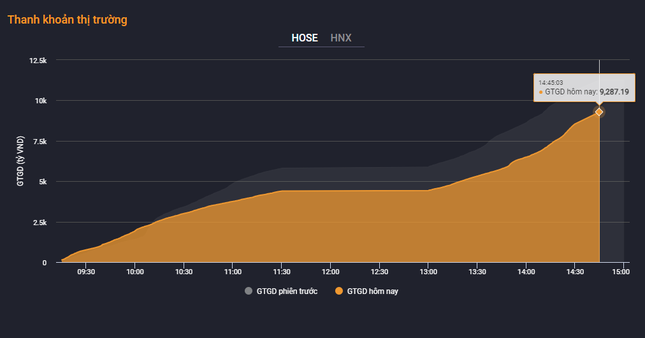

Trading sessions on the HoSE and HNX exchanges concluded with a muted tone, as the total trading value fell below the 10,000 billion VND mark. Market activities were lackluster, with both buyers and sellers adopting a passive stance. The VN-Index exhibited narrow fluctuations amid a sluggish market, and the upward momentum relied predominantly on several leading stocks, including VCB, FPT, and VPB. Notably, VCB contributed 1.5 points, leading the pack on the bourse.

Despite a resurgence of green on the screens, influential sectors such as banking, securities , and real estate failed to provide the necessary impetus to propel the market higher. The absence of robust trading volume impeded the market’s ascent.

Trading volume plunged, with the HoSE’s trading value barely surpassing 9,200 billion VND.

FPT, the stock with the highest trading value today, witnessed a modest turnover of 543 billion VND. TPB followed closely with a turnover of over 523 billion VND, while VPB trailed with a turnover of more than 418 billion VND. The subsequent stocks, including DCM, MWG, and VHM, exhibited a significant disparity in trading volumes.

Amid the subdued market backdrop, the most expensive stock on the exchange continued to attract attention. VNZ closed at the ceiling price, marking a notable turnaround. The Hanoi Stock Exchange (HNX) had previously requested an explanation from VNG regarding the appointment of Wong Kelly Hong and the subsequent disclosure of information. In their clarification, VNG asserted that Mr. Wong Kelly Hong is executing tasks assigned by Mr. Le Hong Minh to ensure the smooth operation of the company and safeguard the interests of VNG’s shareholders.

“VNG has not received any resignation letter from Mr. Le Hong Minh. Therefore, Mr. Le Hong Minh remains the CEO and legal representative of VNG, in accordance with the Enterprise Law and the company’s charter,” the company stated. VNG also affirmed that its production and management operations are proceeding as usual, and it has not received any official documents from state agencies on this matter.

Following VNG’s clarification, VNZ stock rebounded, surging back above the 400,000 VND per share mark. Consequently, its market capitalization climbed to 11,770 billion VND, recovering nearly 600 billion VND during today’s session.

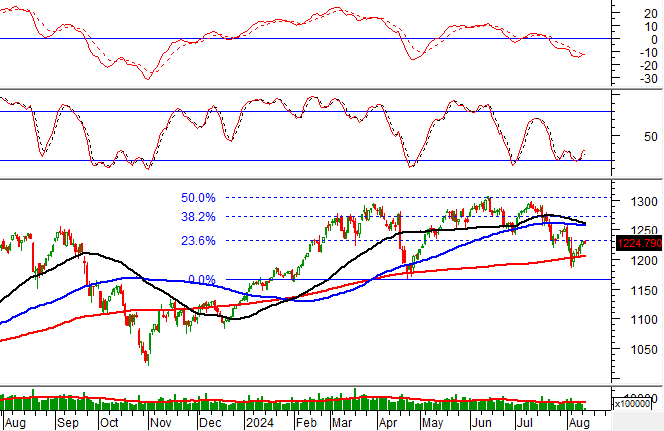

At the closing bell, the VN-Index climbed 3.08 points (0.25%) to reach 1,256.35, while the HNX-Index and UPCoM-Index posted modest gains. However, trading volume plummeted, with the HoSE’s trading value barely surpassing 9,200 billion VND. Foreign investors offloaded Vietnamese shares, resulting in a net sell-off of 224 billion VND, primarily in VPB, VCI, and HDB.

“A Brutal Sell-Off: Investors Abandon Chairman Le Thong Nhat’s NRC Stock”

“Shares of Danh Khoi (NRC), helmed by Chairman Le Thong Nhat, have been on a downward spiral, plummeting to historic lows as investors continue to offload their holdings. The stock’s free fall has sparked concerns among market participants, raising questions about the company’s future prospects and the impact on shareholder value.”

The Stock Market’s Money Flow: Why It’s Taking a Drastic Dip

“Institutional investors remain cautious, staying on the sidelines and causing a significant drop in market liquidity from September onwards. With a wait-and-see approach, these investors are biding their time, potentially waiting for economic headwinds to pass before re-entering the market with renewed vigor.”