On September 12, TCBS – a leading securities company in Vietnam – announced its decision to adjust the plan for issuing shares to increase charter capital from owner’s equity. This includes withdrawing the registration dossier submitted to the State Securities Commission (SSC), presenting the amended issuance plan for approval at the upcoming General Meeting of Shareholders, and completing other relevant procedures.

TCBS plans to resubmit the registration dossier to the SSC after finalizing these tasks. The original plan, approved at the 2024 Annual General Meeting, entailed issuing over 1.74 billion bonus shares in 2024, representing an 800% increase in the number of shares in circulation. This would have boosted the charter capital to over VND 19,600 billion.

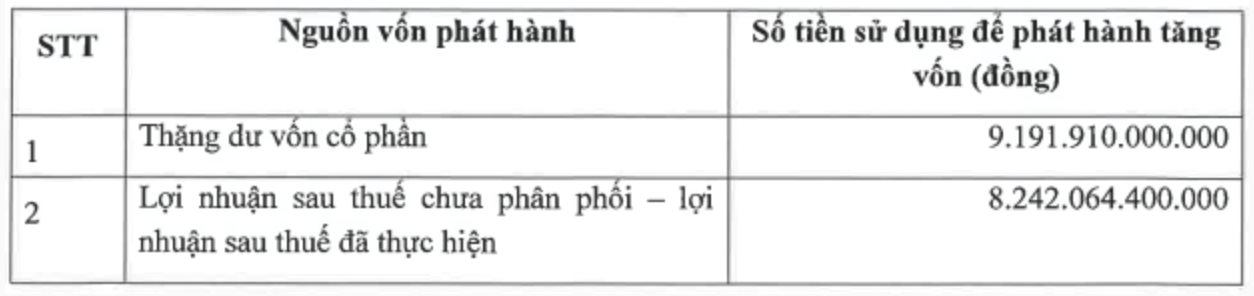

The company intended to allocate over VND 9,400 billion for cash dividends and charter capital increase from retained earnings. Of this, more than VND 8,200 billion would have been used to increase charter capital, with the remaining amount of nearly VND 1,200 billion for cash dividend payments.

Looking ahead to 2024, TCBS targets a 22% increase in pre-tax profit, reaching VND 3,700 billion. In the first half of 2024, the company achieved impressive results, with a pre-tax profit of nearly VND 2,800 billion, a surge of 177% year-on-year, thus completing 75% of its full-year target. Net profit exceeded VND 2,200 billion, reflecting an 187% year-on-year growth.

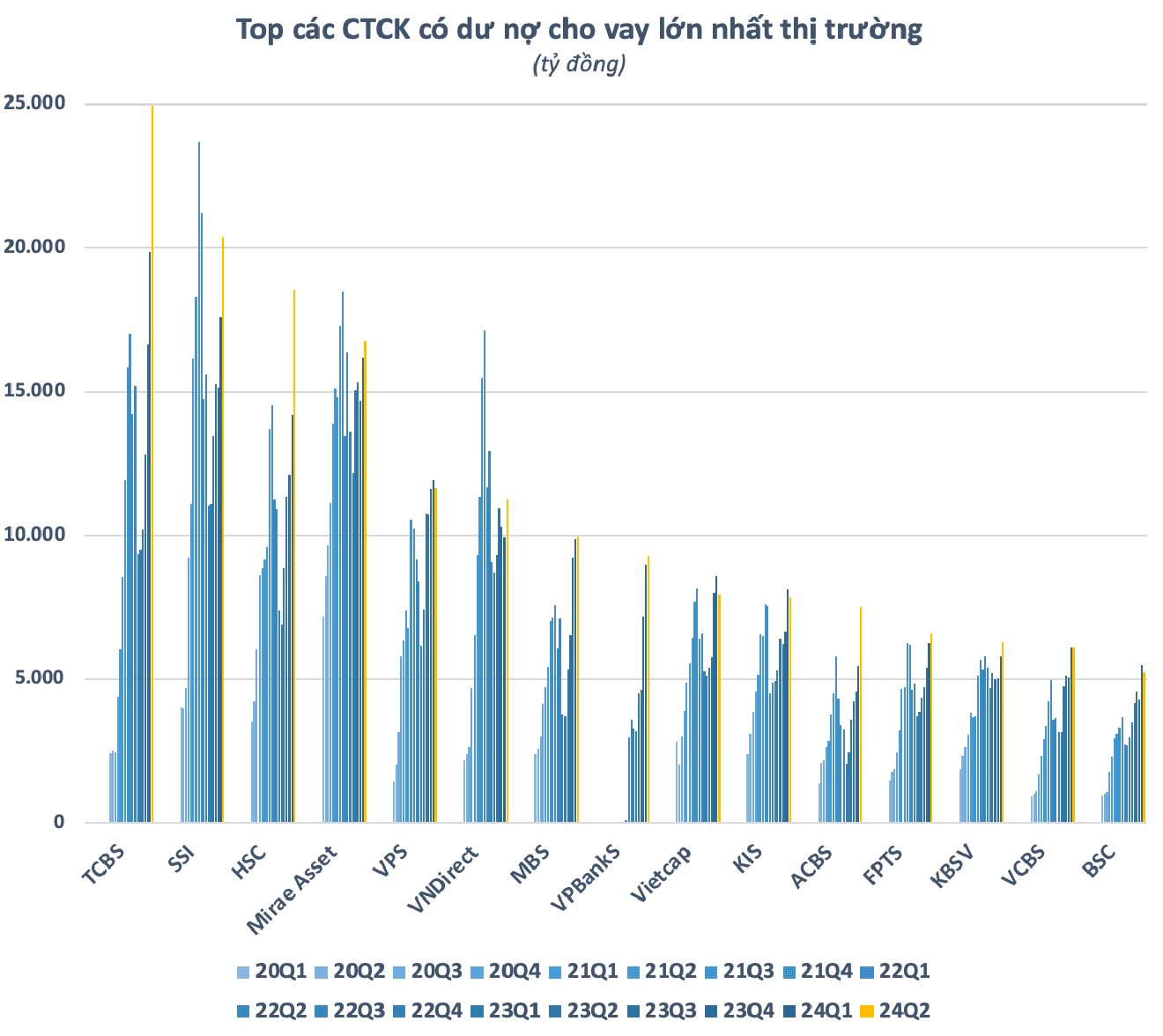

As of Q2 2024, TCBS boasted the largest owner’s equity in the market, surpassing VND 24,600 billion. Notably, the company’s total lending balance neared VND 25,000 billion (approximately USD 1 billion), with margin lending accounting for over VND 24,000 billion. This positions TCBS as the leading securities company in terms of lending and margin lending specifically.