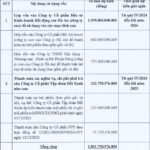

BKAV Corporation, a well-known Vietnamese technology company, has released its financial report for the first half of 2024, revealing a profit of VND 2.7 billion, a significant decline compared to the previous year. As of June 30, 2024, BKAV’s total equity was over VND 223 billion. The company’s liabilities stood at VND 321 billion, with bond debt accounting for VND 169.5 billion.

A stark contrast to its performance in 2019, BKAV’s profit has dwindled to one-tenth of what it was four years ago. The company’s return on equity (ROE) for the first half of 2024 further decreased to 1.21%.

Fig. 1: BKAV Pro’s Financial Performance

BKAV Corporation, established in 2003, has a diverse portfolio encompassing cybersecurity, software, e-government solutions, smart devices, and smartphone manufacturing. The company rose to prominence with its antivirus software in 1995 and later garnered attention for its Bphone, a Made-in-Vietnam smartphone. Mr. Nguyen Tu Quang is the founder and CEO of BKAV, as well as the chairman of its board of directors.

BKAV Pro, a subsidiary of BKAV Corporation, was founded on March 12, 2019, with a registered capital of VND 120 billion. Mr. Nguyen Tu Quang also serves as the legal representative and CEO of this company, which is responsible for software distribution within the BKAV Group.

Despite a strong start in 2018, when BKAV Pro generated impressive revenue and profit margins, the company has faced a downward trend since 2019, with an average annual profit decline of 12%. The latest figures indicate that BKAV Pro’s ROE has dropped to 1.21% as of the first half of 2024.

Home Credit Reports Doubled Profit, Surpassing $20 Million in the First Half of the Year

Home Credit’s stellar performance continues into 2024, with the company’s first-half results outperforming the full-year profits of 2023.

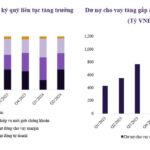

The Stock Market’s Best-Kept Secret: An Binh Securities (ABS) – Unveiling the Second Quarter’s Explosive Growth

An Binh Securities Joint Stock Company (Upcom: ABW) has announced impressive business results for the first half of 2024. The standout performances were the significant market share growth and an exceptional margin lending business.