Impact of Hurricane Yagi.

|

On September 9, 2024, the SBV issued Document No. 7417/NHNN-TD directing credit institutions and SBV branches in several provinces and cities to implement solutions to support customers in overcoming the consequences of Hurricane No. 3. Accordingly, the SBV requested credit institutions to proactively review and summarize the damage incurred by borrowing customers to promptly apply support measures and remove difficulties for customers, such as restructuring repayment periods, considering interest exemptions or reductions, and providing new loans for post-hurricane production and business recovery in accordance with current regulations.

In the afternoon of September 11, 2024, in Quang Ninh, SBV Vice Governor Dao Minh Tu worked with the province and the city of Haiphong on the damage caused by Hurricane Yagi to banks and customers.

Vice Governor Dao Minh Tu shared, “The hurricane has passed, leaving difficulties and losses, but the most important thing that remains is humanity and responsibility. Many areas in the localities directly affected by the hurricane are now facing floods and landslides, and many people are homeless, having lost their property and loved ones. Therefore, it is the responsibility of the banking industry to share the difficulties with the people and businesses. We need to provide support in terms of lending so that people have the opportunity to resume their production and business activities and thus be able to repay their debts to banks.”

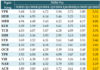

According to a quick report from credit institutions in Quang Ninh province, as of September 10, 2024, there were a total of 11,058 customers with a total outstanding debt of VND 10,654 billion (accounting for 5.6% of the province’s total outstanding debt) who were severely affected by the consequences of Hurricane No. 3; some customers in the field of aquaculture suffered particularly heavy losses (their fish cages were washed away).

In Haiphong, there were a total of 890 customers with a total outstanding debt of VND 15,686 billion affected by the hurricane, mainly in the fields of livestock breeding, aquaculture, production, business and trade, port, and fishing vessels.

Due to the severe impact of Hurricane No. 3 on people and businesses, banks are rapidly deploying multiple solutions to support affected customers.

Mr. Le Duy Hai, Vice President of VietinBank, said that according to preliminary statistics, about 195 corporate customers were affected by Hurricane No. 3, with outstanding loans of about VND 18,000 billion. In the coming time, the bank will quickly assess the overall damage with customers in the whole system to come up with appropriate support measures. For customers who have purchased insurance from the bank, VietinBank will expedite compensation to help people quickly stabilize their lives.

Regarding BIDV, Mr. Le Trung Thanh, Vice President, said that BIDV had continuously updated information from its branches in the two localities of Haiphong and Quang Ninh, as well as some other localities, to assess the damage incurred by customers. The bank evaluates each customer case to come up with a debt restructuring plan, including debt rescheduling and interest reduction, and issues a credit package with a reasonable interest rate and scale to accompany people and businesses in recovering from the hurricane.

Mr. Doan Ngoc Luu, Vice President of Agribank, said that in implementing solutions to support customers and overcome the consequences of Hurricane No. 3, Agribank had directed ABIC Insurance Company to urgently carry out procedures to support and compensate affected customers, ensuring timely support for customers. The bank also directly met with and encouraged customers affected by Hurricane No. 3; grasped and assessed the overall damage of borrowing customers, expected affected debt, repayment capacity, and specific solutions to support customers: implementing measures and restructuring debts under Decree 55, restructuring affected debts under Circular 02, reducing interest rates, providing new loans, and promptly supporting customers to restore and stabilize their business operations.

Regarding credit institutions, the SBV Vice Governor requested a quick review of each customer case, clarifying the extent of damage and grasping the wishes and proposals of customers. At the same time, credit institutions should become a “pillar” for businesses, not collecting debts by all means but being flexible and responsible in sharing and creating favorable conditions for businesses to recover. Within their authority, the branches should consider supporting interest rate reductions for customers and boldly providing loans to help businesses resume production and business activities.

SBV Vice Governor Dao Minh Tu at the meeting on September 11. Source: SBV Quang Ninh

|

In response to the spirit of the SBV, in the afternoon of September 12, 2024, VPBank and MSB were the first two banks to announce specific lending interest rate reduction policies to support customers affected by Hurricane No. 3.

VPBank announced that it would directly reduce lending interest rates for all individual customers with existing loans at the bank and secured assets. Specifically, medium- and long-term loans will be reduced by 1% interest, and short-term loans will be reduced by 0.5% interest. VPBank’s interest rate support program is implemented from September 13 to December 31, 2024, and is applicable in all provinces and cities directly affected by Hurricane Yagi, including Quang Ninh, Haiphong, Hanoi, Thai Nguyen, and Yen Bai.

In addition to reducing lending interest rates, VPBank also adjusted the extremely attractive interest rate offer to only 6.5%/year fixed for the first 12 months for all customers who need to repay their loans in advance at other banks or borrow for real estate purchase, construction, and home repair.

MSB also announced that from now until December 31, 2024, it will reduce lending interest rates by 1%/year compared to the current interest rates for household business customers with a loan term of up to 60 months.

For new customers who are household business owners, MSB offers preferential loan packages, including unsecured credit limits of up to VND 2 billion with interest rates from 11.5%/year and secured credit limits of up to VND 20 billion with interest rates from 5.8%. With high credit limits and long loan terms, as well as diverse funding purposes and credit forms such as loans, overdrafts, guarantees, and credit cards, MSB is truly a great source of support to help household businesses stand firm after the storm and floods.

For small businesses, MSB also promotes competitive credit packages with secured credit limits of up to VND 6 billion and interest rates from 4.99%, and unsecured credit limits of up to VND 2 billion and interest rates from 7.7%. With a loan term of up to 36 months and diverse loan forms such as working capital supplementary loans, medium- and long-term loans, overdrafts, credit cards, and trade finance, MSB helps solve difficulties and damage caused by storms and floods.

The attractive interest rates, simple procedures, and online loan availability are the advantages of MSB’s preferential credit programs, bringing convenience to customers.

Other banks in the system have also been and are continuing to update and summarize information about the damage incurred by customers.

In response to the warning from competent authorities about the work of preventing and combating Hurricane Yagi, OCB immediately established response teams in areas expected to be affected, providing notifications and guidance to help employees in units likely to be affected by the hurricane implement multiple plans to ensure safe transactions for customers and smooth operations of the bank.

In particular, to promptly support customers in overcoming difficulties and restoring production and business activities, in addition to the above activities and following the direction of the SBV in considering the implementation of support policies for affected customers, OCB has been actively reviewing and supporting customers in areas severely affected by the hurricane. Based on the actual situation, OCB will come up with appropriate support solutions depending on the level of damage of each customer.

Han Dong

“Banks to Support Customers Affected by Storm Yagi in Haiphong and Quang Ninh; Over 12,000 Loan Borrowers Impacted”

On September 11, in Quang Ninh province, Mr. Dao Minh Tu, the Permanent Vice Governor of the State Bank of Vietnam, chaired a meeting to address the damage caused by Typhoon Yagi in Quang Ninh province and Hai Phong city. The discussion focused on the impact on banks and their customers in the affected areas.

The Perfect Headline:

“Financial Relief for Quang Ninh: Exploring Credit Support for Customers Affected by Storm No. 3”

The Chairman of the People’s Committee of Mong Cai City has requested that banks defer debt and reduce interest rates on existing loans. In addition, they are encouraging new unsecured loans to provide much-needed financial support to local businesses and citizens. This initiative aims to stimulate economic growth in the area by enabling easier access to capital for reinvestment and business operations.

Is Ho Chi Minh City’s Low Credit Growth a Concern?

As the economic powerhouse of Vietnam, Ho Chi Minh City usually sets the pace for the rest of the country. However, its credit growth rate is currently lagging, falling below the national average.