National Commercial Joint Stock Bank (NCB) has increased savings interest rates. Thus, after more than 2 months, since July 1st, NCB has adjusted its interest rates.

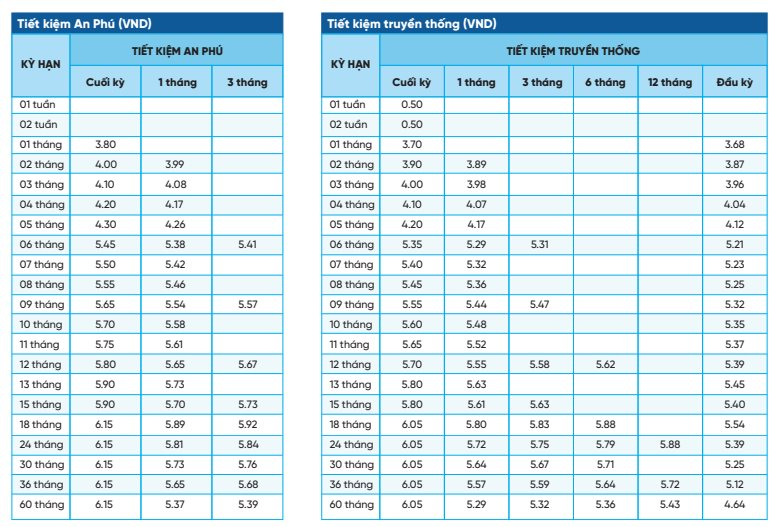

According to the interest rate table for An Phu online savings product, interest rates for terms from 1 to 15 months increased by 0.1% per year, and terms from 18 to 36 months increased by 0.05% per year.

Specifically, the interest rate for the 1-month term is listed at 3.8% per annum, 2-month term is 4%, 3-month term is 4.1%, 4-month term is 4.2%, and 5-month term is 4.3%.

The interest rates for 6 and 7-month terms are listed at 5.45% and 5.5% per annum, respectively.

The savings interest rates for 8 and 9-month terms are 5.55% and 5.56% per annum, respectively.

The interest rates for 10 and 11-month terms are listed at 5.7% and 5.75% per annum, respectively.

The 12-month term savings interest rate increased to 5.8% per annum, and the 13 and 15-month terms are at 5.9%.

Especially, the savings interest rate for the 18 to 36-month term increased to 6.15% per annum. This is also the highest deposit interest rate currently according to the interest rate tables published by the banks.

The latest savings interest rate table at NCB.

Thus, since the beginning of September, seven banks have made adjustments, including: Dong A Bank, OceanBank, VietBank, GPBank, Agribank, Bac A Bank, and NCB.

On the other hand, the interest rate market also witnessed a downward trend from a bank that once led the market with the highest interest rates – ABBank.

Captivating Capital: The Alluring Ascent of Interest Rates

Amidst the rising interest rates, banks are now vying for customers by offering an array of enticing fixed-term deposit certificates.