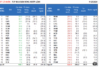

Last week, the VN-Index dropped 22.25 points to 1,251.71. Similarly, the HNX-Index fell 2.23 points to 232.42.

According to statistics from the HoSE, foreign investors net sold 53.75 million units, with a net selling value of over 1,165 billion VND. On the HNX, foreign investors net sold 4.02 million units, with a corresponding net selling value of over 17 billion VND.

In the Upcom market, foreign investors also net sold 126,450 units but the total value was a net buy of more than 6.5 billion VND. Thus, in the trading week from September 9-13, foreign investors net sold 57.9 million units on the entire market, with a total net selling value of nearly 1,176 billion VND.

Personnel Changes

Nam Long Investment Joint Stock Company (stock code: NLG) has announced the appointment of Mr. Chan Hong Wai as Chief Financial Officer of NLG. Prior to joining Nam Long, he held positions as Chief Financial Officer and Executive Director at SPG Land, Chief Financial Officer at Alpha King, Chief Financial Officer at Novaland Group from 2015-2017, and Chief Financial Officer at Masan Group from 2010-2015.

Nam Long Investment Joint Stock Company has a new Chief Financial Officer.

SMC Trading Investment Joint Stock Company (stock code: SMC) has approved the change of Director and legal representative of SMC Hiep Phuoc One Member Limited Liability Company to Mr. Dang Huy Hiep (63 years old), effective from September 12. Thus, Mr. Dang Huy Hiep will replace Mr. Nguyen Van Tien as Director and legal representative of SMC Hiep Phuoc One Member Limited Liability Company.

As of June 30, SMC has invested 30 billion VND – equivalent to owning 100% of the charter capital of SMC Hiep Phuoc One Member Limited Company. SMC Hiep Phuoc was established on July 3, 2009, and operates in the field of iron, steel, and cast iron production.

BV Land Joint Stock Company (stock code: BVL) has just announced the collection of shareholders’ opinions in writing to pass the dismissal of Mr. Ta Hoai Hanh from the position of Chairman of the Board of Directors (BOD) and the election of supplementary members to the BOD for the remaining term of 2023-2028.

Accordingly, the company will propose the dismissal of the positions of Chairman of the Board and Member of the Board of Directors of Mr. Ta Hoai Hanh from September 21 and elect Ms. Khuong Hai Ninh – Director of BV Land Business Department to the Board of Directors.

Ms. Le Thi Ha Thanh, mother of Mr. Nguyen Hung Cuong – Chairman of the Board of Directors of Construction Investment and Development Joint Stock Company (DIC Corp – stock code: DIG) – registered to receive a transfer of 20,753,316 DIG shares to increase ownership from 4,902 shares to 20.76 million shares – equivalent to 3.4% of DIG’s charter capital. The transaction is expected to be executed from September 17 to October 16.

Ms. Le Thi Ha Thanh registered to receive a transfer of 20,753,316 DIG shares.

Ms. Thanh will receive the transfer outside the trading system because she is inheriting shares in the common property of her husband and wife after her husband’s death. It is estimated that Ms. Thanh will receive an asset worth more than 450 billion VND in DIG shares from the late Chairman of the Board of Directors of DIC Corp, Mr. Nguyen Thien Tuan.

Previously, on August 19, DIC Corp announced the appointment of Mr. Nguyen Hung Cuong (42 years old) to the position of Chairman of the Board of Directors, replacing Mr. Nguyen Thien Tuan, effective from August 16. Mr. Cuong is the son of the Chairman of the Board of Directors of DIC Corp, Mr. Nguyen Thien Tuan.

Racing to Issue Bonds

TDG Global Investment Joint Stock Company (stock code: TDG) has just announced a resolution of the Board of Directors on approving the plan to issue private placement bonds in 2024.

Specifically, TDG plans to issue 1,000 bonds with a par value of 100 million VND each. The total value of the bonds issued is expected to be 100 billion VND. The bonds have a term of 3 years from the date of issuance. The interest rate applied for the first two interest calculation periods is 12.5%/year, and the interest rate applied for the remaining interest calculation periods is the sum of 4.5%/year and the reference interest rate.

These are non-convertible bonds, not attached to warrants, and are secured. The first security is the future asset of the Bac Son 2 Industrial Cluster project, valued at more than 217 billion VND according to the appraisal certificate dated August 16 of the Indochina International Investment and Appraisal Joint Stock Company – under the management of HDBank as asset manager.

The second security is 946,379 TDG shares, valued at more than 4.9 billion VND according to the appraisal certificate dated August 21 of International Audit and Valuation Joint Stock Company, owned by TDG General Director Mr. Le Minh Hieu, under the management of HD Securities.

TDG plans to use the entire proceeds from the bond issuance and offering for the purpose of implementing the company’s investment programs and projects. Specifically, it will invest in and build the Bac Son 2 Industrial Cluster project (Bac Son district, Lang Son province) with TDG as the investor.

Bac Son 2 Industrial Cluster is located on an area of 25 ha of land, with a total investment of about 286 billion VND. The operation time is 50 years from the time the investor is decided to lease the land.

Hung Thinh Incons plans to offer more than 89 million shares to existing shareholders.

Hung Thinh Incons Joint Stock Company (stock code: HTN) has approved a resolution of the Board of Directors on deploying a plan to offer additional shares to existing shareholders.

HTN plans to offer more than 89 million shares to existing shareholders, equivalent to 100% of the number of circulating shares at a ratio of 1:1, meaning that for every 1 share held, shareholders will be able to buy 1 new share. Accordingly, HTN will offer to shareholders at a price of 10,000 VND per share. The expected offering time is in the fourth quarter of 2024 or the first quarter of 2025.

The total expected amount to be raised is more than 891 billion VND. HTN plans to use more than 434 billion VND to repay the company’s loans to banks and credit institutions, based on the company’s separate audited financial statements for 2023. Specifically, it will repay principal and interest on loans at BIDV – Northern Saigon Branch worth 360 billion VND and more than 74 billion VND to MSB – Ho Chi Minh City Branch.

The remaining amount of nearly 457 billion VND will be used by Hung Thinh Incons to pay for construction contracts of the company with contractors. In case the amount of money collected is not enough to use for all purposes of capital use, HTN will prioritize repaying loans to banks and credit institutions. In addition, HTN will choose to sell to other investors at a price not lower than the offering price to existing shareholders.

The Stock Market’s Money Flow: Why It’s Taking a Drastic Dip

“Institutional investors remain cautious, staying on the sidelines and causing a significant drop in market liquidity from September onwards. With a wait-and-see approach, these investors are biding their time, potentially waiting for economic headwinds to pass before re-entering the market with renewed vigor.”