The latest Corporate Bond Market Review report published by VIS Rating revealed a slight decrease in the cumulative bond delinquency rate at the end of August 2024 to 14.9%, down from 15.1% in the previous month. This downward trend has been consistent since the first quarter of 2024.

In August 2024, only one corporate bond with a total face value of VND 450 billion was reported to have delayed its interest payment for the first time. This bond was issued by Novaland Group in August 2020 with a three-year term, and its maturity was pushed back by one year to July 2023. However, in July 2024, the bond’s maturity was extended once more to August 2025.

Overall, the total value of newly delinquent bonds from the beginning of the year to the end of August 2024 amounted to VND 12.7 trillion.

Notably, there have been improvements in addressing delinquent corporate bonds. In August 2024, 13 delinquent issuers from the residential real estate, retail, and agriculture sectors repaid a total of VND 2.4 trillion in principal to bondholders. After this partial repayment, the remaining delinquent bond balance of this group of issuers stood at VND 8.5 trillion.

A significant portion of the corporate bond principal payments made in August 2024 was related to the Agricultural and Commodity Import-Export Joint Stock Company (CAJIMEX). CAJIMEX had issued bonds in 2020, maturing in December 2026, but subsequently delayed interest payments in 2023. By August 2024, CAJIMEX had completed the buyback of all bonds as agreed with bondholders.

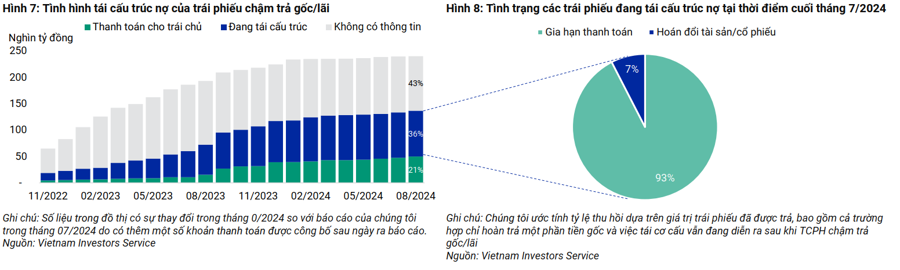

Out of the 567 delinquent bonds that emerged since 2022, 63 bonds have fully repaid their overdue principal and interest to bondholders, and 294 bonds are in the process of restructuring. The recovery rate for delinquent bonds improved to 20.8% by the end of August 2024.

Regarding high-risk corporate bonds approaching maturity, VIS Rating expects that in September 2024, the total value of maturing bonds will reach VND 24.5 trillion, an increase from the previous month’s figure of VND 18.1 trillion.

“We anticipate that out of the bonds maturing in September 2024, VND 1.8 trillion is at risk of principal payment delay, with most of these bonds having previously delayed interest payments. Over the next 12 months, we estimate that approximately 18% of the VND 245 trillion in maturing bonds are at risk of principal payment delays. Of this high-risk bond value, 76% belongs to companies in the Real Estate, Housing, and Construction sectors,” VIS Rating stated.

Additionally, in August 2024, new bond issuances increased to VND 57.7 trillion, up from VND 46.8 trillion in July 2024. Commercial banks accounted for a significant portion of these new issuances, totaling VND 51.3 trillion.

Among the bonds issued by banks in August 2024, 40% were qualified Tier 2 capital bonds with an average term of 8.1 years and interest rates ranging from 5.5% to 7.6% in the first year. The remaining bonds were unsecured bonds with a three-year term and fixed interest rates ranging from 5.2% to 7.7%.

“FiinGroup: Leading the Pack in Bond Issuance with Over VND 136,000 Billion Raised So Far This Year”

The FiinGroup predicts that bank bonds will remain the dominant force in the market in the coming months, with an estimated issuance value of 70% for the second half of 2024.