As of the end of 2023, there were approximately 7,000 locals from Tay Ninh province living abroad, mainly in the US, Australia, China, Canada, and South Korea.

Annually, more than 3,000 overseas Vietnamese from Tay Ninh return to their homeland for visits, investments, business opportunities, and social welfare activities.

Tay Ninh has 7,000 overseas Vietnamese residents.

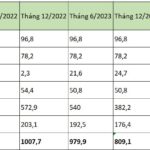

The remittance sent by overseas Vietnamese to Tay Ninh province in 2023 amounted to USD 2.613 billion; for the first six months of 2024, it reached USD 2.571 billion, according to Vietnam News Agency.

In comparison, the remittance to Ho Chi Minh City for the first six months of 2024 reached USD 5.178 billion, accounting for 54.7% of the total remittance in 2023 and a 19.5% increase compared to the same period last year.

Thus, the remittance sent to Tay Ninh is nearly half of that sent to Ho Chi Minh City in the first half of 2024.

Tay Ninh is a border province in the Southeast region, bordering the Kingdom of Cambodia and Ho Chi Minh City.

25% of Remittance Flows into Real Estate

According to the Ministry of Labour, Invalids, and Social Affairs, there are approximately 6 million Vietnamese living and working in over 130 countries and territories, and about 650,000 Vietnamese guest workers in 40 countries and territories.

Remittances to Vietnam have consistently ranked among the top 10 countries globally in the last decade, totaling over USD 190 billion. In 2023, remittances to Vietnam were estimated at approximately USD 16 billion, a 32% increase compared to 2022.

Notably, it is estimated that 25% of annual remittances are invested in the real estate market.

According to the State Bank of Vietnam, remittances continued to increase significantly in the first six months of 2024 due to government policies encouraging and facilitating overseas Vietnamese to invest in their homeland through Vietnamese representative agencies abroad.

Remittances contribute to economic growth, including the real estate sector.

Along with FDI, remittances have contributed to increasing foreign currency inflows, meeting domestic demand, supplementing foreign exchange reserves, and boosting economic growth, including the real estate sector, which is in dire need of capital.

According to real estate experts, in the long run, remittances will be a strong source of demand, driving the market towards central apartment segments that can be operated for rent or luxury villas in large cities and real estate for tourism and recreation that suits overseas Vietnamese’s purchasing power.

Currently, in Hanoi and Ho Chi Minh City, mid-range and high-end residential real estate in central areas attracts investment from overseas Vietnamese.

According to Savills Vietnam, while Vietnamese law has provisions allowing overseas Vietnamese to buy houses in Vietnam, complicated procedures have discouraged many investors or led them to ask their relatives to hold the property on their behalf.

The 2024 Land Law, which took effect on August 1, 2024, five months earlier than expected, has amended and supplemented several new provisions, notably expanding land use rights for overseas Vietnamese.

Specifically, Clause 3 and Clause 6, Article 4, on “Land Users,” stipulate that land users who are entitled to be allocated land, leased land, or recognized land use rights and own assets attached to the land include: individuals in the country, Vietnamese citizens living abroad, and overseas Vietnamese of Vietnamese origin…

Dr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, stated that the new legal framework provides clearer, more flexible, and open regulations, facilitating overseas Vietnamese to invest in and own property in Vietnam, thereby attracting more remittances into the real estate market.

To attract this resource, government agencies should not only promote the implementation of the Land Law but also invest in improving transportation, telecommunications, and other public services to enhance the competitiveness of the real estate market. Additionally, tax reductions or exemptions should be considered for overseas Vietnamese investing in real estate.

“Novagroup Finalizes Sale of Over 3 Million Shares; Major Shareholder Group Linked to Mr. Bui Thanh Nhon Now Holds Less Than 39% Stake in Novaland”

Since the beginning of the year, NovaGroup has sold over 36 million Novaland shares, including shares liquidated by the securities company.

The Sparkling 30-Year Journey of DOJI

With a superior gene, DOJI has consistently demonstrated its prowess across diverse industries, be it jewelry and precious metals, finance and banking, or real estate. The key to their success lies in their long-term vision and pioneering steps, always executed with a unique blend of scientific methods, creativity, and artistic flair. Their achievements speak for themselves, leaving an indelible mark of excellence.

The Ultimate Guide to Captivating Copy: “3 Businesses with Substantial Assets Have Their Debts Up for Grabs by Banks”

Three businesses’ debts are up for sale by the bank, with an attractive package of collateral. This includes land rights to over 30 plots and 2.6 million shares in a publicly traded company on the HNX. A unique opportunity for investors to acquire these valuable assets and secure a strong financial future.

The Southern Land is “Static” Awaiting Tax Files

As of August 1st, 2024, land transaction and transfer profiles in Ho Chi Minh City remain in limbo, awaiting the issuance of a new circular outlining land price guidelines. The delay has caused a standstill in the tax calculation process, leaving many transactions unresolved.