In the international market, the DXY index fell by 0.08 points over the week, reaching 101.11 – the lowest level for the index in over a year.

USD prices continued to decline in the international market as expectations grew for the Fed to cut interest rates next week following US jobs data signaling an economic slowdown.

Specifically, the number of new unemployment benefit claims in the US reached 230,000, slightly higher than expected in the first week of September.

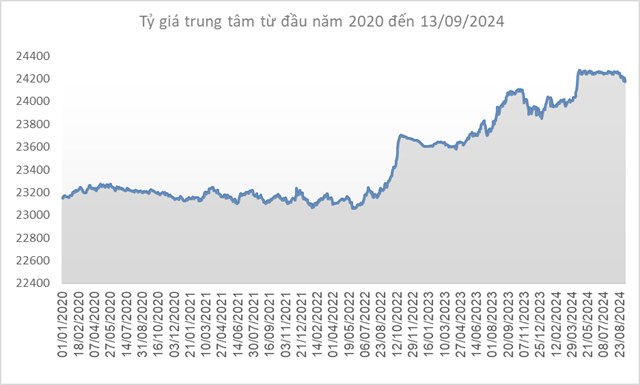

Source: SBV

|

Domestically, the Vietnamese dong-to-USD mid-point exchange rate decreased by VND 30 per USD compared to the previous week (session on 06/09), reaching VND 24,172 per USD in the session on 13/09/2024.

The State Bank of Vietnam (SBV) kept the immediate buying price unchanged at VND 23,400 per USD. Notably, after nearly five months of keeping the immediate selling price fixed at VND 25,450 per USD, the regulator switched to adjusting the immediate selling price according to the movement of the mid-point exchange rate from 30/08. On 13/09, the immediate selling price stood at VND 25,330 per USD, down VND 32 per USD from the previous week.

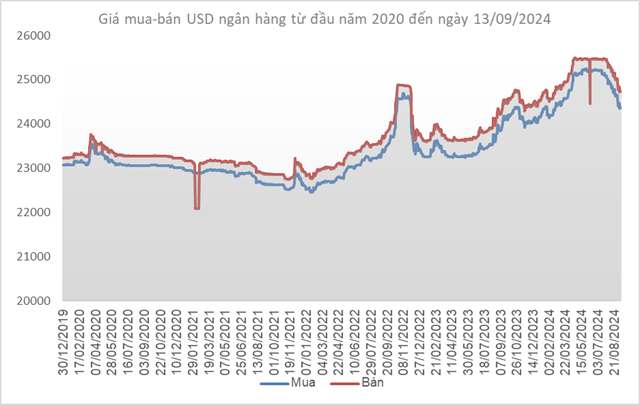

Source: VCB

|

Vietcombank’s posted exchange rate was VND 24,360-24,730 per USD (buy-sell), down VND 40 per USD on both sides. This was also the seventh consecutive week of declining USD bank rates, with a total decrease of VND 731 per USD on both sides.

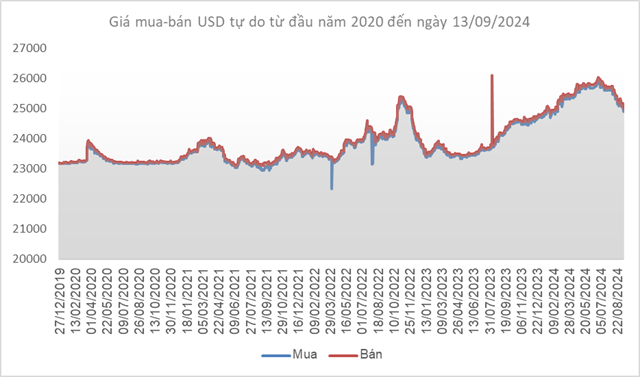

Source: VietstockFinance

|

Following the same trend, the USD/VND exchange rate in the free market decreased by VND 150 per USD on the buying side and VND 90 per USD on the selling side, reaching VND 24,900-25,000 per USD (buy-sell).

According to SSI’s expert assessment, the interbank USD/VND exchange rate, the exchange rates posted by commercial banks, and the free market rates have all decreased significantly, narrowing the increase compared to the end of 2023. With positive foreign currency supply (trade balance estimated at a surplus of $19 billion in the first eight months and FDI disbursement reaching $14 billion), it is possible that the SBV will increase the buying rate (as in the last months of 2022) to be able to add more foreign currency to its reserves.

In another development, the State Treasury (ST) has announced its foreign currency demand from commercial banks, with a maximum volume of 150 million USD in the last week of August. This is a common practice from the ST when there is a need for foreign currency, and as planned, the ST will have a $1 billion international government bond maturing in November.

The Calming Forex Rates and “Breathable” Interest Rates

The U.S. dollar plummeted, prompting the State Bank to purchase this foreign currency to boost its reserves. This strategic move helped to temper the exchange rate and provided more room for interest rate stability on loans, offering a much-needed reprieve to borrowers.