In early September, the Chairman of the Company, Nguyen Duc Tai, announced his intention to sell 1 million shares of MWG. Three months prior, he had also completed the sale of 2 million MWG shares.

These transactions took place against the backdrop of a quietly rising MWG stock price this year, thanks to improved profitability of Bach Hoa Xanh and the recovery of profits from Dien May Xanh and The Gioi Di Dong chains. As of September 6, the stock price had risen by 59%, bringing MWG’s total market capitalization close to the threshold of VND 100 trillion.

In addition to the Chairman, two other members of the Board of Directors, Robert Alan Willett and Doan Van Hieu Em, have also made notable sales. According to information from MWG’s management report, Mr. Willett sold 1.1 million shares at the beginning of 2024, while Mr. Hieu Em reduced his holdings from over 4 million shares to 2.8 million shares from 2023 to the present.

Although the selling volume is not large compared to the total number of circulating shares, the transactions of MWG leaders still attract the attention of the market. This may make outside shareholders feel concerned, as the buying and selling of shares by insiders are often seen as a sign of confidence in the company’s prospects.

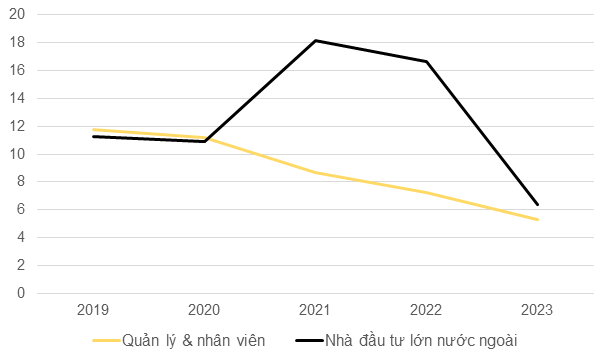

The concern becomes more apparent when looking at another notable trend: The percentage of shares held by MWG’s management and employees has also continuously decreased, from 13.26% at the end of 2018 to only 5.27% at the end of 2023.

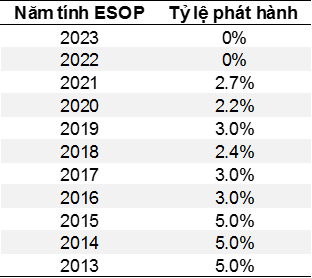

This decline is partly due to the company’s ESOP (Employee Stock Ownership Plan) not being implemented in the last two years, mainly due to the difficult business situation of this multi-sector retailer.

ESOP is a plan by a company to provide shares to its employees, usually as part of their welfare or bonus scheme. This is how MWG’s leaders encourage their staff to participate in the company’s long-term success and share the benefits when the company grows.

At MWG, the ESOP issuance is based on an annual assessment of the company’s profit efficiency and stock performance, and is approved by shareholders at the annual general meeting.

In 2022, the ESOP policy was not implemented because MWG did not meet its target for post-tax profit growth. In 2023, anticipating difficulties in the business environment, the MWG Board of Directors decided not to propose the ESOP plan to avoid putting pressure on the operations team, according to a statement by Chairman Nguyen Duc Tai at the annual general meeting that year.

|

Breaking Tradition

Declining business results are the main reason why MWG has not issued ESOP for the last two years – MWG leaders did not propose the ESOP plan in 2023

– MWG did not meet its target for post-tax profit growth in 2022 – Source: Documents, Resolutions of MWG Annual General Meeting of Shareholders |

|

Withdrawal

Major foreign investors and personnel are withdrawing Unit: %

Source: MWG Annual Report

|

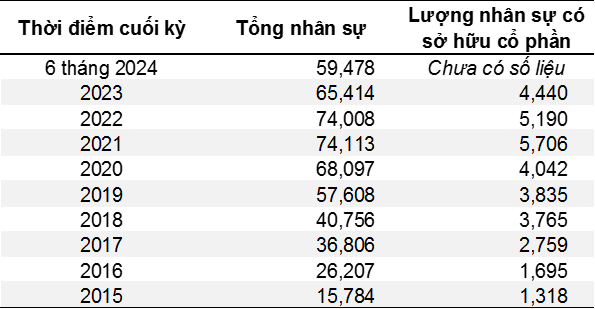

The decline in the percentage of shares held by employees occurred simultaneously with the period of MWG’s business restructuring, including the closure of hundreds of phone and appliance stores. According to the author’s understanding, the income of personnel at Dien May Xanh and The Gioi Di Dong stores has also decreased significantly.

In 2023 alone, the market witnessed a net selling volume of up to 28.5 million shares by MWG management and employees. The number of personnel at the enterprise decreased by nearly 8,600 people, and MWG also had to buy back nearly 1 million ESOP shares from employees who left the company.

|

Deterioration

In just two years, from 2022 to 2023, the number of MWG employees holding shares decreased by more than 22% Unit: People

Source: MWG Financial Statements, Annual Report

|

In 2023, a major shareholder of MWG, the foreign fund group Arisaig Partners, also continuously divested. The market price of shares fell to its lowest level in early November. The company’s annual report noted that the ownership ratio of total foreign investors (including two different groups, Arisaig and Dragon Capital) decreased from 16.6% to only 6.41%, corresponding to a net sale of approximately 150 million shares.

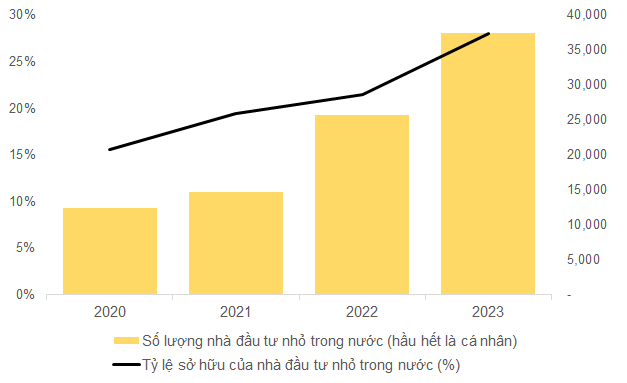

The wave of selling by employees and major foreign shareholders has led to MWG shares falling into the hands of small domestic investors, who tend to have a higher trading frequency.

As the number of MWG management and employees holding shares decreased by 750 people in 2023, the number of small domestic investors holding MWG shares increased to 11,170 people. This explains the dramatic increase in MWG’s liquidity.

|

Soaring

The ownership ratio of small domestic investors soared in 2022-2023 Unit: People

MWG does not disclose specific data on the ownership ratio of institutional and individual domestic investors (not major shareholders) – Source: MWG Annual Report

|

|

Explosion

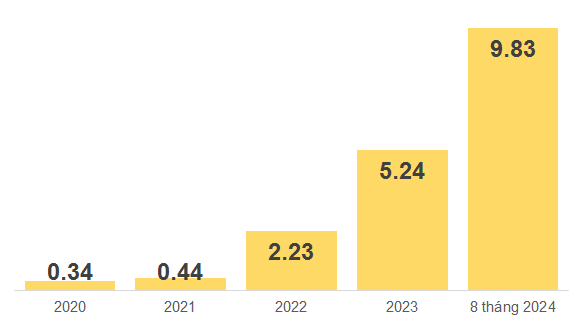

The average daily trading volume of MWG shares has skyrocketed in the last two years Unit: Million shares

Data as of September 6, 2024 – Source: VietstockFinance

|

The Haunting of Real Estate Stocks: Unraveling the Continuous Mishaps

In recent times, DIG shareholders and investors have been through a rollercoaster. From the tragic passing of the company’s chairman to the ongoing inspections and the subsequent stock volatility, it’s been a challenging period. As the company navigates these trials, one can’t help but wonder what the future holds for this business and those invested in it.