Commercial Tenants Feel the Pinch

A survey of several central districts in Ho Chi Minh City revealed that while the number of business premises being returned to landlords has decreased compared to the previous year, the trend has not entirely stopped. Currently, many prime locations remain vacant, with some remaining unoccupied for a year.

One of the most notable cases in the southern market is the recent closure of Starbucks Reserve at 11-13 Han Thuyen, Ben Nghe Ward, District 1. Starbucks officially shut its doors on August 26 due to unsuccessful lease renewal negotiations with the landlord.

Following Starbucks’ departure, the landlord increased the rent from 700 million VND per month to 757 million VND, equivalent to nearly 9 billion VND per year. This increase of over 50 million VND per month would have meant an additional burden of 600 million VND per year for Starbucks, which could have been a contributing factor in their decision to leave after seven years of operation.

Ho Chi Minh City center rental prices continue to rise even when properties remain vacant. Photo: Ha Vy

As of late August 2024, not only F&B businesses but also prominent fashion brands on popular streets such as Nguyen Hue, Dong Khoi, Mac Thi Buoi, Hai Ba Trung, and Ngo Duc Ke have been forced to close due to skyrocketing rents. Some prime locations have been vacant for an entire year.

Even Dong Khoi Street, ranked 13th in the world for the highest rental rates by Cushman & Wakefield, has not been spared. Many premises on this street remain silent for months, despite the presence of well-known brands in the area.

At the end of 2023, an F&B brand on Dong Khoi Street (District 1) returned their premises after the landlord increased the rent by 12%. As of now, the space remains vacant. Another brand in the Thai Van Lung area (District 1) also struggled to afford the rent of nearly 700 million VND per month amid business challenges.

Previously, Highlands Coffee vacated the corner of Nguyen Du and Pasteur, and YEN Shushi closed its branch at 8 Dong Khoi. In March 2024, the MIA brand also left the premises at 325 Ly Tu Trong (Ngã Sáu Phu Dong) with a monthly rent of 700 million VND. From 2019 to the present, this location has changed hands four times.

These examples illustrate how high rents are affecting even well-known brands. With the rise of e-commerce, physical stores are at a disadvantage. While 62% of consumers still prefer in-person shopping, rents in prime locations remain high. As a result, many businesses are relocating due to the high cost of rent, which eats into their profits. To cope with the challenging economic climate, many brands are now seeking more affordable locations in peripheral areas.

Landlords Dictate the Terms

Rent increases are not uncommon for prime assets in Ho Chi Minh City’s most desirable locations. Notably, landlords tend to set high rents for these limited and highly sought-after properties.

Rental rates for commercial properties in the city’s center continue to rise, even as market demand slows. Every two to three years, or at the end of long-term contracts (typically five to seven years), rents in the central districts of Ho Chi Minh City increase by 10-20% (depending on the location), regardless of the tenant’s business performance or their objections.

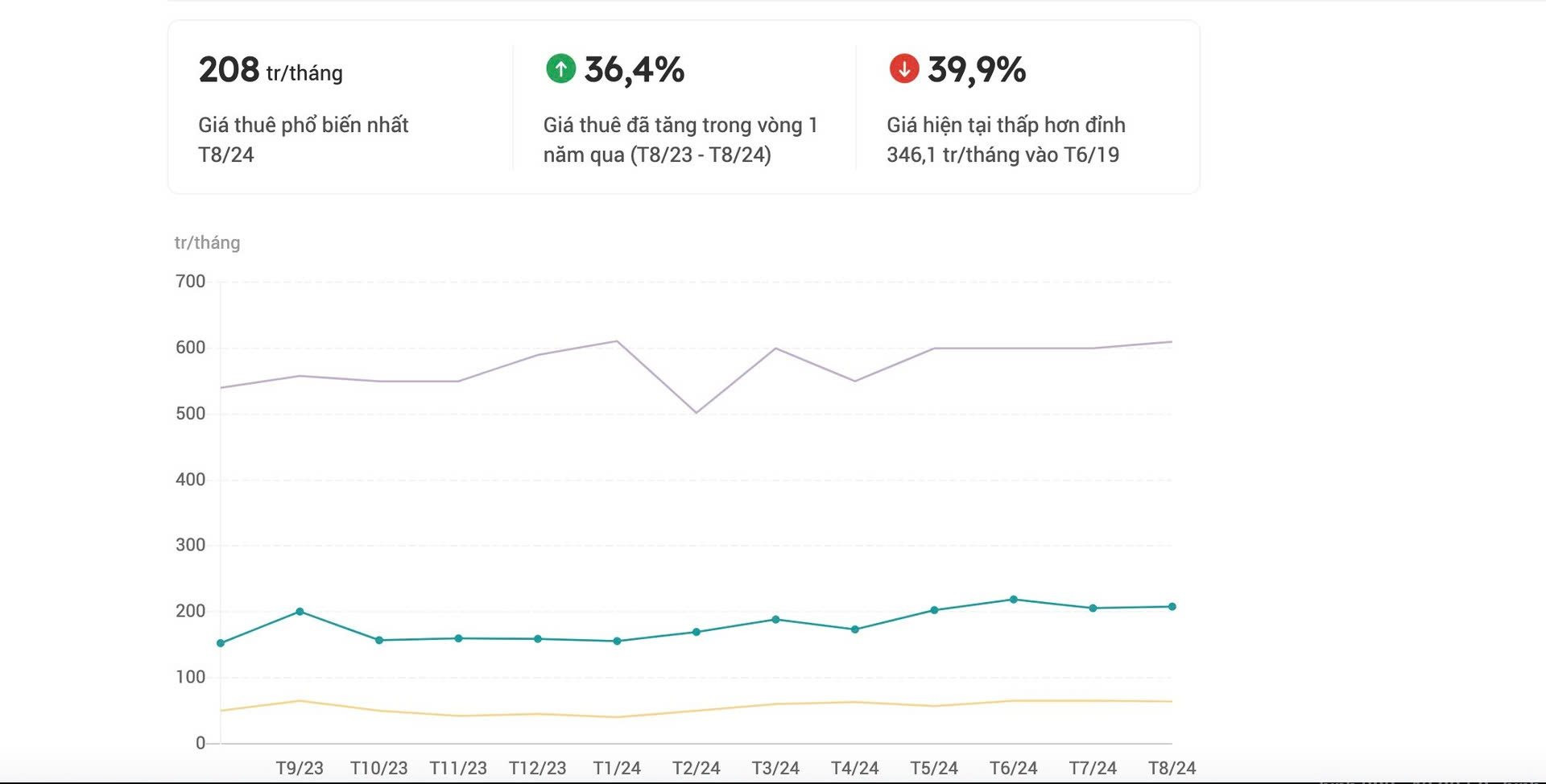

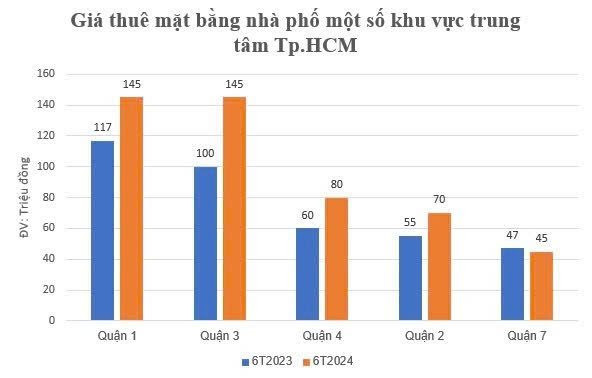

Data from Batdongsan.com.vn shows that rental prices for commercial properties in Ho Chi Minh City’s central districts continued their upward trend in the first half of this year compared to the same period in 2023. Specifically, rental rates in the old Districts 1, 3, 4, and 2 (now Thu Duc City) increased by 25-40%. Only District 7 experienced a slight decrease of over 4%.

Rental prices in most central districts of Ho Chi Minh City continue to rise despite tenant departures.

Mr. Phan Vi, a long-time broker in the city’s commercial real estate market, shared his insights based on his experience working with landlords who own prime assets. He explained that for these individuals, monthly rental income is not a significant concern when it comes to their limited and highly valuable properties.

They believe that their exceptional assets deserve higher “salaries.” If a tenant cannot afford the rent, the landlord is confident that another tenant will be willing to pay a higher price. Mr. Phan Vi likened it to a company offering a talented employee a salary of 50 million VND per month but not increasing it for five years. If another company offers the employee 60 million VND, they will likely leave for the new opportunity.

Mr. Vi emphasized that the value of prime real estate in Ho Chi Minh City is sometimes independent of market forces and is instead determined by the unique characteristics of the property. Owners of such properties are often individuals who “know how to enjoy life” or want to assert their personal status, rather than purely profit-driven investors.

In reality, landlords with vacant commercial properties in the city center often have a plan in place. If the property does not sell or lease as quickly as expected, they may choose to renovate, add floors, or make other improvements to increase its value. Rent reductions are rare.

There are four psychological reasons behind landlords’ reluctance to lower rents: First, rents for prime locations must increase annually. Second, after a five-year lease, it is challenging to negotiate a renewal at the previous rate. Third, inflation justifies higher rents over time. Fourth, landlords believe that if a property is not rented, it is because they haven’t found the right tenant, not because the rent is too high.

The Consequences of the Standoff

The standoff between tenants and landlords in Ho Chi Minh City’s central districts has created significant challenges for the commercial real estate market.

It is difficult to find new tenants in the current market, where many premises are being returned to landlords. Additionally, it is nearly impossible to negotiate a lower rent. In some cases, landlords may offer flexible support for the first one to two years, unrelated to the rent amount.

The consequences of this ongoing standoff are evident. Tenants are forced to leave, and landlords face significant financial losses when properties remain vacant for months. If a property remains unoccupied for three months, the loss is equivalent to the rent of three to four years, which is a substantial setback.

Negotiating lower rents with landlords in Ho Chi Minh City’s central districts is extremely difficult. Photo: Ha Vy

For tenants, the decision to leave prime locations in the city center is often bittersweet. Over the years, even during economic downturns, these brands have chosen to maintain a presence in these areas due to the significant brand exposure they offer. However, with the challenges posed by the current economic climate, relocating to peripheral areas is sometimes the only option.

Currently, the commercial rental market in Ho Chi Minh City’s central districts has not fully recovered, and potential tenants are approaching new leases with caution.

Ms. Do Thi Xuan Trang, Head of Retail Services at Avison Young Vietnam, noted that while there have been some positive signs compared to the previous year, the recovery has been uneven due to variations in location and tenant profiles. Recently, F&B brands with strong growth, such as Arabica, Highlands Coffee, Katinat, Phê La, and Starbucks, have continued to expand their market presence.

However, economic fluctuations and the rapid growth of e-commerce have influenced tenants’ decisions. “Retail brands are becoming more cautious in their site selection. Instead of aggressive expansion, brands are carefully selecting locations, streamlining their store networks, and focusing on enhancing service quality and customer experience,” said Ms. Trang.

International brands, in particular, are more inclined to choose retail spaces in shopping malls rather than street-front shops due to various advantages, including high foot traffic, a mix of shopping and entertainment options, professional management, lower setup costs, and a range of rental options.

When landlords refuse to lower rents, tenants must carefully consider the balance between costs, revenue, and profits. As a result, it is predicted that the commercial rental market for street-front shops will not see significant improvements until 2025. As the economy recovers and new brands or international brands seeking expansion enter the market, demand for prime locations is expected to increase.

Official Agent Signing for Lamina – Long Khanh Commercial Townhouses

The signing ceremony for the partnership and distribution of Lamina Long Khanh commercial townhouses between the investor and Phu Hoang Land Development, along with F1 agencies, took place at the impressive Phu Hoang Land Building.

The World of Trung Nguyen Legend Coffee at the Most Beautiful Post Office in the World

In an impressive continuation of its expansion, Trung Nguyen Legend unveiled its 10th coffee world space in the iconic Central Post Office building in Ho Chi Minh City on September 9, 2024. This new addition to the city’s cultural landscape follows the highly successful launches in China and the US in August 2024, further solidifying Trung Nguyen Legend’s presence in the global coffee scene.