The decrease in on-exchange deposit balance may impact overall liquidity

Recent statistics show that investors’ deposit balance in the Vietnamese stock market has decreased after five consecutive quarters of growth, which is somewhat similar to the downtrend phase in 2022. According to Mr. Son, the VN-Index has now failed to surpass the 1,285 – 1,300 point range for seven times in the last seven months, coupled with relatively cautious signals from international stock markets, causing investors to be more cautious. They may withdraw cash for personal or business reasons, reducing the cash ratio in their accounts, directly affecting the overall market liquidity.

However, for a downtrend to occur, there need to be both internal and external factors. In recent years, the market has been mostly influenced by external factors, followed by internal stories. These are the similarities between international stock markets and Vietnam, especially between the S&P 500 and VN-Index, typically in the periods of tight policy in the international market leading to the decline of major stock indices globally, which immediately affected the Vietnamese stock market.

Mr. Tran Hoang Son, VPBank’s Market Strategy Director

|

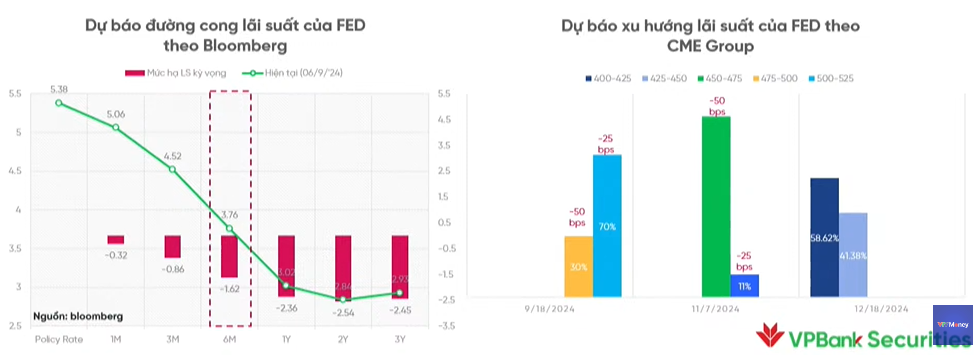

Fed may cut interest rates by 25 percentage points in September

Consecutive declines in US employment reports provide a perspective that the US labor market is being impacted by high-interest rates maintained over the past two years. We see that the US non-farm payrolls continue to fall short of expectations, although they are higher than the previous month. Compared to the average, the number of new jobs being created is tending to decrease gradually, after which the profit-taking pressure occurs very strongly in the US stock market.

This is an indicator for the Fed to consider in the process of lowering interest rates in September. According to analysts and VPBank’s forecast, the current situation is only enough for the Fed to cut rates by 25 percentage points, as the labor market has also given warnings but has not triggered any factors related to a recession.

|

VN-Index faces resistance at the 1,285 – 1,305 point range

The US and global stock markets sent out certain warning signals ahead of the Fed meeting, and the reversal of capital flow trends is affecting many indices, not just stocks but also commodities, bitcoin… Mr. Son assesses this as an early warning factor for the Vietnamese stock market.

The Vietnamese stock market has recovered for two weeks from the August low, and as of now, the upward momentum has stalled, failing to surpass the resistance level of 1,285 – 1,305 points, coupled with disruptive factors from international stock markets. The VN-Index is likely to decline or move sideways this week (September 9-13).

Looking at the weekly chart, the correction has occurred for three consecutive weeks, and the support zone of 1,250 – 1,260 points is temporarily supporting the market in this period. Looking at the daily chart, after a series of 7-8 sideways sessions around 1,280 – 1,290 points but failing to break through, it shows signs of a correction. The index is very close to the support level at MA21, and if this level is broken, the VN-Index will return to a correction signal, with the 1,285 – 1,300 range adjusting and returning to the 1,180 – 1,200 range to create a bottom and recover.

The market entered a recovery phase, but average liquidity began to decline in August and early September, indicating that capital tends to be cautious and investors need to pay attention. Mr. Son leans towards a cautious scenario when the index fails to hold the 1,250 – 1,260-point range, and then may face a correction. Conversely, if the VN-Index holds the 1,250 – 1,260-point range, it can be disbursed and take profits in the 1,285 – 1,300-point range.

|

The Selling Pressure Mounts, Stocks Plunge

The market continues to adjust amidst pressure from large-cap stocks. The selling pressure intensified during the afternoon session, resulting in a 150% surge in trading volume compared to the morning. Notable activities were observed in the food sector.

The Stock Brokers’ View: VN-Index Faces Deeper Correction Risk

The VN-Index is showing signs of weakness as it fails to hold the support level of the 20-day moving average. This could indicate a potential shift in market sentiment and a possible downward trend in the coming days. With the index struggling to maintain its footing, investors are advised to proceed with caution and keep a close eye on their positions. A break below this key technical level could trigger further selling pressure and result in a more pronounced correction. Vigilance and a strategic approach are crucial in navigating this uncertain period.