Bond Market Downsizing Risks

The Ministry of Finance is developing a draft Law amending and supplementing a number of articles of the Securities Law, including adding provisions on private placement of corporate bonds.

Lawyer Tran Tuan Anh, Director of Minh Bach Law Company – Hanoi Bar Association, opined that stringent conditions for individual investors to participate in the private corporate bond market, while aimed at investor protection, could have adverse effects such as reducing liquidity and limiting investment opportunities for small investors.

”

This could decrease the bond market size, hinder capital mobilization by enterprises, especially when the economy needs recovery from the pandemic and natural disasters. Moreover, restraining the development of the bond market will make the financial market less diverse and competitive compared to other capital mobilization channels

“, said Mr. Tuan Anh.

Private corporate bonds are an important capital mobilization channel for enterprises, especially during the pandemic and natural disasters, when enterprises urgently need resources to restore production and business activities. However, the corporate bond market in Vietnam is too small and fails to promote medium and long-term capital formation for the economy.

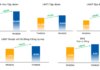

In the first eight months of 2024, the total issued corporate bonds approximated VND 215 trillion, equivalent to 30% compared to 2020 and 30% compared to 2021. The outstanding corporate bonds were about VND 1.1 quadrillion, equivalent to 10% of GDP in 2023, far below the Government’s target of 20% of GDP by 2025 and 25% by 2030.

The decline in the bond market scale, resulting in disrupted capital flow, is attributed to investor obstacles and difficulties in obtaining permission for public bond offerings in the past.

Illustration: Enterprise and Market Magazine.

Mr. Tuan Anh further analyzed that stringent regulations would restrict small investors’ access to attractive investment opportunities in the private corporate bond market, thereby reducing market flexibility.

”

In my opinion, to protect both investors and the market, alternative solutions can be applied, such as enhancing transparency and disclosure. When issuing bonds, enterprises should provide comprehensive information about their financial situation, risks, and prospects to enable investors to make informed decisions based on full and accurate information.

Requiring independent credit ratings can also be a method to mitigate risks for investors. Issued bonds could be subject to evaluation by independent credit rating agencies, aiding investors in accurately assessing the risks associated with these bonds.

The most significant shortcoming of individual investors is their lack of analytical skills to assess bond risks, yet they still participate in purchasing. Therefore, providing educational programs and support to investors from the government and financial institutions, such as financial education initiatives, will enhance small investors’ understanding of the risks and opportunities in the corporate bond market

“, he suggested.

According to Mr. Tuan Anh, these measures can help balance investor protection and encourage broader participation in the bond market.

Sharing the same view, Lawyer Truong Thanh Duc – Director of ANVI Law Firm, expressed concern that tightening regulations on individual investors might shrink the corporate bond market. This would reduce capital mobilization opportunities for enterprises.

The lawyer emphasized that, in the context of Vietnam’s nascent corporate bond market, it is essential to relax conditions to encourage investor participation. Instead of imposing more regulations, we should focus on raising investor awareness and strengthening supervision to prevent legal violations.

Controversial Provisions Need Reconsideration

Lawyers suggested that lawmakers carefully consider and study the draft law, which has sparked diverse opinions.

Lawyer Truong Thanh Duc cited the requirement for public bond issuers to have collateral or bank guarantees as unreasonable. This regulation aims to mitigate risks for investors, especially in a volatile financial market, but its rigid application could cause difficulties, particularly for small and medium-sized enterprises.

Not all enterprises possess sufficient collateral to meet the bond issuance requirements. Furthermore, banks may be reluctant to provide guarantees for small-scale enterprises or those lacking a strong financial position. Consequently, many enterprises are unable to access capital through the bond channel, reducing the diversity of capital mobilization methods and negatively impacting their development.

Mr. Tuan Anh argued that not all corporate bonds carry the same level of risk, and applying a uniform regulation to all types of bonds might be unreasonable. Well-established enterprises with stable financial conditions and a good track record of bond issuance should not be compelled to provide collateral or bank guarantees.

”

The application of this regulation should be adjusted based on the characteristics of each type of bond and the status of the enterprise. For instance, large corporations capable of self-guaranteeing their payment ability may be exempted from this requirement

“, he said.

Another regulation concerning investment limits for funds and institutional investors in corporate bonds could negatively impact the market’s scale and liquidity, especially considering that these institutions are typically large-scale investors with substantial resources.

Lawyer Truong Duc emphasized: “In the current context of Vietnam’s small corporate bond market, we should reduce conditions to encourage investor participation.

If we cannot consider reducing the conditions, we should at least maintain the current regulations. While there is a possibility of violations, they remain a minority, and we should not restrict the market’s development because of this

“, stated Mr. Duc.

The Alluring August Affair: 43 Enterprises Embark on a Bond Odyssey, Raising a Whopping 38 Trillion VND

“The Vietnam Bond Market Association (VBMA) reported 43 private corporate bond issuances valued at VND 37,995 billion and 2 public issuances worth VND 11,000 billion in August 2024, based on data aggregated from HNX and SSC as of August 30, 2024.”