Vietnam’s textile and garment industry is thriving, with estimated export turnover of $28 billion in the first eight months of 2024, according to Mr. Truong Van Cam, Vice President and General Secretary of the Vietnam Textile and Apparel Association. The industry is on track to surpass $44 billion in export turnover by the end of the year. To ensure the sector’s long-term success, there is a pressing need to establish a raw material and accessory center, enabling businesses to secure their supply chains and reduce reliance on external sources.

Minister of Industry and Trade Nguyen Hong Dien (third from left) meets with textile and footwear businesses. Photo: Nguyen Bang

Despite past efforts by businesses to establish raw material centers, these initiatives have not been successful. Vinatex’s proposal to the Ministry of Industry and Trade in 2004 to develop two such centers did not materialize. Similarly, Saigon Garment Company’s attempt to dedicate a workshop as a raw material center was short-lived, closing down after a few months due to ineffectiveness.

Mr. Pham Tuan Anh, Deputy Director of the Industry Department, emphasized the significance of the textile and garment, and footwear industries as Vietnam’s key export sectors, consistently achieving average annual growth rates of over 10%.

Mr. Cam attributed the failures to a lack of synchronized involvement from relevant ministries and local authorities, particularly regarding land allocation. The industry’s weak production capacity for raw materials and fabrics has been a significant challenge, compounded by low interest from businesses. The high proportion of outsourcing in the industry has led to customers specifying foreign sources for raw materials. To address this issue, Mr. Cam suggested that the government provide support in terms of policies, resources, and land to help businesses stabilize their investments and facilitate technology transfer. He referenced successful examples from other countries, such as South Korea and China, where the government played a crucial role in establishing fashion and raw material centers.

Meanwhile, Mr. Nguyen Duc Thuan, Chairman of the Vietnam Leather, Footwear, and Handbag Association (Lefaso), shared that the footwear industry is expected to reach an export turnover of $26-27 billion in 2024. He emphasized the sector’s large trade surplus, attributed to the fact that over 50% of raw materials and accessories are sourced domestically. Companies with 3,000-5,000 workers are moving towards ODM (Original Design Manufacturing), establishing their research and development centers.

Looking ahead, Mr. Thuan stressed the need for breakthrough solutions to upgrade the industry’s value chain, aiming for sustainable benefits. He proposed the development of a raw material and accessory supply market that is scaled, standardized, and transparent.

Additionally, he suggested constructing a transaction center for raw materials and innovative development in the fashion industry in Binh Duong province.

Addressing Self-sufficiency in Raw and Auxiliary Materials

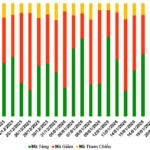

Despite the impressive export turnover of the textile-garment and footwear industries, Mr. Tuan Anh pointed out that the contribution of domestic enterprises remains limited. Over 60% of the textile and garment industry’s export turnover comes from FDI enterprises, although they account for only 24% of the total number of enterprises in the sector. In the footwear industry, FDI enterprises hold a dominant position, contributing nearly 80% of export turnover while comprising only about 30% of the total number of enterprises. The heavy reliance on outsourcing in these industries results in low value addition. Currently, most raw materials and accessories are imported from foreign markets, primarily China, South Korea, and other ASEAN countries.

Mr. Tuan Anh warned that this dependence on imported raw materials could significantly impact the industries’ future development, especially as major markets like the US and EU embrace Net Zero 2050 and enforce stringent regulations on supply source control. To fully capitalize on the preferential tariffs for textile and garment products under free trade agreements like EVFTA, it is essential to develop a stable source of raw materials and accessories for these industries.

“The Creative Hub for Fashion’s Future: 2025”

“We cannot rely on outsourcing forever,” emphasized Deputy Minister of Industry and Trade, Phan Thi Thang. “The textile and footwear industries must take control of their raw materials and design processes. Establishing a trading center for the development of raw materials and accessories for the Vietnamese fashion industry is an essential step towards achieving this goal.”

The Greening of the Leather Industry: A Chance for Vietnamese Businesses to Enhance Their Brand and Competitiveness

The global footwear supply chain has faced, and continues to face, an array of challenges, from the impact of the Covid-19 pandemic to ongoing geopolitical conflicts. These obstacles have altered the very structure and modus operandi of the international footwear industry.