Techcombank’s Latest Savings Rates for September

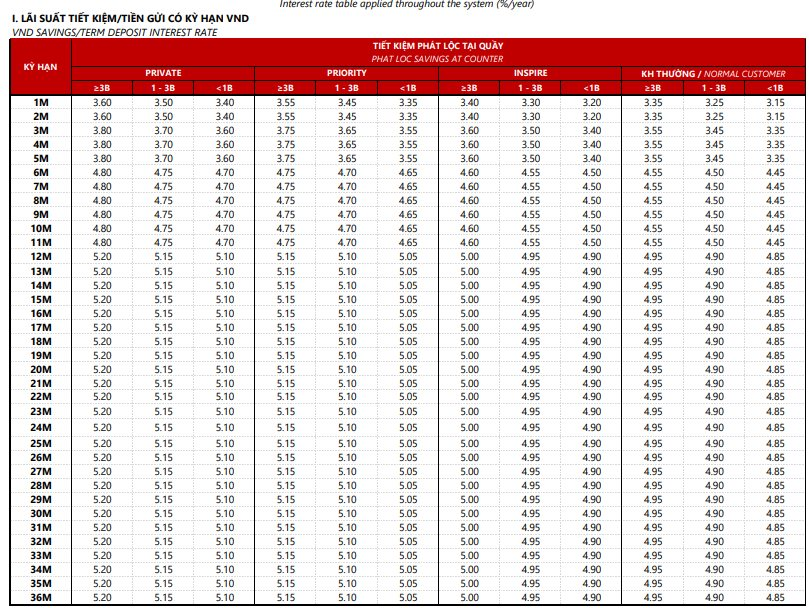

Techcombank’s latest savings rates took effect on September 12, with the bank increasing rates by 0.2-0.3% p.a. for select tenors.

Specifically, according to the Phat Loc counter savings rate table, the interest rate for 1-2 month tenors increased by 0.2% p.a., reaching 3.6% p.a.

The interest rate for 3-5 month tenors increased by 0.2% p.a., reaching 3.8% p.a.

Savings rates for 6-11 month tenors increased by 0.3% p.a. to 4.8% p.a.

The interest rate for tenors of 12 months or more remains unchanged at 5.2% p.a.

Techcombank’s Latest Savings Rates.

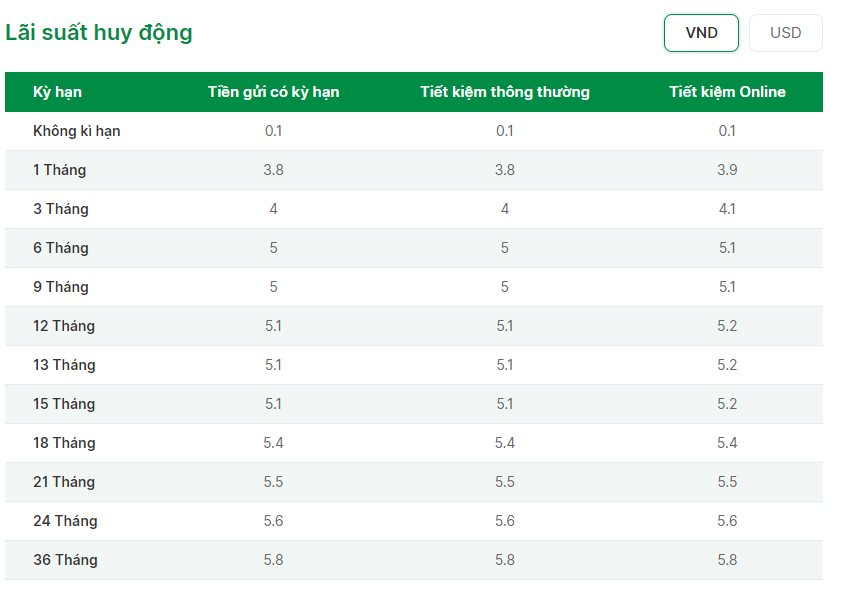

OCB’s Latest Savings Rates for September

OCB recently increased its savings rates effective September 11. Specifically, OCB raised rates by 0.2% p.a. for tenors of 1-8 months and by 0.1% p.a. for tenors of 9-11 months. Rates for tenors of 12-36 months remain unchanged.

According to the online savings rate table, the savings rate for a 1-month tenor is 3.9% p.a., 2-month tenor is 4% p.a., and 3-4 month tenors is 4.1% p.a.

The savings rate for a 5-month tenor is 4.5% p.a., and for 6-8 month tenors, it is 5.1% p.a.

The savings rate for 9-11 month tenors is now listed at 5.1% p.a.

Savings rates for 12-15 month tenors remain at 5.2% p.a., 18-month tenor is 5.4% p.a., 21-month tenor is 5.5% p.a., 24-month tenor is 5.6% p.a., and 36-month tenor is 5.8% p.a.

OCB’s Latest Savings Rates.