Cautious Yet Optimized Financial Management

As the digital economy continues to evolve, the way individuals and businesses manage their finances is undergoing a significant transformation.

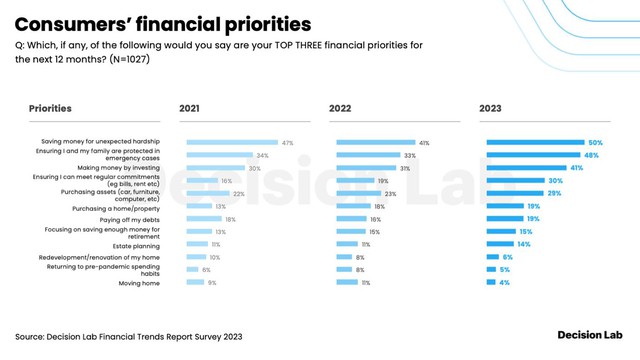

Consumer Financial Priorities as per Decision Lab’s Report (2023)

According to Decision Lab’s 2023 Financial Trends Report, Vietnamese people are becoming more cautious in their personal financial decisions. As a result, 50% of survey respondents prioritized savings as their top priority, and 48% wanted to ensure their family’s financial security in case of emergencies – an increase of 10% and 15%, respectively, from the previous year. Consequently, the number of people opening savings accounts nearly doubled to 62% in 2023.

Most consumers are tightening their belts to allocate budgets for personal savings. In 2024, there is a continued trend of financial prudence, with 54% opting to save even more.

Savings Trend: Embracing Digital to Optimize Returns

According to the latest data from the State Bank, customer deposits at credit institutions have been consistently increasing this year. As of the end of March, bank deposits reached a record high of nearly VND 6.7 quadrillion, an increase of approximately VND 39 trillion compared to the previous month and 2.2% higher than the end of last year, despite low-interest rates.

Digital savings is considered a smart choice in the digital age due to the breakthrough values it offers. Investing in digital deposits helps individuals optimize the profits and earning potential of idle funds, allowing them to take control of their assets. Moreover, instead of visiting a bank branch, customers can now easily perform all transactions on digital platforms, from account opening to final settlement, anytime, anywhere. Especially when compared to traditional deposit methods, digital savings offer superior interest rate promotions and impressive gifts.

Digital Savings, Profitable Idle Money on the MBBank App

MB is at the forefront of the digital savings trend, offering deposit solutions through the MBBank and BIZ MBBank apps, with additional interest rates of up to 0.5% and personalized benefits for different customer segments. A representative from MB shared: “We strive to provide optimal financial solutions with the principle of ensuring safe and competitive interest rates for our customers. We continuously develop flexible digital deposit products that cater to diverse customer segments.”

Specifically, for small and medium-sized enterprises (SMEs), opening a BIZ MBBank account online will earn them an additional 0.2%/year for savings between 1 to 6 months, and an extra 0.1%/year for other terms. Notably, the deposit feature on BIZ MBBank allows for flexible partial withdrawal of the principal when customers opt for a digital investment deposit product with interest payable at maturity, ensuring high-interest rates for the remaining principal. With flexible tenure options ranging from 1 week to 60 months, this package not only optimizes profits but also helps businesses efficiently manage their cash flow as per their requirements.

For large corporate clients (CIB), MB offers flexible financial solutions where the entire process of account opening and settlement of deposits can be conveniently done online via BIZ MBBank. Additionally, customers can easily monitor interest rates directly on the BIB MBBank platform.

As part of its 30th-anniversary celebration, following the success of the “Exciting Birthday – Full of Gifts” program, which saw the participation of over 2,500 corporate customers and the opening of 9,000 deposit accounts, MB is launching the second phase with special benefits and gifts for corporate customers who opt for fixed deposits with tenors ranging from 1 to 11 months. Depending on the deposit amount, customers will receive valuable gifts. At the end of the program, corporate customers will also have the chance to participate in the BIG DEAL program, offering a travel package worth up to VND 75 million and a host of other valuable gifts, totaling VND 6.5 billion.

For individual customers, MB provides an easy online savings service without the hassle of complicated paperwork. Additionally, customers will enjoy preferential interest rates that are 0.1-0.2%/year higher than those offered for over-the-counter deposits. Individuals can choose flexible tenures ranging from 1 week to 60 months and manage their accounts anytime, anywhere via the MBBank app, ensuring safety and security without the worry of losing physical passbooks. Currently, 75% of MB’s individual customers have utilized the money deposit feature on the MBBank app, with deposit values reaching nearly VND 450 billion.

With attractive interest rates and special benefits, MB is the ideal choice to help you optimize your finances and enjoy maximum convenience. Digital savings is not just a trend but a smart choice for the digital age!

The Rent Hike: A Student’s Dilemma During Enrollment Season

The rental prices for student accommodations in areas with a high concentration of universities in Hanoi and Ho Chi Minh City are on the rise as we enter the student enrollment season.

“Vietnam: Among the Top 10 Countries with the Fastest Growing E-commerce Sector Globally”

E-commerce is a trailblazer in the digital economy. With a staggering 25% growth rate in 2023, Vietnam is among the fastest-growing nations in East Asia and is placed within the top 10 countries with the highest growth rates globally.