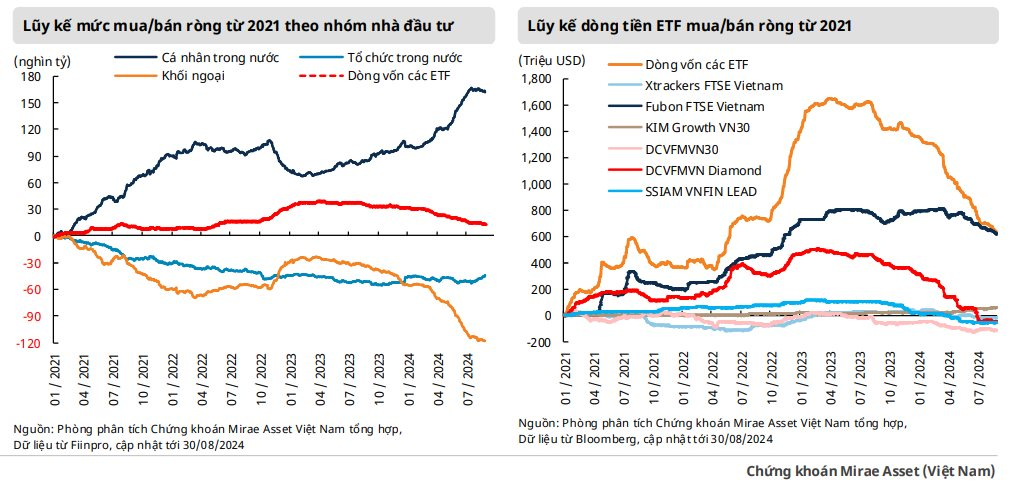

Vietnam’s Stock Market Could Miss the September 2024 Cut-off for FTSE Reclassification

As we move into September and look ahead to the remaining months of 2024,

Mirae Asset Securities (MASVN)

anticipates that the market will continue to receive mixed news regarding the overall growth prospects of major economies in the region and specifically for Vietnam.

”

The market will continue to seek new narratives to drive growth as the story of Vietnam’s market reclassification may once again miss the September 2024 cutoff for the FTSE’s evaluation report

,” the report states.

MASVN notes that the final drafts of amendments to laws related to securities trading and brokerage to meet the remaining criteria for reclassification have just been passed and remain pending before the National Assembly session in October.

Given the current timeline for amendments, the most promising expectation for reclassification consideration is September 2025, as the implementation and practical operation will require time for verification and necessary adjustments to assess the effectiveness of policy changes and the application of the new trading system.

Trading Sessions with Unexpected Volatility Will Become More Frequent

On the other hand, the lack of clear growth drivers and the less-than-optimistic performance of many large-cap stock groups may cause

the market to experience trading sessions with unexpected volatility more frequently.

Previously, the primary trend over the past six months has been sideways movement within a broad range, with the VN-Index fluctuating between 1,200 and 1,280 points.

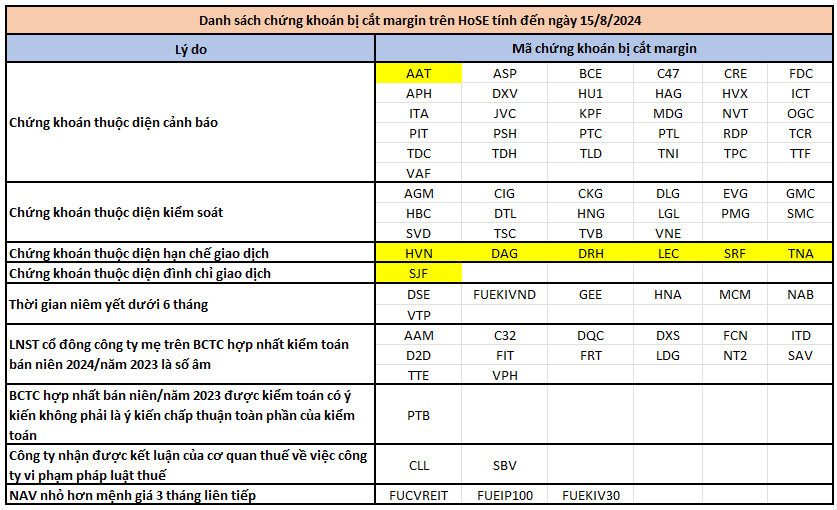

In the medium and long term, MASVN believes there is insufficient data to assess that the market will soon enter a phase of trend reversal. The analysis team opines that the VN-Index is likely to target the psychological mark of 1,300 points, as the VN-Index’s P/E ratio remains relatively attractive when trading below the 10-year average.

However, volatility may arise as profit-taking sentiment increases when the VN-Index surpasses the psychological resistance level, and this trend could persist until the VN-Index successfully conquers the 1,330-point mark. Nonetheless, Mirae Asset also believes that

short-term risks remain present as the VN-Index tends to revert to the equilibrium zone

after recording an extended uptrend for three consecutive weeks, heading towards the support zone between 1,240 and 1,250 points.

Cautious Sentiment Leads to Significant Decline in Liquidity

Previously, the VN-Index closed August 2024 at 1,283.87 points, a gain of over 32 points (+2.59% compared to the previous month) with a three-week consecutive gaining streak.

However, investor sentiment remained largely cautious in August, with the average matched order value declining by 3% from the previous month’s low base and simultaneously recording the lowest level since December 2023, at over VND 14,700 billion per session.

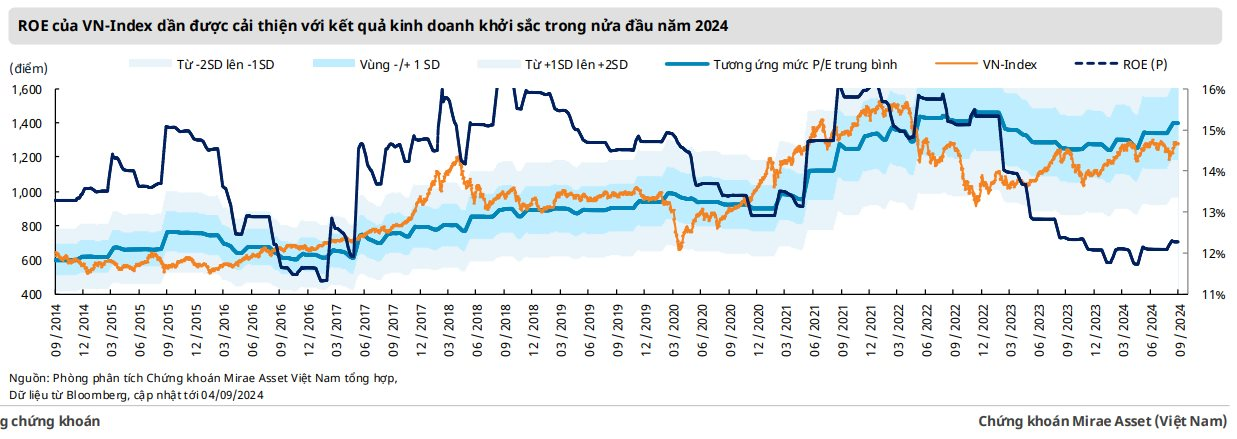

Additionally, cautious sentiment ahead of global market fluctuations led domestic individual investors to net sell for six consecutive months after net selling over VND 3,600 billion in August, reducing the net buy value since the beginning of the year to VND 61,550 billion.

Meanwhile, foreign investors recorded a net selling streak for seven consecutive months, with net selling of VND 3,610 billion in August, also the lowest level since March 2024. Cumulatively from the beginning of the year to the end of August, this group net sold over VND 64,000 billion.

From another perspective, ETFs redeemed for the tenth consecutive month, with a total redemption value of -62 million USD in August, bringing the redemption value since the beginning of the year to -724 million USD as of August 30; however, this is also the lowest redemption level since March 2024.