Vietnam’s stock market experienced a volatile trading week from September 9-13, with the main index adjusting and retreating to just above the 1,250-point support level. The week ended with the VN Index down 22.25 points (-1.75%) compared to the previous week, closing at 1,251.71 points.

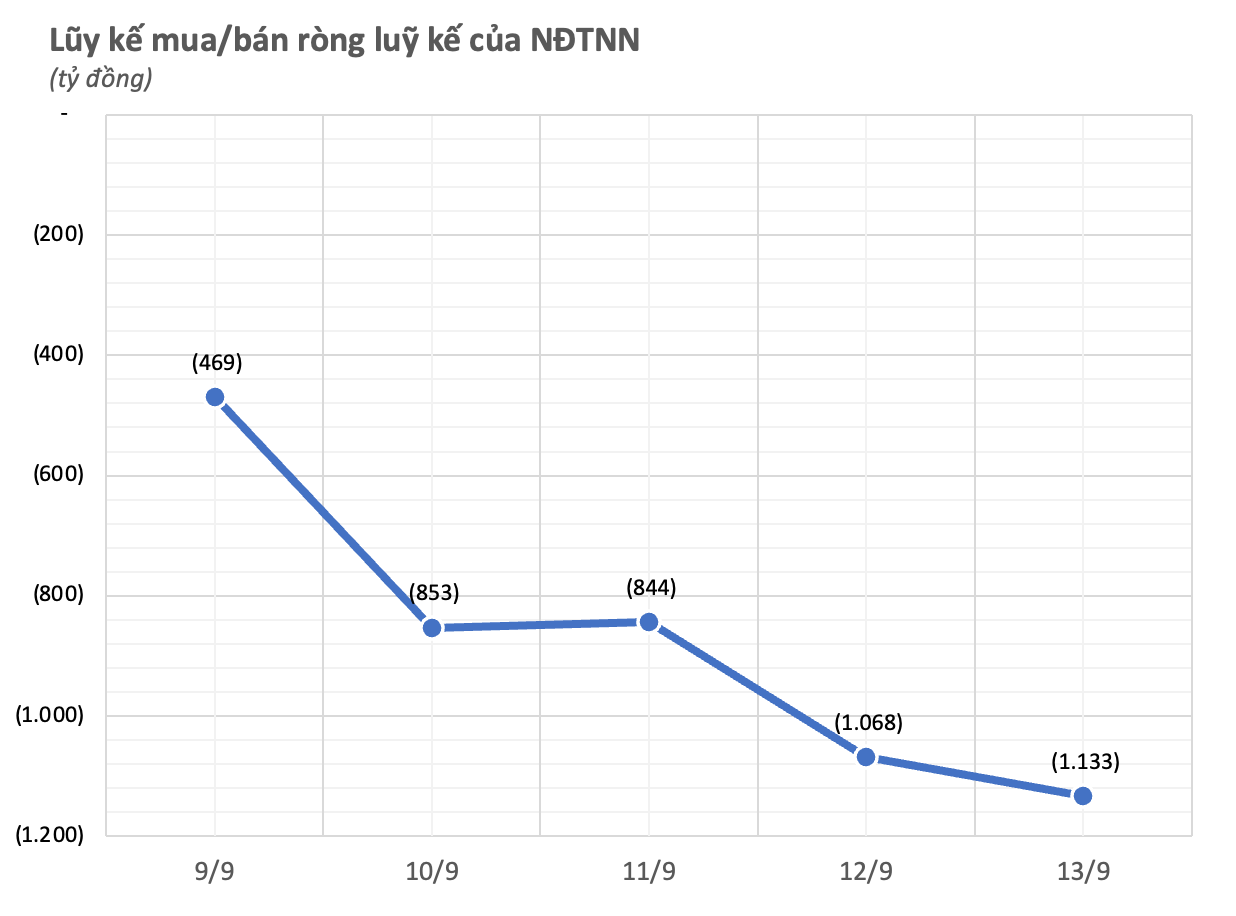

In terms of foreign investment, there was a net sell-off across the market. Cumulatively over the five trading sessions, foreign investors net sold VND 1,133 billion on the entire market, with net selling of VND 867 billion on the matching orders and an additional VND 266 billion on the negotiated trading sector.

Breaking down by exchange, foreign investors net sold VND 1,122 billion on HoSE, VND 17 billion on HNX, and net bought a modest VND 7 billion on UPCoM.

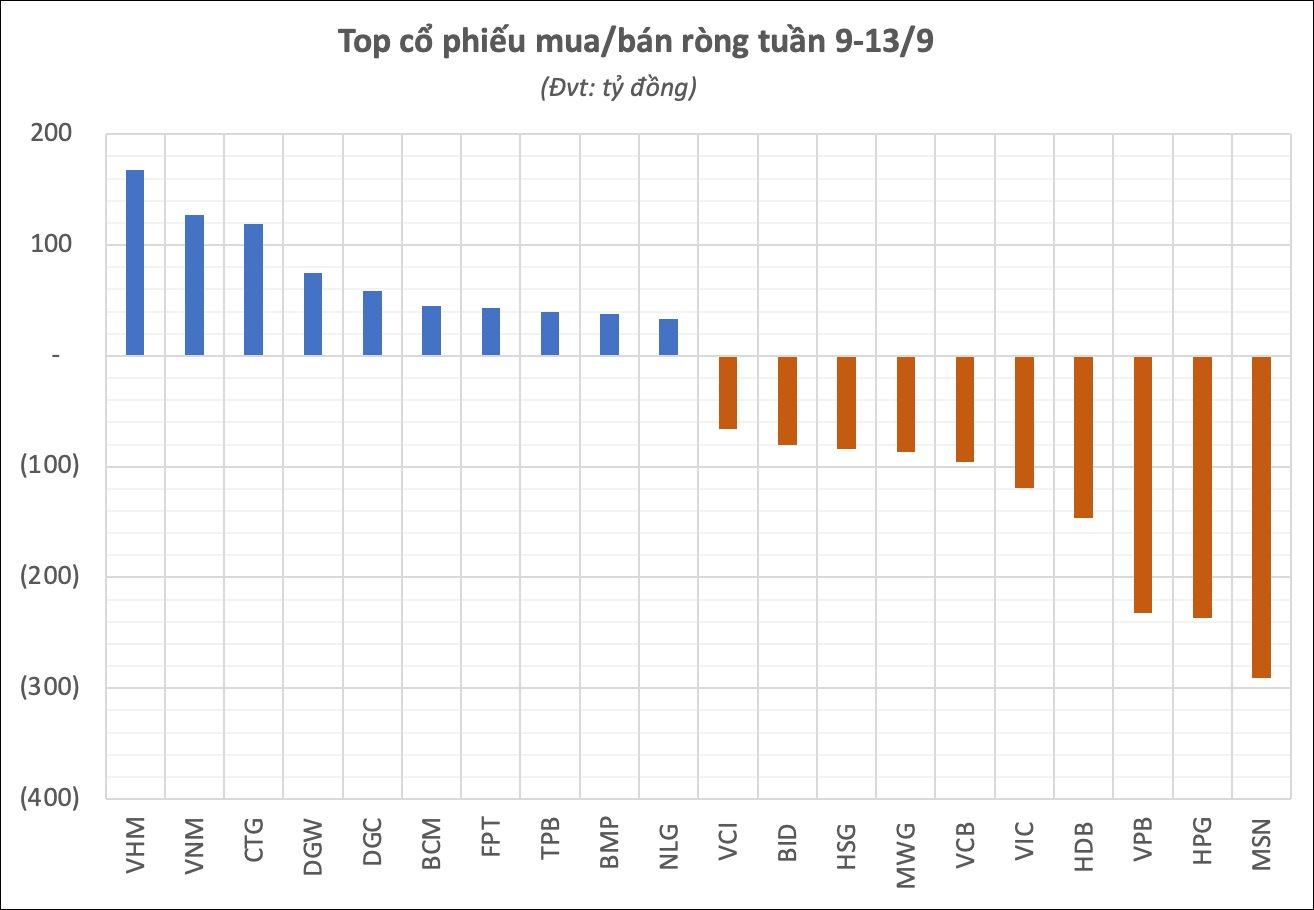

Analyzing by stock, foreign investors net sold the most in the retail sector, with MSN witnessing a net sell-off of VND 291 billion. HPG, a leading steel company, followed with net selling of nearly VND 237 billion over the five sessions and has consistently been among the top net-sold stocks by foreign investors.

Two bank stocks, VPB and HDB, were net sold VND 232 billion and VND 146 billion, respectively. VIC, a prominent holding company, was also net sold VND 119 billion. Other stocks that made it to the net sell-off list for foreign investors this week included VCB, MWG, HSG, BID, and others.

The Calming Forex Rates and “Breathable” Interest Rates

The U.S. dollar plummeted, prompting the State Bank to purchase this foreign currency to boost its reserves. This strategic move helped to temper the exchange rate and provided more room for interest rate stability on loans, offering a much-needed reprieve to borrowers.