Gold prices have been on a remarkable upward trajectory in recent times, reaching new heights with each passing day. On September 13, the price of gold soared to a staggering $2,557 per ounce, only to surpass itself the very next day by climbing to $2,577 per ounce. This unprecedented rise has captivated the attention of investors and experts alike.

Mr. Nguyen Quang Huy, CEO of Finance and Banking at Nguyen Trai University, shared his insights on the global gold price movement. He attributes the surge to a combination of factors, including the inevitable interest rate cuts by the US Federal Reserve and the European Central Bank, the ongoing Russia-Ukraine conflict, and mounting tensions in the Middle East. These factors, he believes, will collectively fuel the momentum for gold prices to soar even higher in the remaining months of 2024.

Mr. Huy elaborates on the impact of interest rate cuts by central banks, explaining how they diminish the allure of income-generating assets like bonds and, in turn, heighten the appeal of non-profit assets such as gold. As interest rates dip, the opportunity cost of holding gold decreases, enticing investors back to this precious metal.

The US Federal Reserve’s primary objective is to stimulate economic growth and curb recessionary pressures, which is likely to result in a series of interest rate reductions extending until the year’s end. Similarly, the European Central Bank’s rate cut also influences gold prices, as lower interest rates in Europe heighten the appeal of safe-haven assets, especially amidst the region’s prevailing economic challenges.

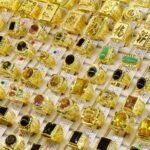

Gold prices in Vietnam are predicted to reach 90 million VND per tael. (Photo: Cong Hieu)

”

These factors could propel gold prices to astonishing heights, with projections reaching $2,800 per ounce by the end of 2024

,” Mr. Huy asserted.

Beyond interest rate cuts, the ongoing Russia-Ukraine war and escalating Middle East tensions have not only driven up oil and energy prices but have also intensified the demand for safe-haven assets like gold. In times of war-related uncertainties, gold has consistently been the investment of choice for those seeking to safeguard their wealth.

With the conflicts showing no signs of abating, it is highly likely that the market will continue to turn to gold to mitigate risks, further propelling gold prices skyward. Prolonged warfare, experts predict, could very well be the catalyst for gold to reach unprecedented price levels.

Mr. Heng Koon How, Head of Market Strategy at UOB’s Research and Investment Strategy Division, shares a similar sentiment. Since breaching the $2,000 per ounce mark in late 2023, gold has shown no signs of slowing down, and Mr. How predicts that this upward trend is here to stay. Geopolitical uncertainties, he explains, are driving investors to flock to gold as a safe haven for their investments.

The escalating tensions in Europe and the Middle East have created a perfect storm of uncertainty, prompting investors to seek refuge in gold. Adding to this is the depreciation of local currencies, which has led to a reported surge in retail investors snapping up physical gold products like bars and bullion as a hedge against the mounting instability.

Moreover, central banks in emerging markets and Asia have been ramping up their gold reserves, providing further impetus to gold prices. China, in particular, has drawn global attention with its substantial gold allocations.

According to the World Gold Council (WGC), as of May 2024, China’s official gold holdings stood at approximately 2,300 tons, accounting for nearly 5% of its total reserves. This marks a significant increase from the 1,900 tons reported just two years prior, in 2022.

UOB highlights that with the escalating risks of global trade conflicts and sanctions, central banks in emerging markets and Asia will be highly motivated to emulate their developed market counterparts and allocate a more considerable portion of their reserves to gold.

”

Driven by a multitude of demand-side factors, gold prices could reach $2,700 by mid-2025. While it may be premature to speculate, a further ascent to $3,000 in the long term is not out of the realm of possibility

,” UOB’s expert asserted.

The surge in global gold prices is expected to have a ripple effect on domestic gold prices in Vietnam. After a period of stability, experts predict that local gold prices could reach 90 million VND per tael if the upward trend in global gold prices persists.

”

Currently, global gold prices are in overbought territory, and from a technical analysis perspective, this level may trigger strong profit-taking. Therefore, investors need to exercise caution and arm themselves with knowledge and investment skills before venturing into this market.

Investors should allocate only a small portion of their portfolio to gold and focus on their core business operations and diversifying their investments

,” advised Mr. Nguyen Quang Huy.

The Cautious Analyst After Gold Surges to New Highs

The price of gold surged on Friday, breaking all previous records, as markets were buoyed by optimism that the Federal Reserve would cut interest rates. This move is expected to stimulate gold investments as the US dollar weakens.