The Ministry of Finance is drafting amendments and supplements to the Securities Law, including new regulations on private corporate bond transactions, which have raised concerns among investors about potential challenges in this market.

Are individual investors being unfairly targeted?

One of the most debated points is the restriction on transactions with individual investors. Specifically, Clause 2, Article 1 of the draft law proposes that professional individual investors are ineligible to invest in privately issued corporate bonds unless they meet certain conditions: a minimum of two years of securities investment experience, a minimum transaction frequency of 10 times per quarter in the last four quarters, a securities portfolio of at least VND 2 billion, and an annual income of at least VND 1 billion in the last two years.

Experts argue that these requirements are overly stringent and may deter potential investors from entering the market.

Mr. Nguyen Quang Huy, CEO of Finance and Banking at Nguyen Trai University, explains that these regulations aim to protect inexperienced investors from significant risks associated with private corporate bonds. However, he believes that setting such high standards may create a divide between investors, particularly disadvantaging small-scale investors.

Mr. Huy illustrates this point by comparing the income requirement of VND 1 billion per year against the average income of Vietnamese citizens in 2023, which was $4,284 per person. This discrepancy immediately excludes a significant portion of the population from accessing corporate bond investment opportunities. As a result, the pool of potential individual investors would significantly decrease, leaving only those with substantial experience and high incomes.

”

This could diminish the appeal of the corporate bond market, leading to a loss of a large number of potential investors and subsequently impacting market liquidity. Moreover, small-scale investors often contribute to market diversity and risk dispersion. Restricting their participation may result in a market that becomes more dependent on large investors or institutional investors

“, emphasized Mr. Huy.

Additionally, Mr. Huy argues that these regulations will reduce the liquidity of the private corporate bond market, which already suffers from lower liquidity compared to publicly issued corporate bonds. This could create difficulties for businesses seeking to raise capital through this channel.

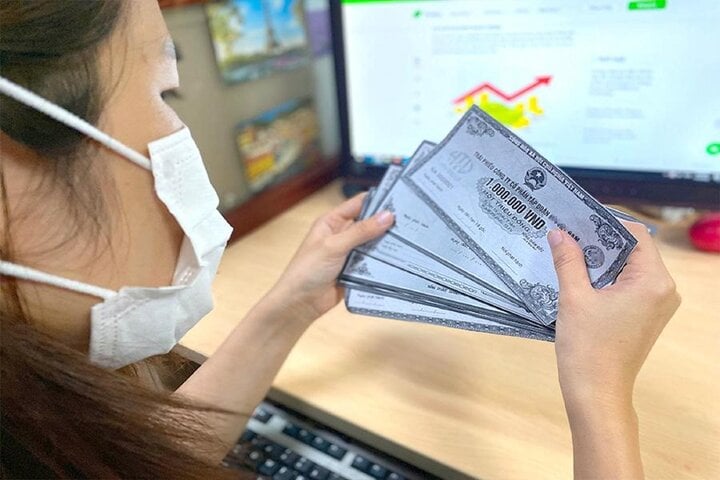

For small-scale investors, Mr. Huy notes that they often seek investment channels with higher returns than banks, and private corporate bonds are a popular choice. However, with the new regulations, their ability to participate is severely limited, causing them to miss out on potentially lucrative investment opportunities. This may push them towards informal or higher-risk investment channels that lack the protection of legal regulations.

Illustration: Small-scale investors may soon be excluded from the corporate bond market.

Mr. Huy also highlights the inherent risky nature of corporate bonds and agrees that requiring investors to have a certain level of experience and income is reasonable for investor protection. However, he suggests that instead of imposing rigid criteria, there should be more flexible control measures. He proposes that mandating short-term training courses or knowledge assessment tests for individual investors could be a viable alternative. These courses and tests should be conducted by reputable state-recognized training institutions, empowering investors with the necessary skills to manage their risks effectively when entering the bond market. By doing so, investors can still freely participate in the market with a clear understanding of the associated risks.

Echoing this sentiment, economic expert Dinh Trong Thinh agrees that the new detailed regulations tightly controlling the eligible investor pool may lead to a bottleneck in the already struggling corporate bond market.

Mr. Thinh questions the necessity of imposing additional conditions, such as a minimum of 10 securities transactions per quarter in the last four quarters or an annual income of VND 1 billion in the last two years. He argues that these requirements will exclude a large number of investors from the corporate bond market, resulting in a significant loss of capital for the market.

A leader of a Hanoi-based enterprise shares the concern that these regulations may block the channel for capital mobilization through private bond issuance, pushing investors towards other less-regulated forms such as promissory notes, bills of exchange, loan certificates, or cooperative investment contracts with organizations.

At the same time, these regulations could leave businesses struggling to access the capital needed to initiate new projects.

Small and medium-sized enterprises may also struggle to comply

In addition to the stricter conditions for professional securities investors, the draft amendment to the Securities Law also proposes that organizations issuing public bonds must provide collateral or a bank guarantee when applying for a license, except in cases where the credit institution offers subordinated debt that meets the conditions to be counted as Tier 2 capital and has a representative of the bondholders as stipulated.

Mr. Nguyen Quang Huy believes that the requirement for collateral or a bank guarantee is a more stringent control measure to protect investors from the risks of bankruptcy or non-payment by the issuing enterprise. However, he points out that this condition may be challenging for many small and medium-sized enterprises (SMEs) to meet.

SMEs often lack substantial assets or strong credit relationships with banks to easily obtain issuance guarantees. As a result, they may lose the option of raising capital through private corporate bond issuance, reducing the diversity of the corporate bond market.

Consequently, the capital market, particularly the corporate bond segment, will become more reliant on large enterprises and credit institutions. This could deprive investors of opportunities to participate in potentially high-risk but innovative and startup projects. The market may become less vibrant and dynamic, missing out on the chance to foster the growth of agile and innovative businesses.

”

While the new regulations in the draft amendment to the Securities Law aim to protect investors and enhance market safety, they need to be carefully considered and adjusted to align with the realities of Vietnam’s financial market.

Striking a balance between safety and flexibility in investment is essential for fostering the development of both enterprises and investors. Every investment channel entails expected profits and corresponding risk management capabilities. Only when investors are equipped with the necessary skills and knowledge, either through their own initiative or with the support of state agencies, can the market sustainably grow in both scale and quality

“, concluded Mr. Huy.

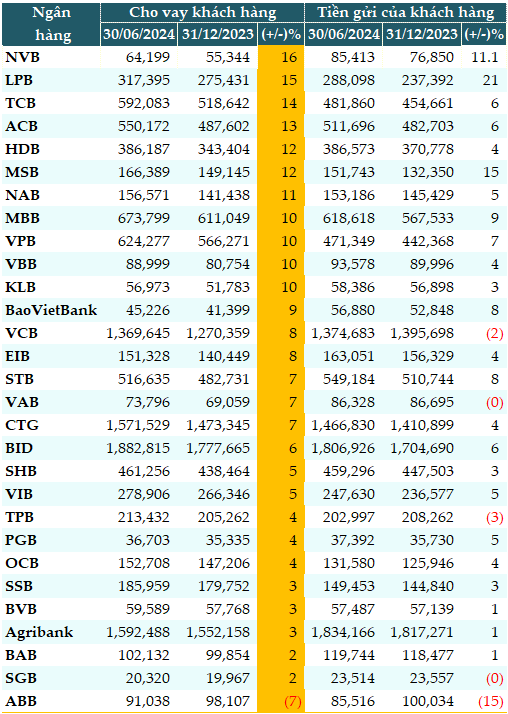

“A Startling Surge: VDSC’s Non-Performing Loans Soar by VND 76 trillion since 2023”

Based on the NPL ratio data published by the SBV, VDSC estimates that the bad debt of the banking system has increased by approximately VND 75.9 trillion compared to the end of 2023. This significant surge in non-performing loans underscores the imperative for robust risk management strategies within Vietnam’s financial landscape.

More than 2 trillion dong bonds repurchased ahead of schedule in February

Based on the data compiled by VBMA (Vietnam Bond Market Association) from SSC and HNX, the issuance of corporate bonds (TPDN) in February 2024 remains sluggish, similar to what happened in the first month of the year.