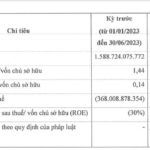

Compared to the same period, the profit margin was only about 60%.

|

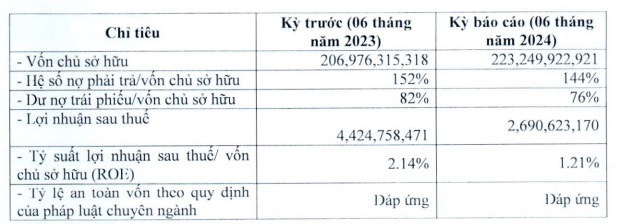

BKAV Pro’s financial indicators in the first six months of 2024

Source: HNX

|

Equity at the end of June 2024 stood at over 223 billion VND, an increase of 8% compared to the same period last year. The debt-to-equity ratio decreased from 1.52 times to 1.44 times, equivalent to about 321 billion VND in debt; the bond debt-to-equity ratio also decreased from 0.82 times to 0.76 times, meaning bond debt was approximately 170 billion VND.

With decreasing profits and increasing capital, the ROE decreased from 2.14% to 1.21%.

The results for the first half of 2024 extend BKAV Pro’s gloomy business performance. Mr. Nguyen Tu Quang’s company had previously experienced three challenging years, with a continuous decline in after-tax profits, from over 100 billion VND in 2021 to nearly 19 billion VND at the end of 2023. If the situation remains the same in the last six months, BKAV Pro will have a streak of four consecutive years of declining profits.

Mr. Nguyen Tu Quang – CEO of BKAV Pro

|

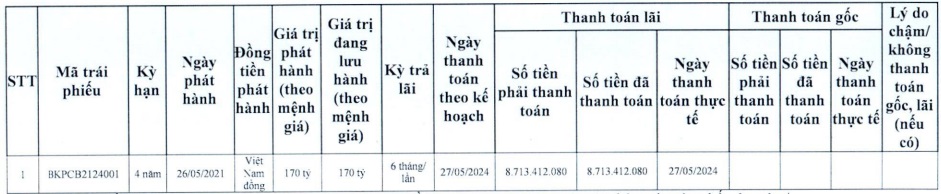

BKAV Pro is currently circulating a bond lot with the code BKPCB2124001, a volume of 1.7 million bonds, a par value of 100,000 VND/bond, and a value of 170 billion VND. The first-year coupon interest rate is fixed at 10.5%/year, and the following years’ rates are calculated as the reference rate plus a margin of 4.5% and not less than 10.5%/year, with interest paid every six months. The depository organization is VNDIRECT Securities Corporation (HOSE: VND).

The purpose of issuing this bond lot is to raise capital for the expansion and development of AI View cameras, investment in digital transformation, and a portion for the development of Bphone lines.

The bonds initially had a three-year term from May 26, 2021, to May 26, 2024, but the term has recently been extended by one year at the bondholders’ approval (maturing on May 26, 2024). The interest rate for the next year is set at 11%/year.

Along with the extension, the terms of the bond lot have also been modified. Accordingly, the bond lot will be secured by more than 6.1 million shares of BKAV Pro (previously 5.44 million shares) owned by the parent company, BKAV Joint Stock Company, and all capital contributions of Mr. Nguyen Tu Quang, Chairman of the Board of Directors and General Director of BKAV Pro, in Vietnam Digital Transformation Platform Company (DXP).

In addition, the bondholders’ representative has the right to request BKAV Pro, Joint Stock Company BKAV, and Company DXP to report on the collection, disbursement, and accumulation of cash flow to ensure a minimum of 1.5 billion VND/month in the securities account of BKAV Pro maintained at VNDIRECT Securities Corporation (HOSE: VND).

The companies commit to not incurring new debts unless approved by the bondholders’ representative. At the same time, all funds from the business, as well as from Mr. Quang’s personal capital from divestment or capital calls, will be prioritized for bond repayment.

In the first six months of 2024, BKAV Pro fulfilled its interest payment obligations for this circulating bond lot.

|

BKAV Pro fulfills its interest payment obligations for the circulating bond lot

Source: HNX

|

It is known that BKAV Pro was established in March 2018 with an initial charter capital of 50 billion VND, with three founding shareholders: Bkav Joint Stock Company holding 96%, Mr. Vu Ngoc Son (then General Director) holding 2%, and Ms. Lai Thu Hang holding 2%. In August 2018, the company increased its charter capital to 100 billion VND, and the ownership structure of the founding shareholders remained unchanged. In October 2018, Bkav Joint Stock Company reduced its ownership to 83.963%, while the two individuals maintained their 2% stakes. Since July 2022, the company has been led by Mr. Nguyen Tu Quang as General Director and legal representative.

“Agricultural Giant Trieu Hai: Commanding a Capital of nearly 14.7 Trillion VND, with a Profit of over 6 Billion VND in the First Half of 2024.”

In its half-yearly financial report submitted to the Hanoi Stock Exchange (HNX), Thaco Agri, a leading agricultural company, boasts an impressive 25% increase in profits for the first half of 2024.