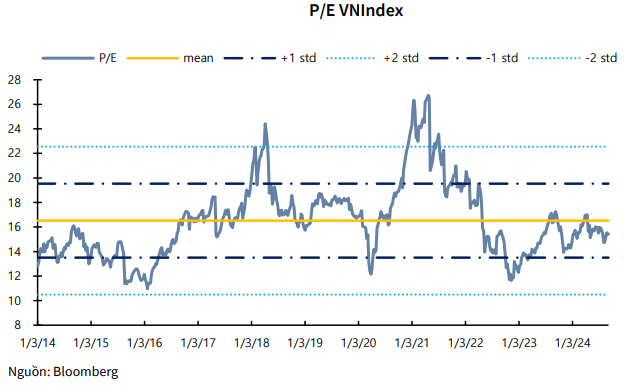

The KBSV Research Center, a subsidiary of KB Vietnam Securities Corporation, has released its September 2024 strategic report. From a fundamental perspective, in terms of valuation, the current P/E ratio of the VN-Index is approximately 15 times (according to Bloomberg data) and is in line with the two-year average.

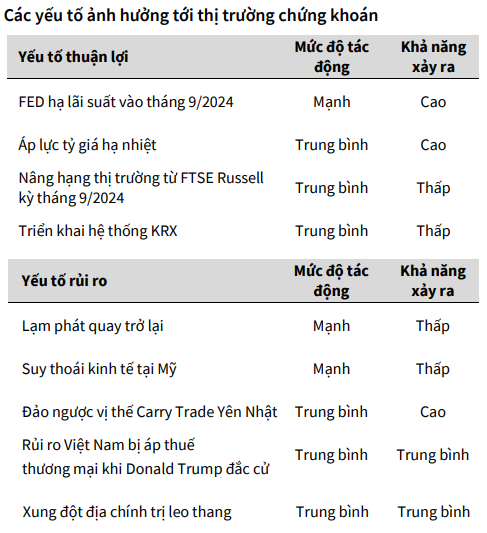

Looking at the mid- to long-term picture, KBSV Research believes that maintaining low-interest rates will be a key supportive factor for the recovery of domestic production, industry, investment, and consumption.

However, in the short term, there may still be potential risks of negative market reactions to escalating conflict concerns in the Middle East, recession risks in the US, and declining consumption in China.

From a technical perspective, the primary trend for the VN-Index in the short term remains upward in September. KBSV Research leans towards the scenario (70% probability) that the VN-Index will recover at the support level of around 1,260 (+/-5) and has the opportunity to surpass the short-term peak of 1,30x.

In the remaining scenario (30% probability), the index may undergo a deeper correction, falling to the next support level at 1,23x before a recovery rally emerges.

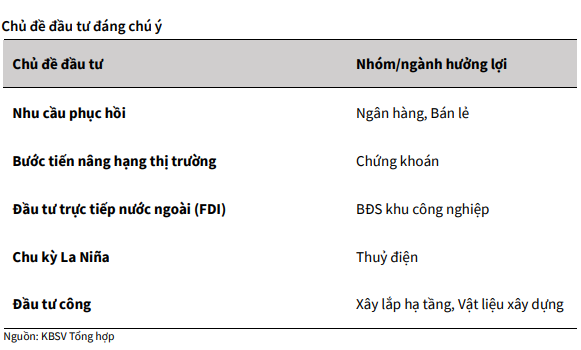

Regarding investment themes for September, in addition to the sectors mentioned in previous reports, including retail, industrial real estate, construction infrastructure, building materials, and hydropower, KBSV Research has added the banking sector with the theme of recovering demand and the securities sector with expectations of improvement in the upgrade process.

KBSV Research also notes that the market is entering a short-term adjustment phase, which will present a good opportunity for investors who do not have a position to deploy capital or for existing investors to increase their holdings.