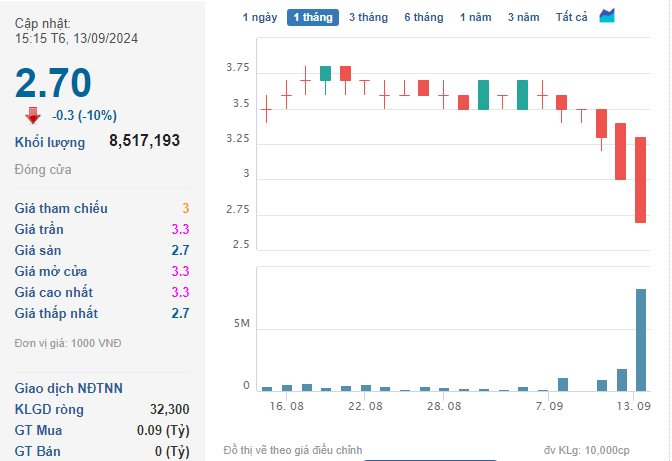

The NRC share price of Danh Khoi Group JSC closed at VND 2,700 per share on September 13, down 10% from the previous session, with a sudden surge in matching trading volume to over 8.5 million units – more than tenfold the average trading volume of the last 10 sessions (560 thousand units).

This was the second consecutive session that NRC shares fell to the floor; in the previous session (September 12), this real estate stock fell 9.09% to VND 3,000 per share, with a matching trading volume of nearly 1.9 million units.

Looking at the broader picture, NRC shares have declined in 7 out of the last 10 trading sessions (including 2 floor sessions), with the market price plummeting 33.3%, equivalent to a loss of VND 900 per share.

Currently, NRC shares are trading at their all-time low since their listing in 2018.

NRC shares were dumped by investors on September 13, with a sudden surge in matching trading volume. (Source: Cafef)

In terms of business performance, according to the reviewed consolidated financial statements for the first half of the year, Danh Khoi’s revenue from sales of goods reached VND 2.56 billion in the first six months of this year. As a result, the company reported a post-tax loss of over VND 10 billion, a significant decrease compared to the profit of VND 7 billion in the same period last year.

In another development, in addition to business losses, Danh Khoi also faced tax arrears and overdue bond payments. As of June 30, the company had short-term financial borrowings of over VND 342 billion and long-term financial borrowings of over VND 46 billion. Of this, the company had VND 256 billion in bond debt. However, the company has not paid VND 139.5 billion in overdue bonds plus nearly VND 24 billion in interest.

Furthermore, as of June 30, Danh Khoi also owed VND 102.2 billion in taxes. The penalty interest expense for late payment of taxes amounted to VND 25.6 billion. The company also had employee benefits payable of over VND 6.8 billion.

As of June 30, Danh Khoi’s board of directors comprised: Mr. Le Thong Nhat – Chairman; and six members: Ms. Han Thi Quynh Thi, Mr. Tran Vi Thoai, Mr. Ho Duc Toan, Mr. Bui Duc Hoan, Mr. Nguyen Huu Quang, and Mr. Vu Ngoc Chau.

Meanwhile, the company’s board of directors and chief accountant included Mr. Nguyen Huy Cuong – General Director; Mr. Nguyen Huu Quang – Deputy General Director; Mr. Ho Duc Toan – Chief Financial Officer; and Ms. Tran Ngoc Chieu – Chief Accountant.

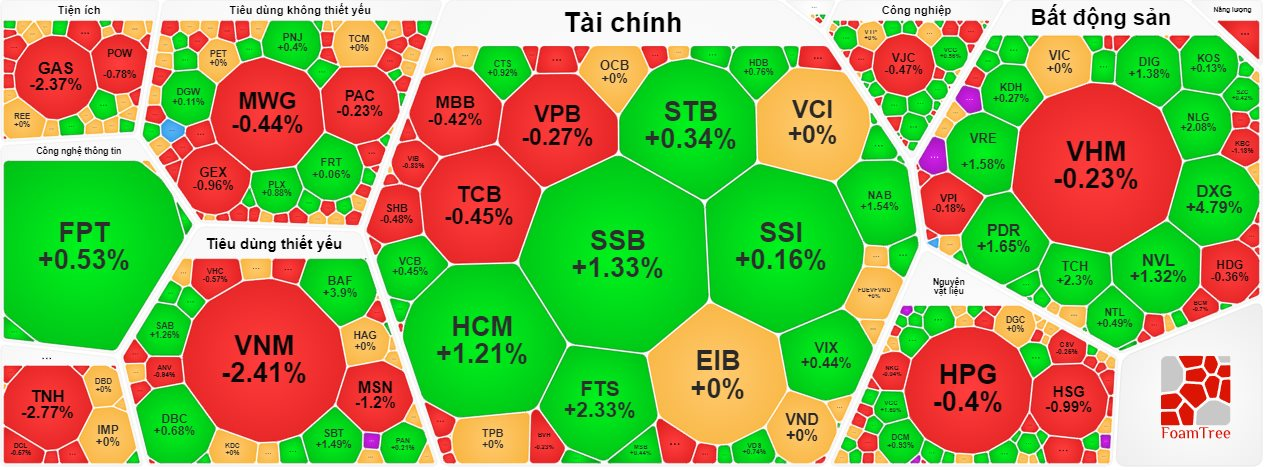

Market liquidity dries up as VN-Index falls nearly 5 points

Faced with the market’s strong volatility, many investors chose to stay on the sidelines, causing liquidity in the market to remain low, reaching nearly VND 12,300 billion on all three exchanges. On the HoSE alone, liquidity reached nearly VND 11,200 billion.

Real estate stocks unexpectedly attracted investment capital on the day VN-Index fell nearly 5 points.

At the close of the September 13 session, the VN-Index fell 4.64 points to 1,251.71. In contrast, the HNX-Index increased by 0.51 points to 232.42, and the UPCoM-Index also rose by 0.23 points to 92.95.

After propping up the VN-Index in the previous session, blue-chip stocks turned into a burden for the market today. In the VN30 basket, red dominated the screen, with the VN30-Index falling 3.31 points to 1,294.30.

Among them, GAS and VNM put the most pressure on the VN-Index, falling by more than 2%. Following closely was MSN, which declined by 1.2%. Other stocks that fell by less than 1% included ACB, BCM, BID, BVH, CTG, HPG, MBB, MWG, POW, TCB, VHM, VIB, VJC, and VPB.

On the other hand, the stocks that had the most positive impact on the VN-Index were VCB, FPT, SAB, VRE, HDB, SSB, and PLX, all of which rose by around 1%.

Real estate stocks stood out in today’s trading session on the HoSE, while VHM, HDG, VPI, and KBC fell slightly. Many other blue-chip stocks in this sector attracted strong investment capital, such as DXG (+4.79%), NLG (+2.08%), and TCH (+2.3%). Following closely, PDR, VRE, DIG, and NVL all rose by more than 1%.

On the HoSE, DRH shares of DRH Holdings JSC unexpectedly surged to the ceiling, successfully breaking a 10-session losing streak (including 3 floor sessions). At the close of the September 13 session, the DRH share price stood at VND 1,900 per share, up 6.74% from the previous session, with a matching trading volume of nearly 2.7 million units.

DRH shares suddenly surged to the ceiling, breaking a previous 10-session losing streak. (Source: Cafef)

While NRC shares of Danh Khoi attracted attention on the HNX, VNZ shares of the tech “unicorn” VNG on the UPCoM exchange rose for the third consecutive session (including 2 ceiling sessions). Notably, before this, VNZ shares had fallen sharply in 3 sessions following news of changes in the company’s management.

At the close of the September 13 session, the VNZ share price stood at VND 418,100 per share, up 2.08% from the previous session, with a matching trading volume of nearly 20,000 units.

Foreign investors net sold for the second consecutive session on the HoSE, with a net selling value of nearly VND 73 billion. They offloaded VHM shares the most, with a net selling value of nearly VND 200 billion. This was followed by MWG (VND 124.19 billion), VCI (VND 85.47 billion), and HPG (VND 73.47 billion).