With the number of shares offered equal to the number of shares currently outstanding, the subscription ratio for HTN shareholders is 1:1 (for every share held, a shareholder is entitled to purchase 1 newly issued share). After the issuance, shareholders are free to transfer the additional offered shares.

The expected timeline for the offering is the fourth quarter of 2024 and/or the first quarter of 2025, immediately after obtaining the certificate of registration for public offering of shares from the State Securities Commission.

In the event of a 100% successful offering, HTN can raise a maximum of nearly VND 891.2 billion. The company stated that it will prioritize the use of capital in the following order:

Priority 1 is to repay HTN’s loans to banks and credit institutions, with an expected VND 360 billion to be paid to the Bank for Investment and Development of Vietnam – North Saigon Branch (BIDV) and nearly VND 74.4 billion to be paid to the Vietnam Maritime Bank – Ho Chi Minh City Branch (MSB).

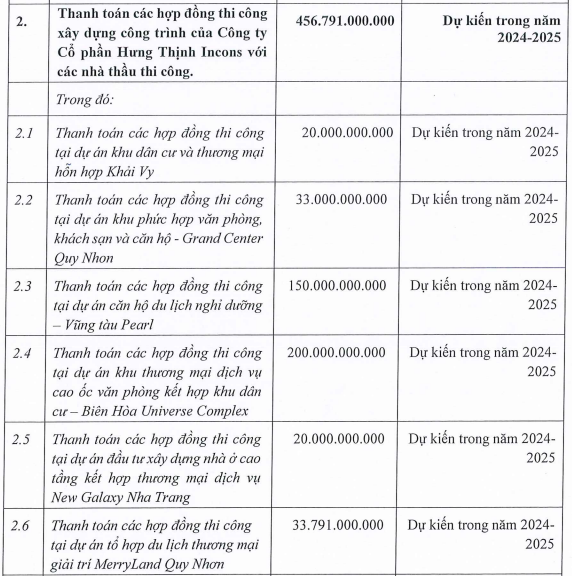

Priority 2 is to pay the construction contractors a total amount of nearly VND 456.8 billion.

|

Construction contracts requiring capital from the share offering

Source: HTN

|

In the event that the proceeds are insufficient to cover all intended uses of capital, HTN will implement several handling options, including: selling to other investors at a price not lower than the offering price to existing shareholders; considering the selection and adjustment of capital usage plans; and contemplating short-term borrowing from banks.

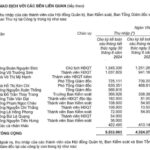

In terms of financial results, HTN recorded VND 900.5 billion in net revenue and over VND 13 billion in net profit in the first half of 2024, representing decreases of 55% and 49%, respectively, compared to the same period last year. This decline is attributed to the company’s construction output, which reached only VND 890 billion, a decrease of over 55%.

As of June 30, 2024, HTN’s total debt stood at nearly VND 2,100 billion, remaining relatively unchanged from the beginning of the year. Of this, the outstanding balances at the two banks mentioned in the capital usage plan were over VND 561 billion at BIDV North Saigon Branch (including nearly VND 557 billion in short-term debt and almost VND 4 billion in long-term debt) and over VND 387 billion in short-term debt at MSB Ho Chi Minh City Branch.

Notably, the auditor of HTN’s reviewed financial statements for the first half of 2024 expressed doubt about the company’s ability to continue as a going concern. Accordingly, HTN’s ability to operate will depend on its capacity to arrange capital.

Ha Le