Investor sentiment turned more positive in the afternoon as news of the natural disaster and its impact on stock prices became fully reflected in the market. The index opened negatively, falling over 10 points, but gradually recovered to close just 1.96 points lower at 1,253 points.

While the breadth remained negative, it improved significantly from the previous day with 218 declining stocks versus 170 gainers. Rare gains were seen in a few sectors, including Securities (+0.18%), Materials (+0.4%), Information Technology (+0.52%), and Transportation (+0.41%). These sectors had undergone corrections recently, so the current price levels presented buying opportunities in some leading stocks.

On the flip side, Banking (-0.35%), Real Estate (-0.35%, with NVL plunging due to margin cuts), Telecommunications (-0.78%), and Food & Beverage (-0.14%) sectors witnessed declines. The top stocks dragging the market today were VCB (-0.81 points), followed by SSB (-0.69 points), and NVL (-0.40 points). Conversely, HPG, HVN, and FPT were the strongest stocks, contributing 0.9 points to the Vn-Index.

Despite the improved sentiment, the positive shift was more evident on the supply side, with limited selling pressure. However, the demand side remained cautious, resulting in a significant drop in liquidity across the three exchanges to VND 13,500 billion. Foreign investors recorded a slight net buy position of VND 9.2 billion, and their net buy value in matched orders was VND 15.6 billion.

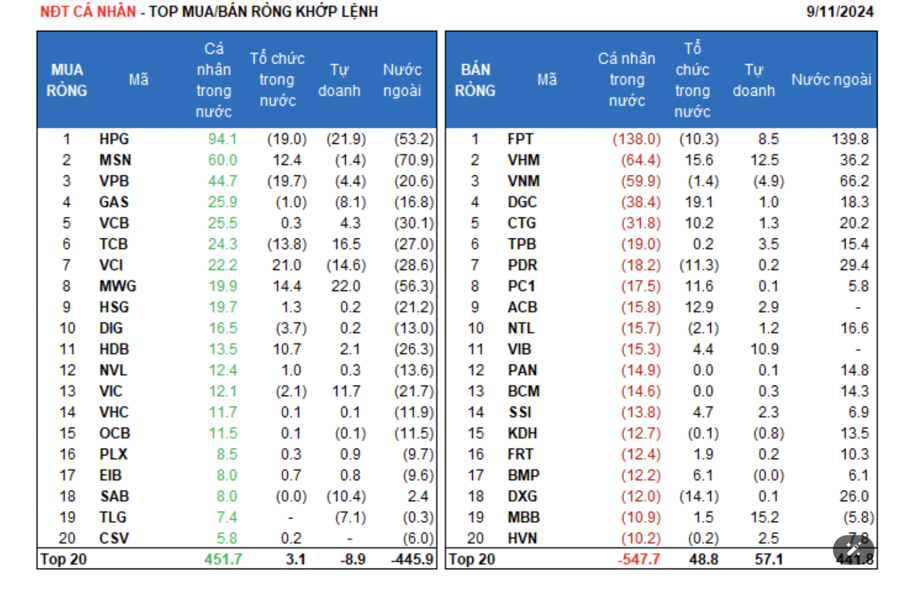

The top net bought stocks by foreign investors in matched orders were from the Information Technology and Real Estate sectors, including FPT, VNM, VHM, PDR, DXG, CTG, DGC, NTL, TPB, and PAN.

On the other hand, the Banking sector witnessed net selling by foreign investors in matched orders, with the top stocks being MSN, MWG, HPG, VCB, VCI, HDB, VIC, HSG, and VPB.

Retail investors sold a net of VND 271.1 billion, of which VND 150.2 billion was in matched orders.

In terms of matched orders, they bought a net position in 11 out of 18 sectors, mainly in the Basic Resources sector. The top stocks bought by retail investors included HPG, MSN, VPB, GAS, VCB, TCB, VCI, MWG, HSG, and DIG.

On the net selling side in matched orders, they sold 7 out of 18 sectors, primarily in the Information Technology and Real Estate sectors. The top stocks they sold included FPT, VHM, VNM, DGC, CTG, TPB, PC1, ACB, and NTL.

Proprietary trading recorded a net buy position of VND 109.5 billion, with a net buy value of VND 71.6 billion in matched orders.

In matched orders, proprietary trading bought a net position in 9 out of 18 sectors, with the strongest purchases in the Banking and Real Estate sectors. The top bought stocks by proprietary trading today were MWG, TCB, MBB, VHM, GVR, VIC, VIB, STB, FPT, and KBC. The top sold sector was Basic Resources, with the top sold stocks being HPG, VCI, SAB, GAS, FUESSV30, TLG, VNM, GMD, TCH, and VPB.

Domestic institutional investors bought a net position of VND 154.1 billion, with a net buy value of VND 63.0 billion in matched orders.

In terms of matched orders, domestic institutions sold a net position in 9 out of 18 sectors, with the largest value in the Basic Resources sector. The top sold stocks were VPB, HPG, DXG, TCB, PDR, FPT, GEX, VJC, IMP, and DIG. The top net bought sector was Financial Services. The most purchased stocks included VCI, DGC, VHM, MWG, ACB, MSN, PC1, HDB, CTG, and FUESSV30.

Today’s negotiated transactions reached VND 1,782.0 billion, a decrease of -0.4% from the previous session, contributing 12.6% to the total trading value.

Notable transactions occurred in TCB, with over 15 million units worth VND 349.6 billion traded between individual investors. EIB also witnessed negotiated transactions conducted by individuals.

The allocation of money flow increased in Real Estate, Securities, Construction, Steel, Retail, Oil & Gas, and Aviation sectors while decreasing in Banking, Chemicals, Agro-Forestry-Fisheries, Food, Software, Warehousing, and Logistics sectors.

In terms of matched orders, the allocation of money flow increased in the mid-cap VNMID sector but decreased in the large-cap VN30 and small-cap VNSML sectors.