The demand for IT professionals continues to grow, as indicated in the recently released report on hiring trends in the Asia-Pacific region for Q4 2024 by ManpowerGroup, a human resource solutions company.

BUSINESSES ADJUST TO STAY RESILIENT

According to ManpowerGroup, as we near the end of the 2024 fiscal year, the global job market is experiencing significant fluctuations, with businesses ramping up their production and operations.

The survey, conducted from July 1 to July 31, 2024, with over 10,000 employers across seven countries and territories in the Asia-Pacific region, reveals a brightening hiring outlook. However, economic uncertainties continue to temper the optimism of many businesses.

The survey finds that 91% of businesses lack the necessary talent to achieve their Environmental, Social, and Governance (ESG) goals. The sectors with the highest demand for talent are finance and real estate, information technology, and industrial and materials.

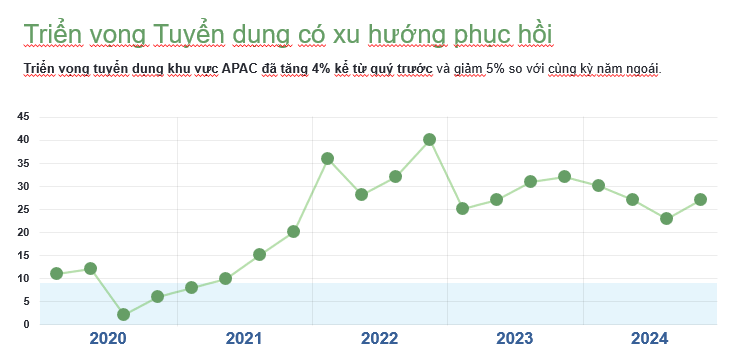

The Net Employment Outlook (NEO) – a global indicator of labor market trends – is the difference between the percentage of employers anticipating an increase in hiring and those expecting a decrease. The current NEO for the Asia-Pacific region (APAC) stands at 27%.

Specifically, in the IT sector, the survey shows that 78% of businesses in this field struggle to find talent that meets their requirements. The NEO for IT businesses in APAC is 35%. This represents a 7% increase from the previous quarter and a 2% decrease from the same period last year.

“As we approach the end of the year, we gain a clearer view of the recovery of the APAC labor market,” shared Francois Lancon, Chairman of ManpowerGroup Asia-Pacific & Middle East. “The increase in hiring intentions from the previous quarter signals that employers are adjusting to cope with ongoing economic challenges and are keen on attracting and retaining the talent needed for growth.”

He further added that in the Q4 report, ManpowerGroup continues to observe robust hiring prospects in the IT sector, underscoring the critical role of technology in driving labor demand across the region.

“As digital transformation and AI adoption accelerate, the need for skilled IT professionals grows, compelling businesses to invest in talent attraction and development,” said Francois Lancon.

GLOBAL HIRING TRENDS BY REGION

In the Asia-Pacific region (APAC), the survey shows that managers across the countries and territories forecast an NEO of 27% for the region, a 4% increase from the previous quarter and a 5% decrease from the same period last year.

Businesses in India (37%), Singapore (29%), and China (27%) continue to exhibit the strongest hiring intentions in the region. In contrast, Hong Kong is the most cautious in its hiring plans (8%). The most optimistic outlook globally was observed in the finance and real estate sector (64%) in Singapore.

In North America, employers remain optimistic, with a hiring outlook of 32% for Q4, a 5% increase from the previous quarter and a 3% decrease from the same period last year.

US businesses (34%) have the strongest hiring intentions in the region, a 4% increase from the previous quarter. The US is also one of the countries with the most optimistic outlook globally, particularly in the IT sector.

In Central and South America, the regional NEO reaches 23%, a 1% increase from the previous quarter and an 8% decrease from the same period last year. The most optimistic outlook is observed in Costa Rica (36%), Brazil (32%), and Guatemala (30%).

Guatemala’s businesses show the highest NEO globally in the consumer goods and services sector (56%). Meanwhile, Costa Rica leads in IT (53%) and industrial and materials (43%) sectors.

Notably, among all regions globally, Europe, the Middle East, and Africa (EMEA) have the lowest hiring intentions, with an NEO of 21%. While this is a 2% increase from the previous quarter, it still represents a 3% decrease from the same period last year.

Businesses in South Africa and Switzerland (32%), Ireland and the Netherlands (30%) have the most optimistic outlook in the region. In contrast, employers in Israel and the Czech Republic predict the most modest hiring plans.

Both the UK (28%) and France (22%) have NEOs above the regional average.

Belgium has the most optimistic outlook globally in the healthcare and life sciences sector (62%), while South Africa leads in energy and utilities (55%).

In the face of a competitive job market, businesses prioritize work-life balance to retain employees. This strategy is especially prevalent in APAC, with 56% of companies in the region adopting it. Other strategies include management training to better support employees, more promotion opportunities, stress reduction initiatives, and technology upgrades.

“Leak” in the F&B Industry: The High Staff Turnover Woe Affecting 85% of Businesses, Causing a Headache for Over 50% of Cafe Owners.

The F&B industry is notorious for its high staff turnover, with a staggering 80% of its workforce comprising teenagers seeking part-time work to boost their income and gain experience. This transient nature of the workforce is highlighted by recent statistics, which reveal that nearly 80% of F&B staff in Vietnam leave their jobs within a year, while only 0.9% stay for over five years.