The Ho Chi Minh Stock Exchange (HoSE) witnessed increased selling pressure towards the end of the trading session on September 10, 2024, particularly in large-cap stocks, hindering the VN-Index’s breakthrough. The VN-Index closed the day down 12.5 points, or 0.99%, at 1,255.23. Trading liquidity on HoSE remained low, with a total value of nearly VND 15,600 billion.

In terms of foreign investment, foreign investors continued to be net sellers on the market, offloading approximately VND 383 billion worth of shares.

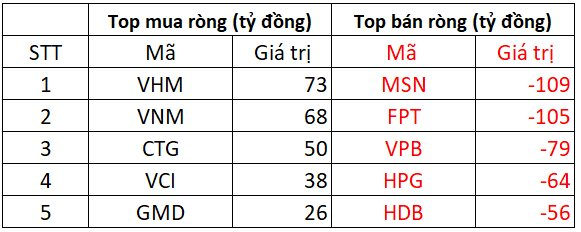

Foreign Investors’ Net Selling on HoSE Reaches nearly VND 386 billion

On the selling side, MSN and FPT faced the largest net selling by foreign investors on HoSE, with values of VND 109 billion and VND 105 billion, respectively. VPB, HPG, and HDB followed suit, with net outflows of VND 79 billion, VND 64 billion, and VND 56 billion, respectively.

Conversely, VHM witnessed the highest net buying, with nearly VND 73 billion. VNM also attracted net purchases of VND 68 billion. Foreign investors injected several billion Vietnamese dong into securities such as CTG, VCI, and GMD.

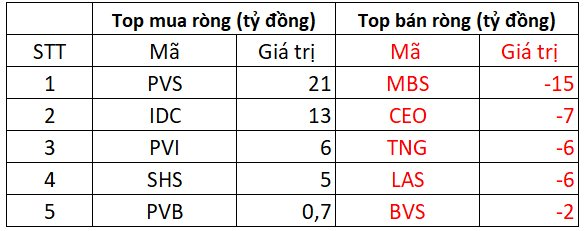

Foreign Investors Net Buy on HNX with a Value of VND 7 billion

PVS topped the net buying list on the Hanoi Stock Exchange (HNX), with a net buy value of VND 21 billion. IDC followed closely, with net purchases of VND 13 billion. Foreign investors also invested around VND 5-6 billion in PVI and SHS.

On the opposite side, MBS faced strong net selling by foreign investors, amounting to VND 15 billion. CEO, TNG, and LAS were the next three stocks with net selling values ranging from VND 6 to 7 billion, followed by BVS with VND 2 billion.

Foreign Investors Net Sell on UPCOM with a Value of over VND 4 billion

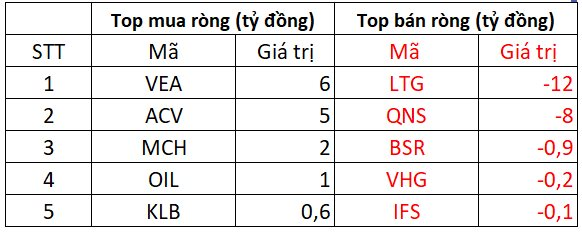

In terms of net buying on the Unlisted Public Company Market (UPCOM), VEA led with net purchases of VND 6 billion. ACV followed closely, with net buying of VND 5 billion, while MCH and OIL attracted net buying of around VND 1 to 2 billion.

In contrast, LTG faced net selling of VND 12 billion by foreign investors. They also offloaded VND 8 billion worth of QNS shares.

LTG and QNS experienced net selling of VND 12 billion and VND 8 billion, respectively.

The Most ‘Expensive’ Stock on the Stock Exchange Takes a Negative Turn

Today’s trading session (September 9) was relatively dull, with the value of stocks traded on the HoSE through matching orders hovering around VND 10 trillion, hitting a three-week low. Large-cap stocks were painted in red, and the market lacked driving force. The negative trend also continued for VNZ, the most expensive stock on the exchange, as shares of VNG Corporation continued to be heavily sold off.

The Foreigners’ Sell-Off of Nearly 500 Billion Dong of Vietnamese Stocks in the First Session of the Week: What’s the Focus?

The foreign sell-off pressure on the Ho Chi Minh Stock Exchange (HOSE) amounted to a net sell-off value of VND484 billion.

The Rise of Vietnam’s Stock Market: 1.4 Million New Accounts Since January

As of the end of August, individual investors held over 8.6 million securities accounts, equivalent to approximately 8.6% of the population. This significant proportion of investors showcases a thriving personal investment landscape, with individuals taking an active interest in their financial future.

The Two HoSE-Listed Stocks to be Suspended Soon

The HoSE-listed stocks DRH and LEC have been suspended from trading since September 16th due to violations of information disclosure regulations. Both companies have now issued official statements regarding this matter.