The Two Giants Are in a Record-Breaking Race

With the market’s ups and downs, it’s not easy to pick stocks with long-term upward momentum. According to statistics, after the trading session on September 12, the percentage of stocks that maintained their long-term upward trend (above MA200) on all three exchanges fell below 50%.

However, in the plastics industry, the two giants, BMP and NTP, are both making their mark by aiming for new price records.

Specifically, on September 12, NTP hit an all-time high price of VND73,700 per share before closing the session at VND71,700 per share. Meanwhile, BMP stock also faced profit-taking pressure on September 12, but is still less than 9% away from its all-time high. It is known that BMP‘s all-time high was set at VND119,550 per share on April 15.

BMP’s market capitalization reached more than VND8,900 billion on HOSE as of the end of the trading session on September 12

|

A “secret” race in share prices is taking place between the two giants, BMP and NTP. Currently, BMP has consecutively increased its price for four years, with a performance of nearly 100% in 2023.

NTP’s market capitalization reached more than VND10,200 billion as of the end of the trading session on September 12.

|

As for NTP stock, it is “chasing” BMP with the second consecutive year of price increase. After growing by 30% in 2023, NTP has increased by more than 100% compared to the beginning of 2024.

The competition in the plastics industry is far from over.

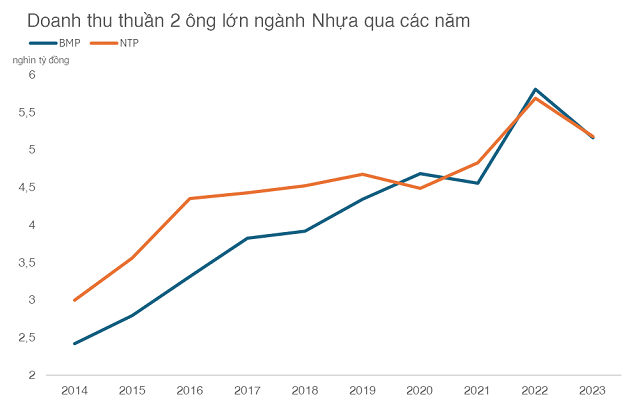

In terms of business operations, there is a clear rivalry between the two giants, BMP and NTP. In the past two years, both BMP and NTP have recorded revenue of over VND5,000 billion.

In the last two years, the two giants have both achieved revenue of over VND5,000 billion.

|

Since 2023, while BMP has pursued a strategy of maintaining product prices and protecting profits, NTP has adopted a more flexible pricing policy. In the period before August 2022, BMP sold its products at a price approximately 10% higher than NTP, but since then, this gap has widened to 20%.

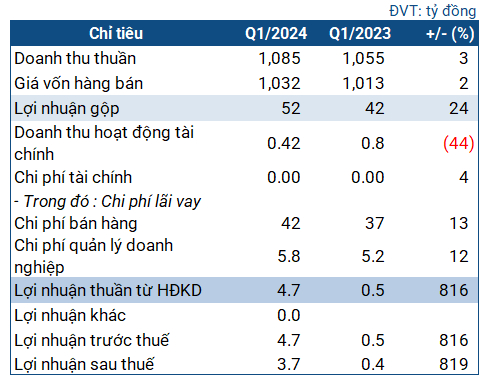

Recently, VNDIRECT Securities Company stated that the price gap between BMP and NTP has narrowed after NTP‘s average selling price increased by 10% compared to the same period.

Before the arrival of Typhoon Yagi, VNDIRECT forecast that BMP‘s revenue in 2024 would fall below VND4,600 billion, and its after-tax profit would decrease by 13% over the same period to VND909 billion. BMP will continue to maintain a high cash dividend payout ratio, especially from 2018 – after being acquired by SCG Thailand, the payout ratio has been maintained at 99% of profit for five consecutive years. With this policy unchanged in the next three years, VNDIRECT predicts that BMP will pay a cash dividend of VND12,000 per share, which can be paid in Q4/2024 and Q2/2025.

As for NTP, thanks to its more competitive pricing compared to its direct competitor, NTP is expected to gain market share from BMP, especially in the context of the current challenging economic environment.

In a report in May 2024, DSC Securities Company assessed that NTP could continue to maintain the good results achieved in 2023. Accordingly, NTP is expected to achieve revenue and profit in 2024 of VND5,366 billion (+4%) and VND657 billion (+17%), respectively.

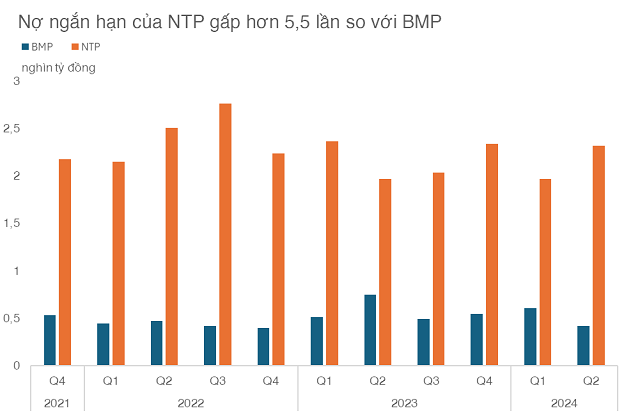

Thus, NTP‘s profit is growing but will not catch up with BMP as it does not receive the same support from its parent company as BMP does, while also having to rely on higher financial leverage.

As of Q2/2024, NTP’s short-term debt was more than 5.5 times higher than that of BMP.

|

However, the company is showing a trend of reducing its short-term debt. Together with the Fed’s expected interest rate cut this year, NTP may be able to reduce its borrowing costs. It is known that in the past five years, NTP has consistently paid dividends with a cash dividend ratio of 20-25% of par value. At the same time, the company also paid dividends in shares in 2020 and 2022 with a ratio of 20%.

In 2024, the company will pay cash dividends at a rate of 20% (including the second tranche of 2023 and the first tranche of 2024). The company has completed the payment of 2023 dividends in shares at a rate of 10% at the beginning of this September.

The Profitable Flamingo: How the Resort Chain Soared to Success in 2024

Flamingo Holdings has just released its financial report for the first half of 2024, and the results are impressive. The company has seen significant growth in both revenue and profit, surpassing expectations and setting a strong precedent for the remainder of the year. With a strong performance across the board, Flamingo Holdings is poised for continued success and a bright future ahead.

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.