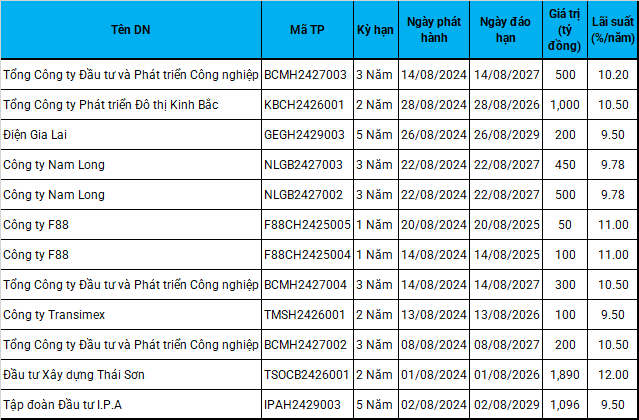

August 2024 saw a significant number of businesses issuing bonds to restructure their existing debts. Kinh Bac City Development Holding Corporation JSC (HOSE: KBC), having cleared its bond debt from the previous year, returned to the market with a VND 1,000 billion issuance, due in 2 years, with an interest rate of 10.5%/year. The bonds are asset-backed and are not subordinate to the issuer’s debt. The proceeds are intended to restructure KBC’s debts towards two of its subsidiaries: Saigon – Bac Giang Industrial Park (KBC owns 88.6%) and Hung Yen Investment and Development Group (KBC owns 93.93%). Repayment is expected in Q3-Q4/2024.

Similarly, Nam Long Investment Corporation (HOSE: NLG) continued to raise VND 950 billion through two bond issuances, with a 36-month term, maturing in 2027, and an interest rate of 9.78%/year. NLG will use the proceeds to repay the principal of the matured bonds NLGB2124001 and NLGB2124002. In June 2024, NLG also successfully raised VND 550 billion, bringing the total bond issuance for the year to VND 1,500 billion.

On August 2, I.P.A Investment Group Joint Stock Company (HNX: IPA) successfully issued VND 1,100 billion worth of “three-no” bonds, with a 5-year term and an interest rate of 9.5%/year, to restructure the debts of three bond issuances: IPAH2124002, IPAH2124003, and IPAH2225001.

Electricity of Gia Lai Joint Stock Company (HOSE: GEG) issued a new bond worth VND 200 billion, with a 5-year term and an interest rate of 9.5%/year, to restructure a portion of the GEGB2124002 bond issuance, which was issued on October 21, 2021, and matures in October 2024. The restructuring is expected to take place between August and October 2024.

The largest fundraiser in August was Thai Son Construction and Investment Joint Stock Company, a subsidiary of Vinhomes Joint Stock Company (HOSE: VHM), with nearly VND 1,900 billion in bond issuance. The bonds are secured by assets under custody at Techcom Securities (TCBS). Thai Son offers a fixed interest rate of 12%/year throughout the 2-year term.

At the beginning of August, Thai Son was selected by the People’s Committee of Bac Giang province as the investor for the Nham Bien mountain golf course urban area project in Dong Son commune (Bac Giang city) and Tien Phong commune (Yen Dung district). The total investment for this project is nearly VND 6,400 billion.

Becamex Industrial Investment and Development Corporation (HOSE: BCM) offered an additional VND 1,000 billion worth of bonds in August, with interest rates ranging from 10.2% to 10.5%/year, bringing its total bond debt for the year to VND 1,800 billion. The collateral for these bonds is the right to use urban land in two plots (K10 and K4) in Hoa Phu ward, Thu Dau Mot city, Binh Duong province, with respective areas of 2.4ha and 1.15ha. This major industrial park in Binh Duong still has outstanding bonds of about VND 13,200 billion.

F88 Business, the only consumer finance company in this issuance round, issued an additional VND 150 billion worth of bonds, bringing its total bond issuance for the first eight months to VND 350 billion. Similar to previous issuances, these new bonds also have a term of 12 months and are of the “three-no” type, but with a lower interest rate of 11%/year compared to 11.5%/year in April.

|

Corporate Bond Issuances in August 2024

Source: Author’s Compilation

|

VPB and LPB Return, MBB and BID Issue Bonds Exceeding VND 21,000 Billion

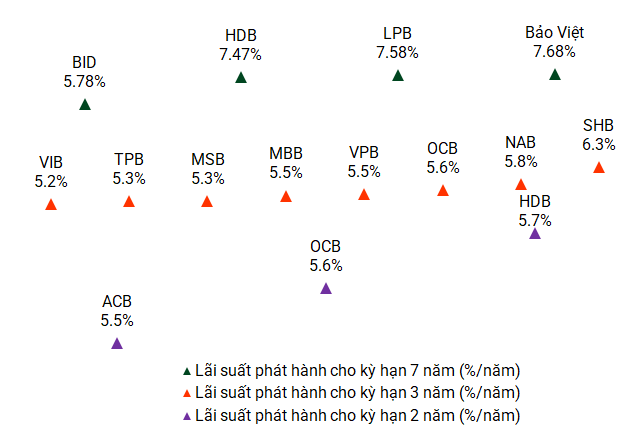

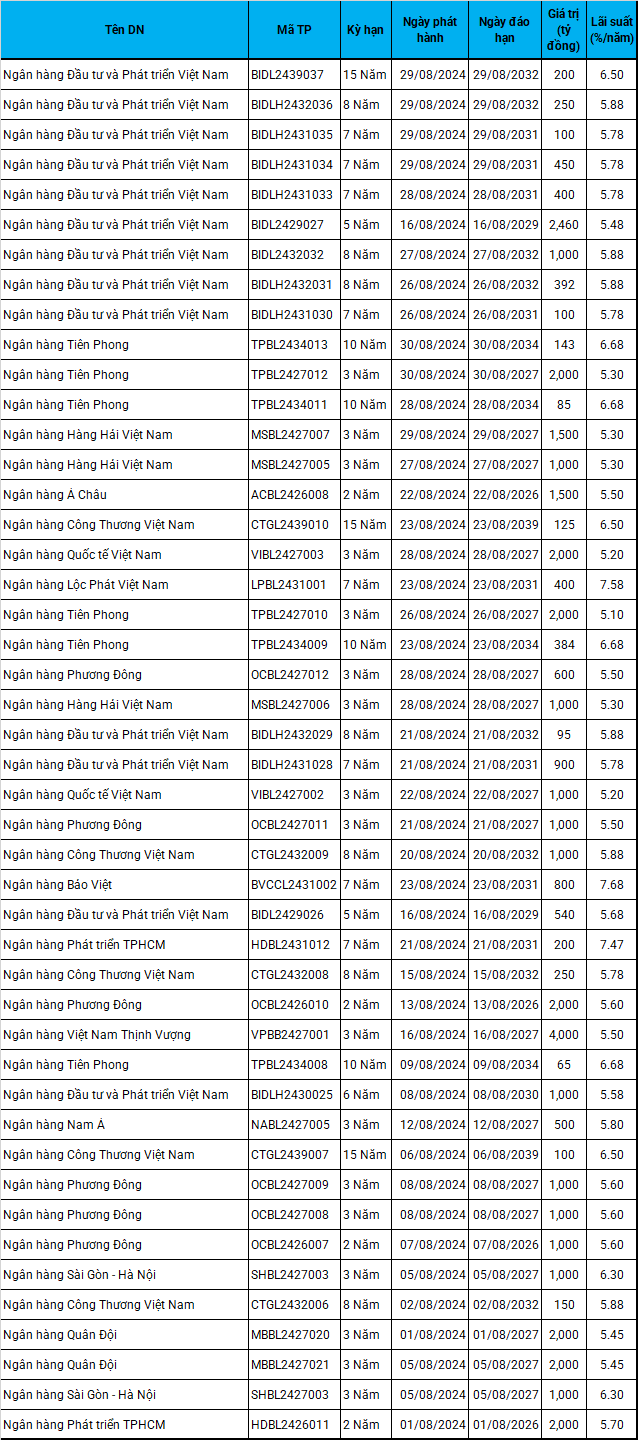

After a 2-year hiatus, Vietnam Prosperity Joint Stock Commercial Bank (HOSE: VPB) returned to the market with a “three-no” bond issuance worth VND 4,000 billion in face value, with a 3-year term, maturing in August 2027, and an interest rate of 5.5%/year, higher than the average of 3.2%/year in 2021 for the same tenor. According to statistics from the Hanoi Stock Exchange (HNX), VPB issued VND 27,000 billion worth of bonds in 2021, VND 2,200 billion in 2022, but there was no issuance recorded in 2023. The bank currently has three outstanding bond issuances, totaling VND 5,500 billion (including the recently issued batch).

VPB’s shareholders also approved a plan to borrow VND 400 million in sustainable international bonds over 5 years, of the “three-no” type. The issuance is expected to take place in 2024 or Q1/2025. The proceeds will be used to provide credit for projects and plans that meet the green and social eligibility criteria set by VPB.

Loc Phat Bank (HOSE: LPB) issued its first batch of bonds this year, and also its first since changing its name. The bond issuance is worth VND 400 billion, with a 7-year term and an interest rate of 7.58%/year. This amount is modest compared to the nearly VND 16,000 billion worth of bonds issued in 2023 and 2021. Currently, LPB has 12 outstanding bond issuances, totaling approximately VND 21,000 billion. The previous tenor ranged from 2 to 3 years.

Maritime Bank (HOSE: MSB) borrowed VND 3,500 billion in bonds from bondholders, with a 3-year term, but at a higher interest rate of 5.3%/year compared to 3.9%/year for the issuances in April and May. In the first eight months of 2024, MSB raised VND 9,300 billion, doubling the amount raised in the previous years.

Military Bank (HOSE: MBB) became the “champion” in bond issuance after raising an additional VND 4,000 billion in August, bringing its total bond issuance for the year to VND 22,500 billion, 6.5 times higher than the figure for the whole of 2023, and the highest in the past 4 years.

Meanwhile, BIDV (HOSE: BID) raised nearly VND 7,900 billion, with interest rates ranging from 5.48%/year (for a 5-year term) to 6.5%/year (for a 15-year term). Thus, BIDV has borrowed nearly VND 22,000 billion in bonds in the first eight months, close to the peak of VND 25,400 billion in 2022.

|

Issuance Interest Rates for Some Common Tenors of Banks

Source: Author’s Compilation

|

|

Bond Issuances by Banks in August 2024

Source: Author’s Compilation

|

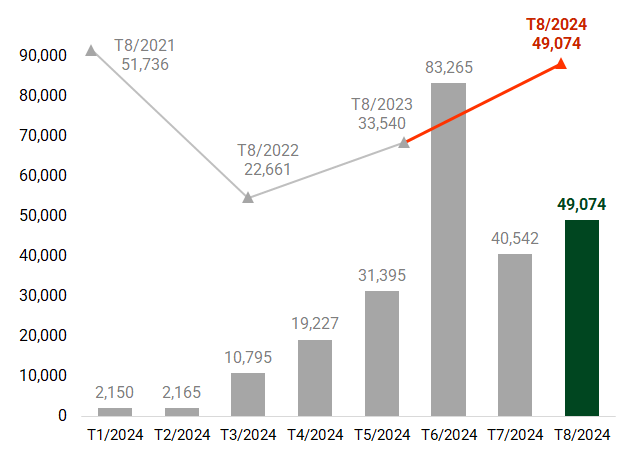

Maintaining Growth Month after Month

In August 2024, there were 58 bond issuances, totaling approximately VND 49,000 billion, an increase of 21% compared to July and 46% compared to the same period last year. August of this year had the highest issuance value in the same period over the past 3 years, second only to August 2021, which recorded VND 51,700 billion.

Commercial banks raised approximately VND 42,600 billion, accounting for 87% of the total issuance value.

According to statistics from the Hanoi Stock Exchange (HNX), in the first eight months of 2024, there were 240 registered private bond issuances, with a total value of nearly VND 236,000 billion. Of these, 233 issuances were successful, raising nearly VND 219,000 billion. Credit institutions continued to be the group with the largest issuance and purchasing volume.

In the secondary market, 67 bond codes were registered for trading in August, with a total value of VND 66,000 billion. The total trading value of the whole market reached more than VND 72,000 billion. The average trading value per session was about VND 3,300 billion, mainly contributed by credit institutions and real estate businesses.

|

Development of Corporate Bond Issuances from the Beginning of 2024 and the Same Period in Previous Years (Unit: Billion VND)

Source: Author’s Compilation

|

Tu Kinh

“The Devastating Impact of Storm Yagi: A $40 Billion Blow”

The Ministry of Planning and Investment estimates that Typhoon Yagi caused 40 trillion VND ($1.7 billion) in damages to northern provinces, resulting in a 0.15% decrease in this year’s GDP compared to previous forecasts.