Illustrative image

HSBC Vietnam Joint Stock Commercial Bank (HSBC) has released its condensed financial statements for the first half of 2024, revealing notable changes in its financial position.

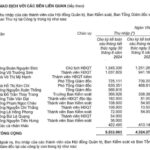

As of June 30, 2024, HSBC’s total assets had decreased by over VND 35,144 billion compared to the end of 2023, a reduction of 21.4%, settling at VND 128,956 billion. The most significant decline was observed in the bank’s inter-institutional deposits and loans, which contracted by 44% (amounting to VND 32,842 billion). This follows a similar trend in 2023, where total assets dropped from VND 198,614 billion to VND 164,100 billion.

Conversely, customer loan balances exhibited a positive trend, increasing by 4.7% from VND 66,513 billion in 2023 to VND 69,667 billion in the first half of 2024. However, non-performing loans as of June 2024 stood at VND 597 billion, representing a concerning surge of nearly 55% compared to the beginning of the year. These non-performing loans now constitute 0.54% of the total loan portfolio.

On the funding side, customer deposits witnessed a substantial decrease of VND 34,173 billion compared to the previous year, translating to a reduction of over 25%. By June 30, 2024, customer deposits rested at VND 101,704 billion. This continues the trend from 2023, where customer deposits at the bank decreased by more than VND 39,600 billion, or nearly 22.6%.

HSBC has not disclosed the reasons behind this significant decline in customer deposits.

Turning to the bank’s financial performance, HSBC Vietnam recorded a pre-tax profit of nearly VND 2,237 billion in the first six months of 2024, reflecting a 32.5% decrease compared to the same period last year.

This downturn in profitability is attributed to a combination of factors, including a decline in operating income, coupled with increases in both operating expenses and provisioning costs.

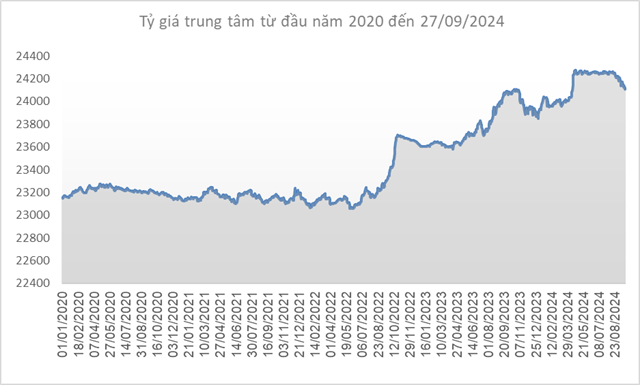

Specifically, net interest income, HSBC’s primary source of revenue, plummeted by 20.5% year-on-year due to the rapid contraction in inter-institutional deposits and loans. Conversely, net service income displayed an encouraging increase of 11%, generating VND 480.4 billion. Net foreign exchange income and net securities trading income, however, dipped by 8% and 65%, respectively, resulting in VND 343.9 billion and VND 4.9 billion. Net income from other activities rose by 36% to reach VND 126.7 billion.

Aggregating the performance across business segments, HSBC’s total operating income for the first half of 2024 decreased by 15.9% year-on-year to VND 4,134 billion. Meanwhile, operating expenses climbed by 10.7% to VND 1,659 billion, and provisioning costs surged by 139% to VND 238 billion.

“Rumors of PGBank Phu Thuy’s Leadership Going Bankrupt and Being Arrested Are False, Police Are Investigating to Take Action Against Those Spreading Misinformation”

The Hanoi Police have confirmed that rumors of the leader of the PGBank Phu Thuy branch in Gia Lam district being arrested for bankruptcy are false. Prior to this, unfounded rumors had spread in Duong Xa and Duong Quang communes of Gia Lam district regarding the alleged bankruptcy and arrest of the branch leader.