accounts for 60% of steel demand, is gradually overcoming obstacles thanks to policy reforms. The number of ongoing projects reflects significant growth in the North and a recovery in the South, ensuring sustained demand for construction materials in the coming quarters.

Notably, the application of temporary anti-dumping measures on HRC steel and coated steel products from China, India, and South Korea may be implemented in October-November 2024. This policy will significantly impact HRC steel as, after HPG‘s increased HRC capacity, the domestic market will be the primary consumer, and with 60-70% of the industry’s consumption coming from imports, the anti-dumping tax will have a substantial effect.

In the short term, experts remain cautious. Mr. Tran Truong Manh Hieu, Head of Analysis at KIS Vietnam Securities, stated that domestic steel companies could face intense competition, leading to narrower profit margins. “The outlook for these companies will improve when this competitive pressure eases. That’s when it will be a good time to consider investing in the industry,” added Mr. Hieu.

Similarly, Mr. Bui Van Huy, Ho Chi Minh City Branch Director of DSC Securities, pointed out two issues facing the steel industry: (1) the continuous decline in global steel prices and increasing competitive pressure, and (2) the risk of anti-dumping investigations by the European Commission on Vietnamese HRC steel. Mr. Huy predicted that “the steel industry’s momentum will return strongly once these two negative factors subside.”