Saigon Commercial Joint Stock Bank (SCB) has announced adjustments to the transaction limit for its instant money transfer service, Napas 247, for individual customers, effective from 1 pm on September 12, 2024.

From now on, individual customers will be able to transfer a maximum of VND 10 million per transaction per day, applicable to both over-the-counter and SCB eBanking channel transactions.

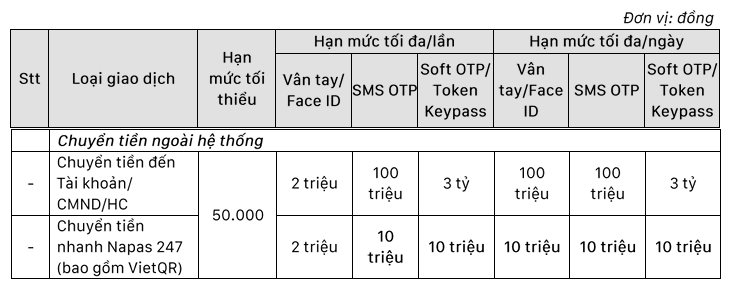

Specifically, for instant money transfers authenticated by fingerprint or Face ID, the limit is VND 2 million per transaction and VND 10 million per day. For transfers authenticated via SMS OTP, Soft OTP, or Token Keypass, the limit is VND 10 million per transaction and VND 10 million per day.

Illustration of the new transaction limits for SCB’s Napas 247 instant money transfer service.

Prior to this change, SCB had already adjusted the transaction limit for Napas 247 instant transfers twice, reducing it from VND 200 million to VND 100 million per transaction per day on August 15, 2024, and then to VND 50 million per transaction on August 23, 2024.

The limits for other types of transactions remain unchanged. For intra-bank transfers, the limits are: VND 2 million per transaction and VND 100 million per day for fingerprint or Face ID authentication; VND 100 million per transaction per day for SMS OTP; and VND 3 billion per transaction per day for Soft OTP or Token Keypass.

The transaction limit for bill payments by individual customers at SCB is VND 100 million per day. These payments include utility bills, mobile phone top-ups, insurance purchases, QR code payments, and flight bookings, among others.

In addition to the significant reduction in transfer limits, SCB has also been closing down many of its branches recently. On August 30, the bank announced the closure of 13 branches. According to the Vietnam Banks Association (VNBA), SCB has shut down 120 branches across the country since June 2023, including 64 in Ho Chi Minh City and 56 in other provinces.

SCB assures its customers that the closure of these branches will not affect the bank’s operations and that all customer rights and transactions will be fully guaranteed at other SCB branches.

On October 15, 2022, the State Bank of Vietnam announced its decision to place SCB under special control to stabilize the bank’s operations. This measure is in line with legal regulations and is intended to limit negative impacts on both the bank and the wider banking system. The State Bank of Vietnam has also appointed experienced and qualified personnel from Vietcombank, BIDV, VietinBank, and Agribank to manage and operate SCB.